The U.S. Dollar has been trading in a bearish flag since May 1, at $11.04, indicating a bearish primary trend. As of this writing, the USD/SEK currency pair trades at about $10.66.

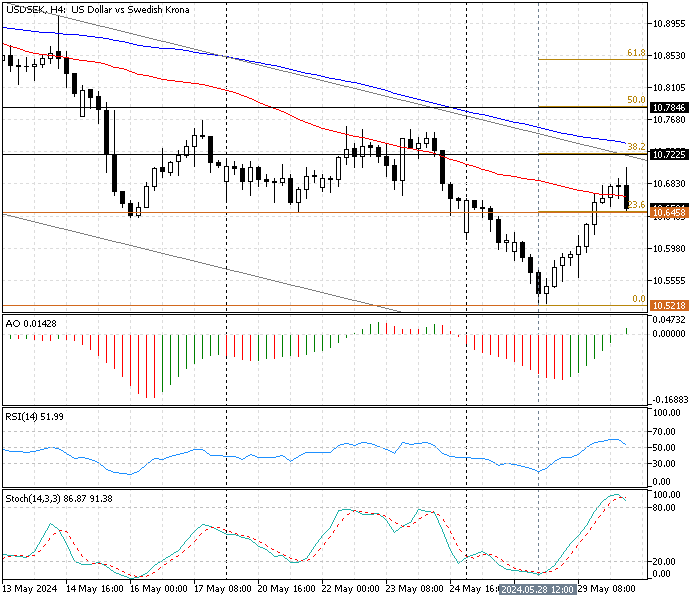

USD/SEK Technical Analysis 4-Hour Chart

As shown in the image above, the bulls closed the price above SMA 50 in the 4-hour chart. The recent rise in the USD/SEK price from $10.52 should be considered a consolidation phase, mainly because the currency pair still ranges below SMA 100 and resides in the bearish flag.

Today, the bulls are trying to stabilize the price above the SMA 50 and the immediate support at the 23.6% Fibonacci, the $10.64 mark.

The technical indicators in the 4-hour chart are explained below:

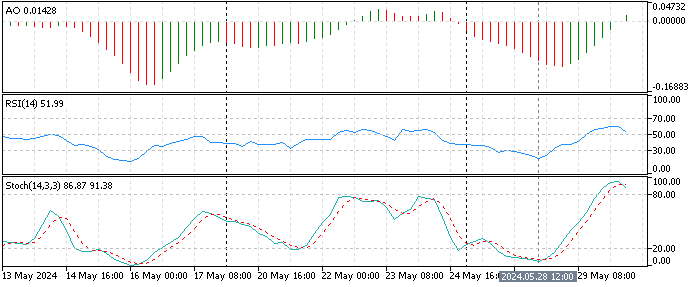

- The awesome oscillator bars are green and recently crossed above the zero line, depicting 0.014 in the description. This signals the uptrend prevails.

- The relative strength index indicator is declining from the 60 level, signifying the uptrend momentum is fading.

- The stochastic oscillator is above 80, with the %K Period value at 87, signaling the market’s overbought state. This growth in the indicator suggests that the uptrend might cool down or resume.

These developments in the technical indicators in the 4-hour chart recommend that despite the strong bullish beginning on May 28, the momentum could cool down, or the downtrend might resume.

USDSEK Forecast – May-30-2024

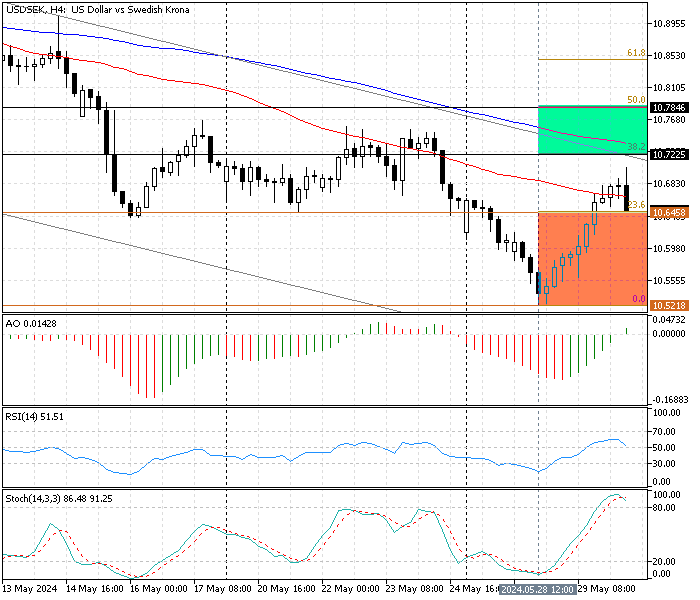

From a technical standpoint, the primary trend is bearish as long as the USD/SEK trades inside the bearish flag and below the SMA 100. The downtrend started on May 1 will likely resume if the bears cross below the 23.6% Fibonacci level at $10.64. If this scenario unfolds, the next bearish target could be set at May’s all-time low of $10.52.

The bearish outlook should be invalidated if the price exceeds $10.72, the 38.2% Fibonacci support level.

Bullish scenario

The awesome oscillator is the only technical indicator indicating that the bullish momentum from $10.52 might extend further. For this scenario to play out, the bulls must close and stabilize the price above the immediate support at the 38.2% Fibonacci level, the $10.72 mark. This demand zone is backed by the descending trendline and SMA 50, which makes it a robust resistance and barrier for bullish traders.

If the price exceeds $10.72, the primary trend should be bullish, and the U.S. Dollar’s path to the 50% Fibonacci level at $10.78 against the Swedish Krona will be paved.

USD/SEK Key Support And Resistance

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $10.64, $10,52

- Resistance: $10.72, $10.78

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.