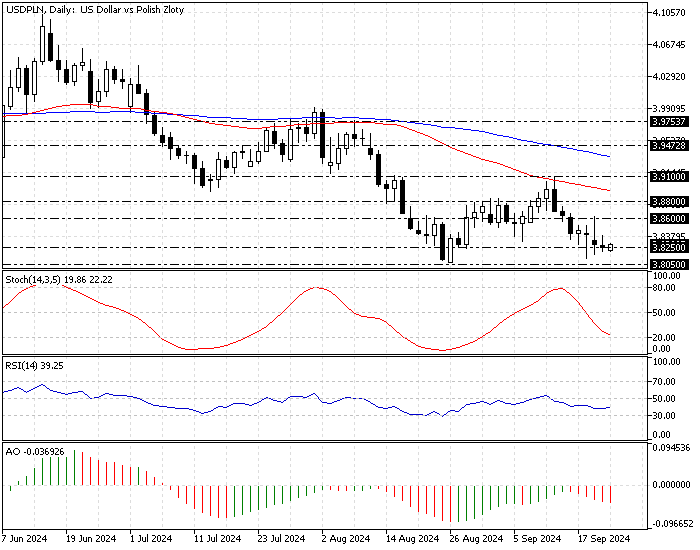

FxNews—Last week, the U.S. dollar bulls failed to maintain a position above the 100-period simple moving average against the Polish Zloty. As a result, the USD/PLN downtrend was triggered again after the price peaked at 3.91 (August 15 High).

Additionally, the currency pair has flipped below the 50- and 100-period simple moving averages, testing the August 28 low at 3.825, which provides immediate support.

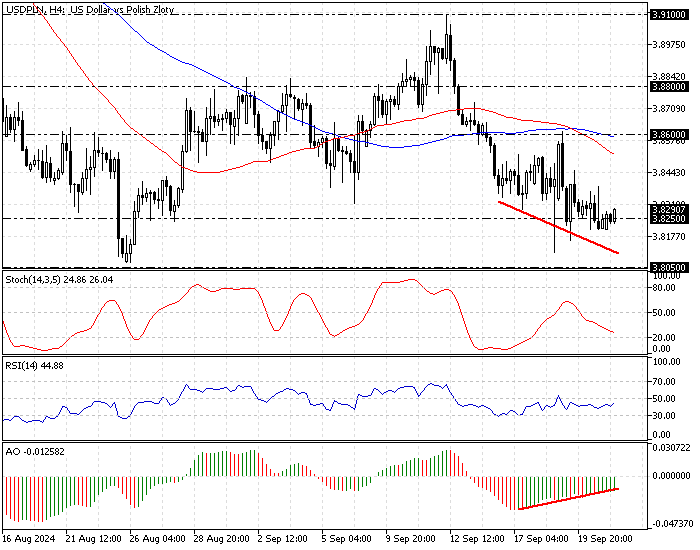

The USD/PLN 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators used in today’s analysis.

USDPLN Forecast – 23-September-2024

The Awesome oscillator signals divergence in its histogram (see the 4-hour chart above), indicating that the market could consolidate near upper resistance levels. That said, the stochastic and relative strength index indicators hover below the median line and above the oversold territory, meaning the downtrend could resume.

From a technical perspective, immediate support lies at 3.805, the lowest point of the USD/NOK in 2024. That said, the downtrend will likely resume if the sellers push the price below 3.805. If this scenario unfolds, the next support level bears could target is likely the 3.76 mark.

Resistance holds strong at 3.86, neighboring the 100-period simple moving average. The bear market should be invalidated if the USD/NOK price flips above the 3.86 mark.

- Also read: USD/NOK Forecast – 23-September-2024

USDNOK Bullish Scenario – 23-September-2024

If the bulls (buyers) cross and stabilize the price above the 3.86 resistance, a consolidation phase could be triggered, and the price could initially retest the September 23 high at 3.91.

Please note that the primary support to the bullish scenario will be the 100-period SMA.

USDPLN Support and Resistance Levels – 23-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 3.825 / 3.805 / 3.76

- resistance: 3.86 / 3.88 / 3.91