FxNews—Late Friday night, the Japanese Yen began erasing some of its recent losses against the major currency pairs as the market prepared to close for the weekend. The strong Yen also hit the British pound, trading at approximately 195.3 as of this writing.

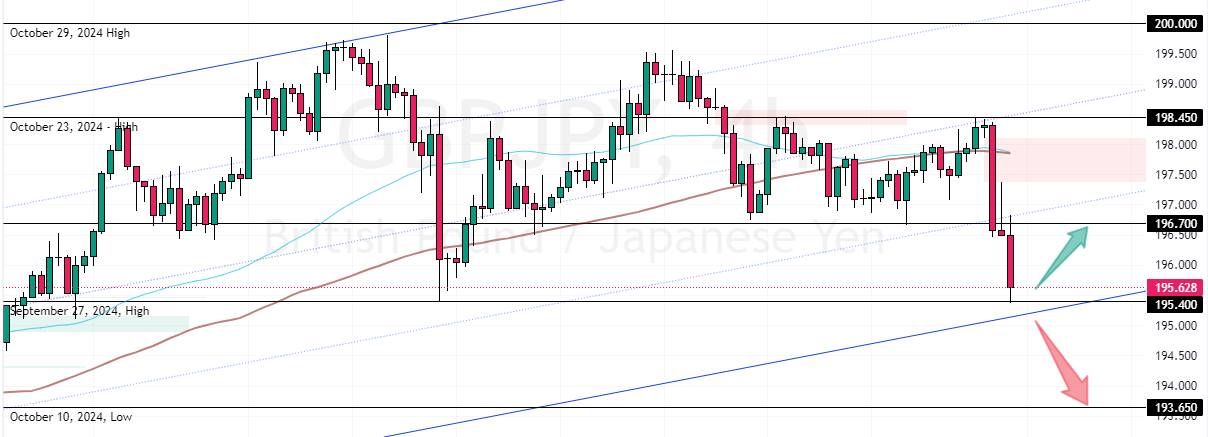

GBPJPY Fails at 198.45 Resistance, Leading to Sharp Decline

The sharp decline in GBP/JPY was mostly because the bulls failed to surpass the 198.45 resistance after two attempts. Consequently, the market dipped, and selling pressure increased after the prices fell below 196.7.

Currently, the GBP/JPY pair nears a critical support level, the September 27 low at 195.4. As for the technical indicators, the RSI 14 is about to shift below 30, meaning the market could become oversold. Additionally, the Awesome Oscillator flipped below zero, indicating the bear market should prevail.

Overall, the technical indicators suggest that while the primary trend is bearish, the GBP/JPY could become oversold soon, which could potentially cause the prices to consolidate or reverse.

GBPJPY Forecast – 15-November-2024

The immediate support is at 195.4. From a technical perspective, the GBP/JPY price can potentially bounce from the immediate support if the level holds. In this scenario, the currency pair could consolidate by rising toward the immediate resistance at 196.7.

- Next read: EUR/JPY Eyes New Lows Below 165.0 Mark

On the other hand, the downtrend will likely resume if sellers (bears) close and stabilize the price below the 195.4 mark. If this scenario unfolds, the downtrend could extend to 193.65.

- Support: 195.4 / 193.65

- Resistance: 196.7 / 198.4