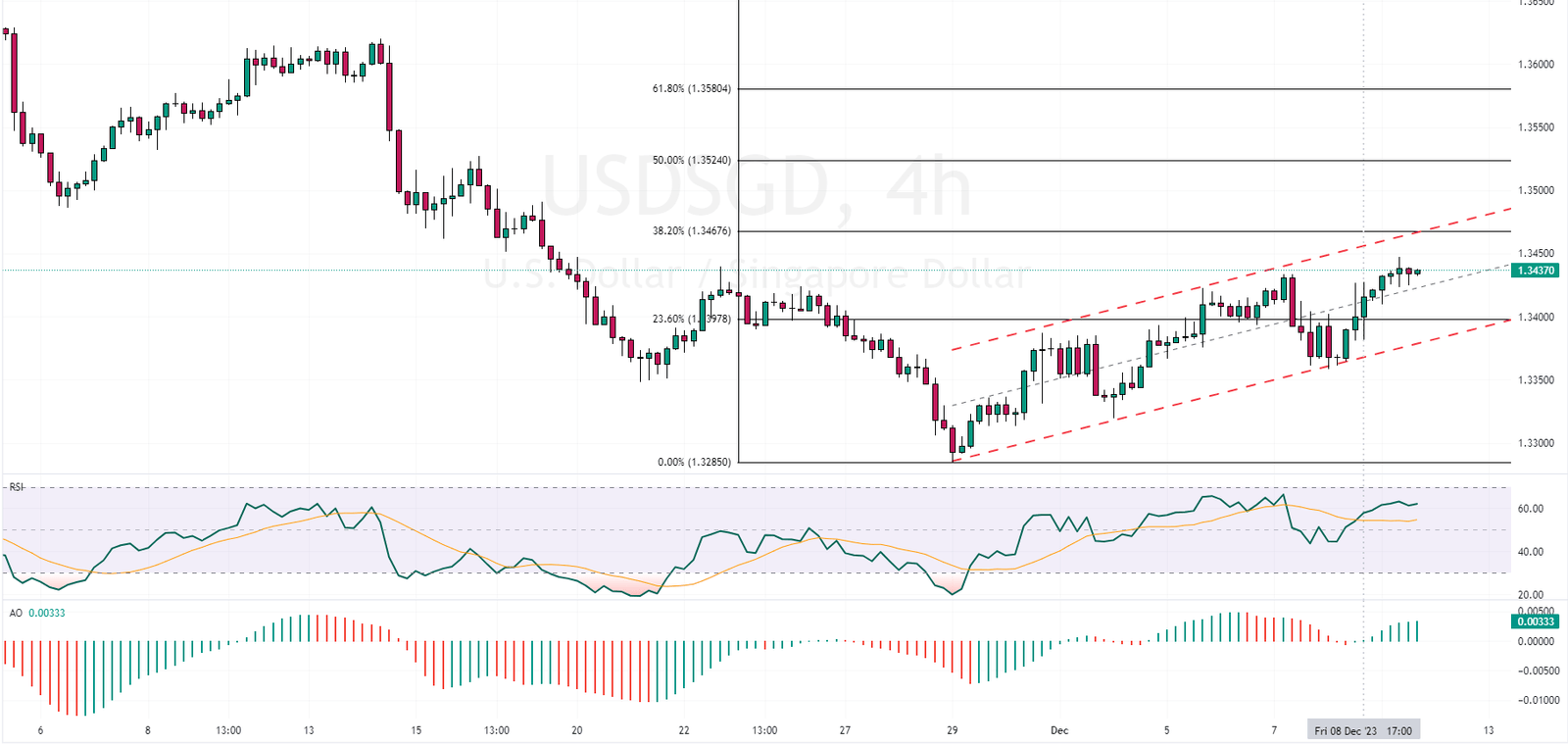

FxNews – The USDSGD currency pair is currently testing the median line. On December 8th, the pair closed successfully above the 23.6% Fibonacci retracement level, indicating a positive trend.

USDSGD Technical Analysis and Forecast

From a technical perspective, the Relative Strength Index (RSI) maintains a position above the 50 line. Concurrently, the Awesome Oscillator is showing green bars. These indicators collectively suggest a bullish trend is underway.

Experts at FxNews forecast that the USDSGD price will likely experience further growth, potentially reaching the 38.2% Fibonacci level. Interestingly, this resistance area also coincides with the upper band of the bullish flag pattern.

The USDSGD Bearish Scenario

It’s important to note that the lower band of the bullish flag is crucial in supporting the uptrend. Should this level be breached, it would signify a potential shift, undermining the current bullish scenario. Therefore, traders should monitor this level closely as a key indicator of the pair’s future direction.

Singapore Forex Reserve Dips

Bloomberg—In November 2023, Singapore’s foreign exchange reserves significantly decreased. The total reserves dipped to SGD 461.1 billion, down from SGD 463.4 billion in October. This change marks a subtle yet significant shift in the country’s financial landscape.

Breaking down the components, the gold and foreign exchange segment experienced a reduction, moving from SGD 453 billion in October to SGD 450.7 billion in November. Similarly, Special Drawing Rights (SDRs), international reserve assets created by the International Monetary Fund (IMF), decreased slightly from SGD 8.41 billion to SGD 8.37 billion. Furthermore, the IMF reserve position, which indicates the country’s ability to access IMF funds, fell marginally from SGD 1.96 billion to SGD 1.94 billion.

To put this in perspective, a year ago, in November 2022, Singapore’s foreign exchange reserves were significantly lower, standing at SGD 399.1 billion. Despite the recent monthly dip, this year-over-year growth indicates a generally positive trend.

Economic Implications

Foreign exchange reserves are vital for a country’s economic health. They are used to back liabilities and influence monetary policy. For a financial hub like Singapore, these reserves are critical in maintaining the stability of its currency and the confidence of international investors. While the November decrease is slight, monitoring these trends for long-term implications is essential.

The drop in reserves could be due to various factors, such as changes in the global market, shifts in domestic policy, or currency valuation adjustments. While a one-off decrease is not alarming, continued declines could suggest economic environment challenges or shifts in global trade dynamics. However, the increase from the previous year’s level does indicate an overall positive trajectory for Singapore’s economy. This increase can bolster confidence in Singapore’s financial stability, making it an attractive destination for investors.