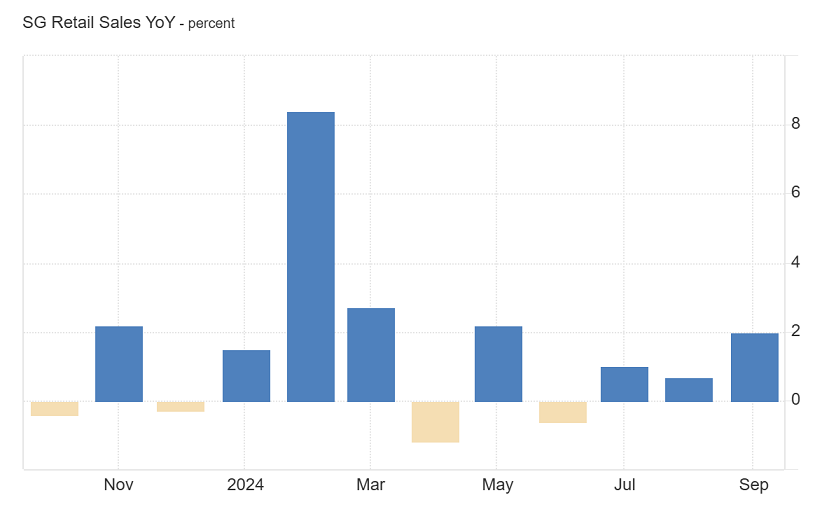

FxNews—In September 2024, Singapore’s retail sales increased by 2% compared to the same month last year. This growth was faster than the 0.7% rise in August and marked the strongest expansion since May. The boost was mainly due to higher sales in several key areas.

Motor vehicle sales soared by 29.6%, up from a 17% increase in August. This significant jump means many more people bought cars in September. Sales of cosmetics, toiletries, and medical goods rose by 2.9%, slightly higher than the 2.7% growth in the previous month, indicating steady demand for these products.

Singapore’s Home Furniture Sales Rebound with 2% Growth

Furniture and household equipment sales grew by 2%, turning around from a 0.6% decline in August. This suggests consumers spent more on home-related items. Computer and telecommunication equipment sales increased by 0.1%, improving from a 3.1% drop in August. This small increase shows a slight pickup in demand for tech products.

Other miscellaneous items experienced a 4.1% sales increase, a significant improvement from a 6.9% decrease the month before.

Singapore’s Food and Alcohol Spending Slows After Last Month’s Surge

However, some sectors faced declines. Sales of optical goods and books fell by 2.2%, but this was a smaller drop compared to the 3.7% decrease in August. This indicates that fewer people reduced their spending in this category. Food and alcohol sales decreased by 0.4%, a shift from a strong 9% increase in the previous month, meaning consumers spent slightly less on these items.

Wearing apparel and footwear sales dropped by 9.3%, more than the 6.4% decline in August, showing reduced spending on clothing and shoes. Sales of watches and jewelry fell by 0.8%, reversing from a 2.5% growth in August, suggesting a slight decrease in luxury purchases.

On a month-to-month basis and after adjusting for seasonal factors, retail sales increased by 0.4% in September. This was a slower pace than the 0.8% increase in August. This means that while retail sales continued to grow compared to the previous month, the growth rate has eased.

USDSGD Forecast – 5-November-2024

The USD/SGD currency pair is experiencing a downtrend from 1.326. This decline was expected because the RSI 14 indicator has been signaling a bearish divergence. As of this writing, USD/SGD trades at approximately 1.315, testing the 23.6% Fibonacci retracement level and active support.

Furthermore, the USD/SGD market outlook remains bullish as long as the price is above the 23.6% Fibonacci retracement level. The immediate resistance rests at 1.320.

USDSGD Bulls Eye 1.320 to Resume Uptrend

From a technical perspective, the uptrend would resume if USD/SGD bulls pull the price above the 1.320 mark. If this scenario unfolds, the next bullish target would be revisiting the October all-time high at 1.326.

Conversely, the bullish outlook should be invalidated if USD/SGD dips below the 23.6% Fibonacci. If this scenario unfolds, the downtrend could expand to the 38.2% Fibonacci at 1.308.

- Support: 1.315 / 1.308

- Resistance: 1.32 / 1.326