Forex trading can seem like a maze of jargon and numbers, especially for those just starting. One term that often pops up is “a lot.” But what exactly is a lot in forex? Let’s dive in and demystify this concept.

A Glimpse into the World of Forex

Before we delve into lots, understanding the forex market’s vastness is essential. Imagine a bustling marketplace where currencies from all over the world are exchanged. That’s forex for you! It’s the world’s largest financial market, with a daily trading volume exceeding $6 trillion.

Breaking Down the ‘Lot’

A “lot” in forex refers to the standardized quantity of a currency you can buy or sell in a single trade. Think of it as a unit of measurement, just like buying a dozen eggs or a liter of milk.

There are three main types of lots in forex:

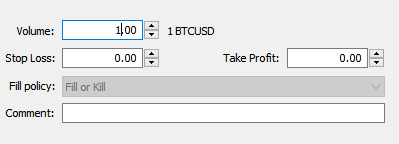

1. Standard Lot: This is the most common type of lot, representing 100,000 units of the base currency. So, if you’re trading the EUR/USD pair and you buy one standard lot, you’re essentially buying 100,000 euros.

2. Mini Lot: A mini lot is one-tenth the size of a standard lot, representing 10,000 units of the base currency.

3. Micro Lot: As the name suggests, this is even smaller, representing 1,000 units of the base currency.

Why Do Lots Matter?

You might wonder, “Why can’t I trade any amount I want?” The reason is simplicity and standardization. With lots, traders can quickly understand and calculate potential profits, losses, and risks. It’s like ordering a pizza – instead of specifying every ingredient’s exact weight, you call it small, medium, or large.

The Power of Leverage

One of the fascinating aspects of forex trading is the ability to use leverage. This means you can control a prominent position with relatively little money. For instance, with a 100:1 leverage, you can hold a standard lot of $100,000 with just $1,000 in your account. But remember, while leverage can amplify profits, it can also magnify losses.

Conclusion

Understanding the concept of a lot in forex is crucial for anyone navigating the thrilling waters of currency trading. It’s a foundational block that helps traders make informed decisions. So, the next time you hear someone talking about trading lots in forex, you’ll know exactly what they mean!

Remember, as with all investments, it’s essential to research and understand the risks involved. Happy trading!