The USD/SGD pair’s uptrend from the May 16 low at $1.342 eased near the 50% Fibonacci level at $1.354. As of writing, the U.S. Dollar is returning downside from the 50% Fibonacci against the Singapore dollar, trading at about $1.351, clinging to the 38.2% Fibonacci level.

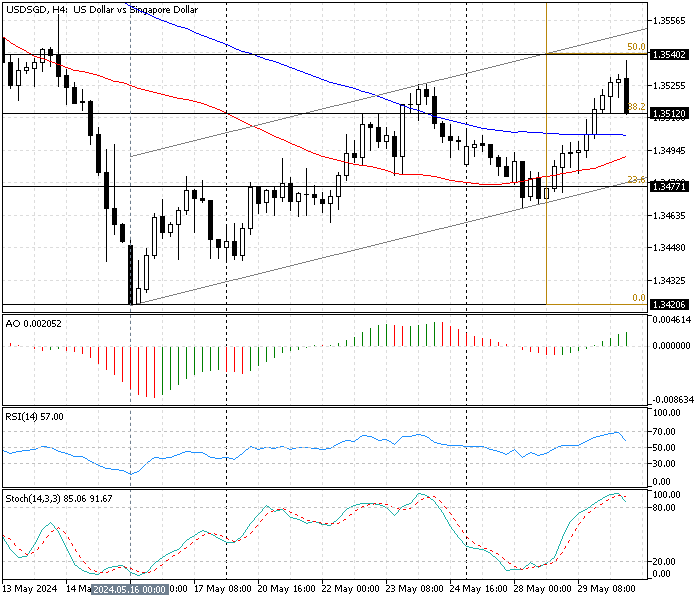

USD/SGD Technical Analysis 4-Hour Chart

The 4-hour chart above shows the currency pair ranges in an uptrend in the bullish flag, and the bulls successfully closed above the SMA 100 and the 38.2% Fibonacci level. The surge in price resulted in the stochastic oscillator stepping into the overbought territory. Currently, the %K line of the indicator is recording 84, signaling the market is saturated from buying pressure. This growth in the Stochastic indicator could result in the Singapore Dollar erasing some of its losses against the American currency.

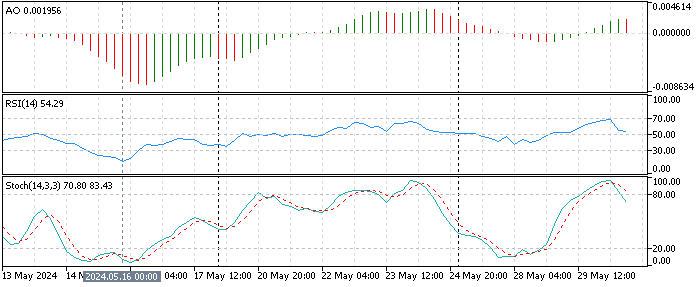

The other indicators don’t provide vital information.

- The awesome oscillator bars are green and above the zero line, recording 0.002 in the description, which indicates a bullish trend.

- The relative strength index value is 56, declining from 70, indicating the market is losing momentum. There might be a consolidation phase on the horizon, or the trend could reverse from the bull market to the bear market.

These developments in the technical indicators in the 4-hour chart suggest the USD/SGD currency pair is in a bull market, but a consolidation phase might be imminent.

USDSGD Forecast – May-30-2024

The market is bullish from a technical standpoint. Therefore, traders and investors should seek buying opportunities. However, the indicators in the 4-hour chart suggest being cautious when approaching the market.

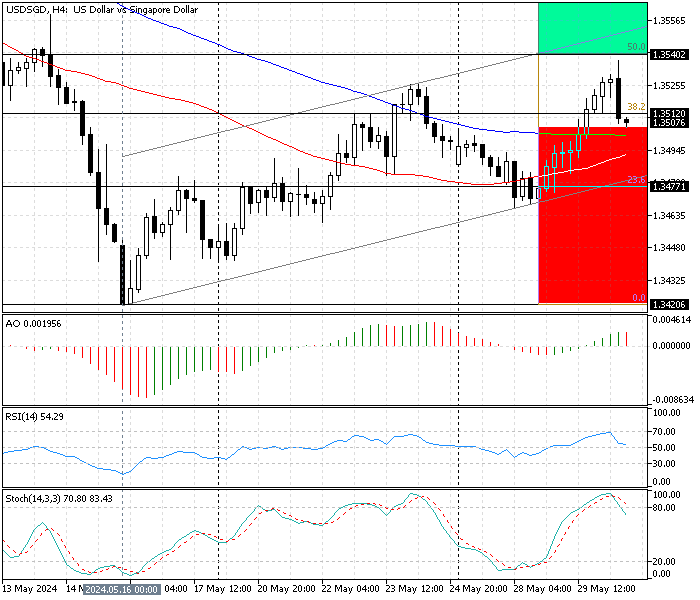

The immediate support is $1.351, which the bears are testing today. If the price flips below the immediate support, which coincides with % the 38.2 Fibonacci level, the decline can extend further to test the SMA 100, followed by the SMA 50, and the lower line of the bullish field at about $1.347.

The immediate resistance that supports this analysis is the %50 Fibonacci level. If the USD/SGD price exceeds $1.354, the consolidation phase or the short-term downtrend outlook should be invalidated.

Bullish Scenario

Immediate support is at the 50% Fibonacci resistance level at $1.354. If the bulls push the price above this level and stabilize it above it, the uptrend that began on May 16 will likely resume. If this scenario unfolds, the next bullish target could be set at the 61.8% Fibonacci resistance level at $1.356.

The bullish scenario should be invalidated if the price dips below the 1.347 resistance level.

USD/SGD Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.347, $1.342

- Resistance: $1.354, $1.356

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.