FxNews—In the previous Bitcoin technical analysis (Bitcoin Hits 2024 High as Momentum Hints at Overbought), we stated that digital gold is overpriced because of the Stochastic Oscillator, and RSI 14 hovered over overbought territory then. Interestingly, the overbought condition resulted in the BTC/USD price dipping below $71.410, starting a new bearish wave from the October high of $73,860.

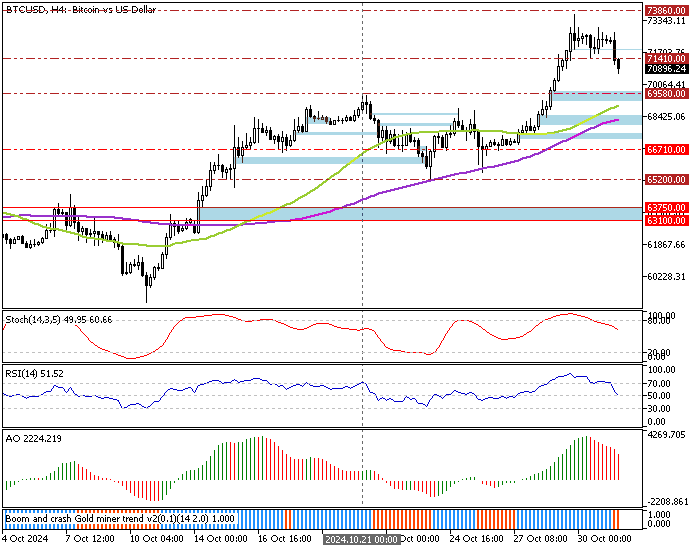

As of this writing, Bitcoin is trading at approximately $70,900. The 4-hour price chart below demonstrates the price, support, resistance levels, and technical indicators used in today’s analysis.

Bitcoin Technical Analysis – 31-October-2024

The Stochastic Oscillator and RSI 14 are declining, recording 60 and 52 in the description, respectively. This decline means the bear market gains momentum while the trading security is not oversold, and the downtrend is likely to resume.

Furthermore, the Awesome Oscillator histogram is red, declining toward the signal line from above, meaning the uptrend weakens. On the other hand, the primary trend should be considered bullish because the price is above the 50- and 100-period simple moving averages.

Overall, the technical indicators suggest the primary trend is bullish, but the dip from $73,860 could be a consolidation phase.

Bitcoin Price Forecast 31-October-2024

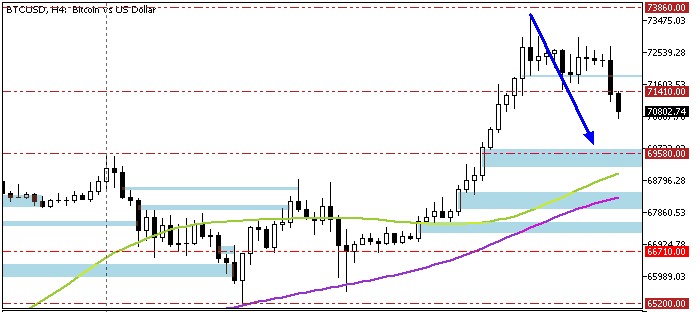

From a technical perspective, the current bearish momentum could extend to the $69,580 (October 21 high) if the BTC/USD price stays below the immediate resistance at approximately $71,410.

Please note that the $69,580 support is backed by the 50-period simple moving average and the Fair Value Gap area, making it a decent supply zone to join the bull market. Therefore, monitoring this level closely for bullish signals such as a long-wick candlestick pattern or a bullish- engulfing candlestick pattern is advisable.