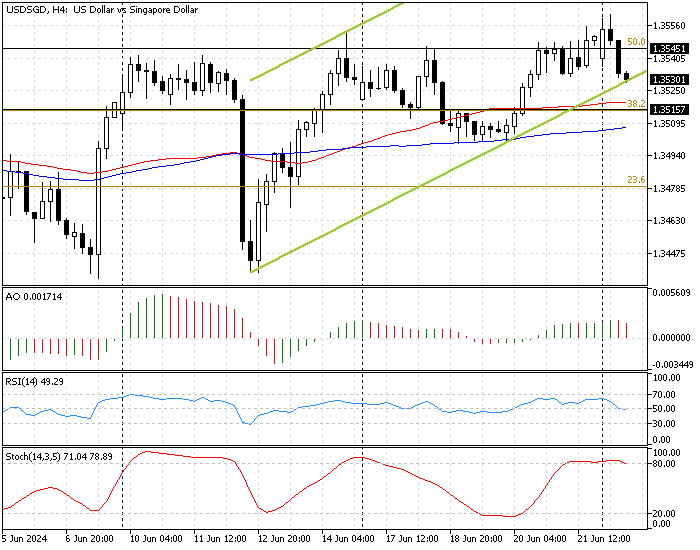

FxNews—The U.S. Dollar fell below the %50 Fibonacci retracement level at 1.354 against the Singapore dollar in today’s trading session. As of writing, the USD/SGD currency pair tests the ascending trendline at about 1.353, above the simple moving average of 50.

USD/SGD Technical Analysis – 24-June-2024

The primary trend is bullish because the USD/SGD price is above the 100-period moving average and inside the bullish flag, as shown in the 4-hour chart above.

The technical indicators suggest the bull market weakens, and the price might dip to test the lower resistance levels.

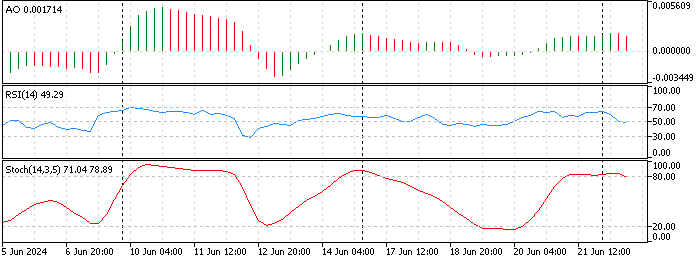

- The Awesome Oscillator’s value is 0.0017. The bars are above zero and declining, signifying that the uptrend is slowing down.

- The relative strength index indicator has flipped below the median line, showing 48 in the description. This means the downtrend began at 1.356.

- The stochastic oscillator gives an interesting signal. The %K value is declining from the overbought territory, depicting 78 in the value, signaling the market is overbought, and the USD/SGD price could dip to lower supply zones.

USD/SGD Forecast – 24-June-2024

The primary trend is bullish because the USD/SGD price is above the 100- and 50-period simple moving averages. Hence, the dip from 1.356 should be considered a consolidation phase.

From a technical standpoint, if the USD/SGD price crosses below the ascending trendline, the bears will likely target the %38.2% Fibonacci at 1.3515. Furthermore, if the selling pressure exceeds 1.3515, the next supply zone will be the 23.6% Fibonacci at 1.347.

The %50 Fibonacci level plays the immediate resistance to the selling strategy. Should the price exceed 1.354, the downtrend scenario should be invalidated.

Bullish Scenario

As we mentioned earlier in this article, the primary trend is bullish. For the uptrend to resume, bulls must exceed and stabilize the price above the immediate resistance at 1.354. If this scenario unfolds, the next ceiling will be the 61.8% Fibonacci level at 1.357, followed by the 78.6% Fibonacci level at 1.3616.

The 100-period simple moving average supports the USD/SGD buy strategy.

USD/SGD Key Support and Resistance Level

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.351 / 1.347

- Resistance: 1.354 / 1.357 / 1.361

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.