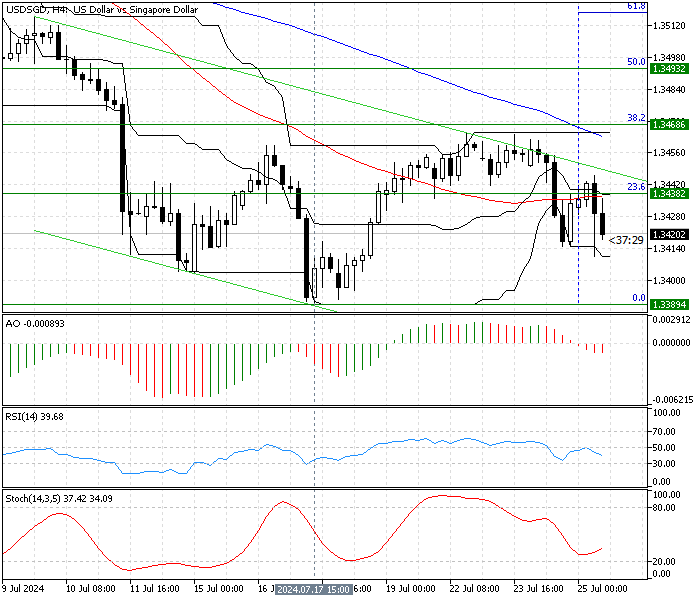

FxNews—The U.S. Dollar is in a bear market against the Singapore dollar, trading in the bearish flag. As of writing, the USD/SGD currency pair trades at about 1.34, closing below the 50-period simple moving average in the 4-hour chart.

The diagram below demonstrates the price, the key Fibonacci levels, and the technical indicators utilized in today’s analysis.

USDSGD Technical Analysis – 25-July-2024

The price is below the 50 and 100-period simple moving average, signaling a robust bear market. In addition to the moving averages, other technical indicators suggest the downtrend will likely resume.

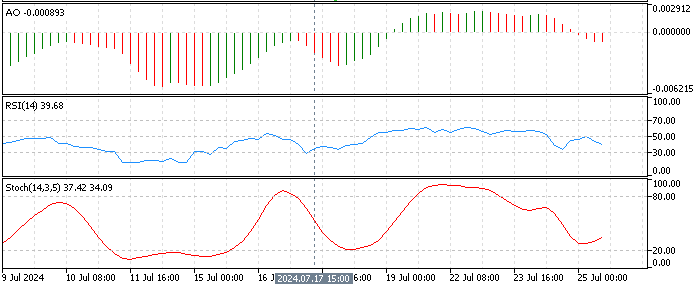

- The awesome oscillator bars are red and below the signal line, meaning the downtrend prevails.

- The relative strength index value is approximately 40, below the median line, indicating that the U.S. Dollar is not oversold and that the downtrend should continue.

- The stochastic oscillator is not overbought, oversold territory, hovering around 34, which means the price might move sideways for a while.

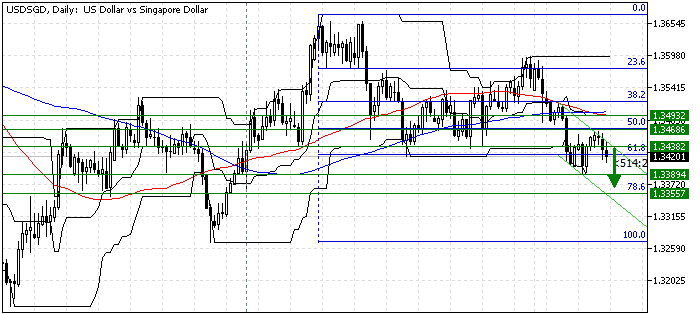

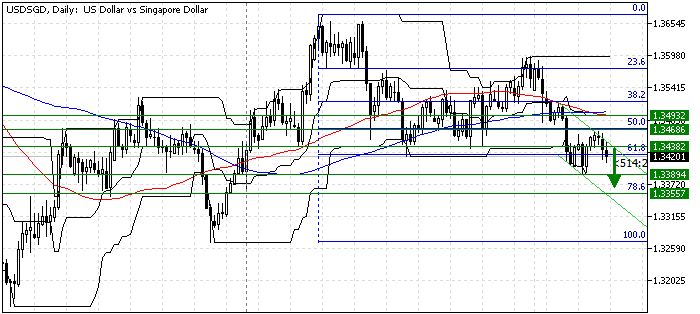

USDSGD Forecast – 25-July-2024

The 23.6% Fibonacci at 1.343, which coincides with the descending trendline, is the immediate resistance. If the USD/SGD price holds below 1.343, the downtrend will likely be triggered again. In this scenario, the July 17 low at 1.338 could be retested.

Furthermore, if the selling pressure exceeds the 1.338 mark, the sellers’ road to the March 21 low at 1.335 could be paved. Please note that the downtrend should be considered invalid if the price crosses above the 23.6% Fibonacci at 1.343.

USDSGD Bullish Scenario – 25-July-2024

As stated above, the immediate resistance is at 1.343. If the USD/SGD price climbs above 1.353, the uptick momentum initiated from July 17 could test the 38.2% Fibonacci at 1.346.

Furthermore, if the bull’s pressure exceeds 1.346, the following key resistance level will be 50% Fibonacci at 1.349.

- Also read: USD/DKK Forecast – 25-July-2024

USDSGD Key Levels – 25-July-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.338 / 1.355

- Resistance: 1.346 / 1.349

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.