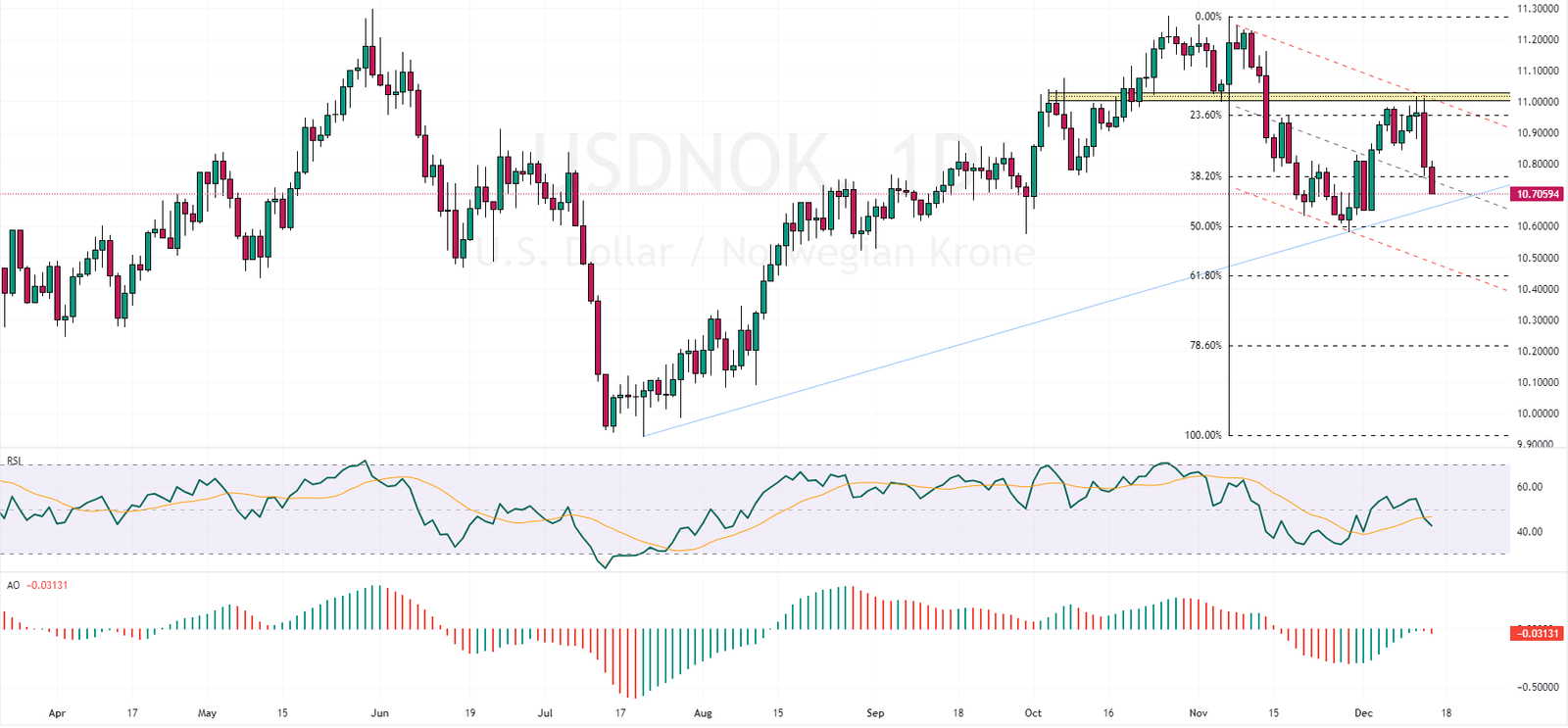

FxNews—The USDNOK pair has recently dropped significantly from its 11.0 high. This downward trend has been ongoing since yesterday.

USDNOK Technical Analysis and Forecast

In today’s trading, the pair closed below the median line of its bearish flag pattern, signaling a possible further decline. Currently, the USDNOK is moving towards the lower boundary of the flag. We can expect a steep decline if the pair breaks through the 50% Fibonacci support level. Should this occur, the next target for bears would be the 61.8% Fibonacci support level.

Conversely, if the lower edge of the flag holds strong, the USDNOK might enter a consolidation phase. In this case, a bullish trend could develop, aiming for the upper band of the bullish flag. The 23.6% Fibonacci resistance level further reinforces this target.

Feds Dovishness Boosts European Stocks

Bloomberg – On Thursday, the US Federal Reserve announced that it would keep interest rates unchanged and signaled that it would lower them three times in 2024. This was a more aggressive plan than what it had suggested in September. This news sparked a global market rally; European stocks were among the biggest beneficiaries.

The STOXX 50, which tracks the performance of 50 large companies in the eurozone, jumped 1% to reach 4,585 points, a level not seen since 2000. The STOXX 600, which covers a broader range of European companies, rose 1.5% to its highest level since early 2022.

The Fed also revealed its “dot plot,” which shows the future expected path of interest rates. According to the dot plot, the Fed expects to cut interest rates four times in 2025 and three times in 2026, bringing the fed funds rate between 2% and 2.25%. This is lower than the current range of 2.5% to 2.75%.

Fed Chairman Jerome Powell explained that the Fed wanted to avoid keeping interest rates too high for too long, which could hurt the economic recovery. He said that the Fed was “very focused” on this issue. Investors welcomed the Fed’s decision and look forward to hearing from the European Central Bank and the Bank of England on Thursday. Both central banks are expected to maintain their accommodative monetary policies supporting economic growth and inflation.

The Economic Impact of the Fed’s Decision

The Fed’s decision to lower interest rates in the future has positive and negative effects on the economy. On the positive side, lower interest rates make borrowing cheaper and encourage spending and investment. This stimulates economic activity and creates jobs. Lower interest rates also weaken the US dollar, which makes US exports more competitive and boosts trade.

On the negative side, lower interest rates reduce the returns on savings and investments. This discourages saving and could lead to excessive risk-taking and asset bubbles. Lower interest rates also increase the risk of inflation, which erodes the purchasing power of money and reduces the actual value of debt.

The net effect of the Fed’s decision depends on the balance between these positive and negative factors, the state of the economy, and the public’s expectations. The Fed’s role is to monitor the economic indicators and adjust its policy accordingly.