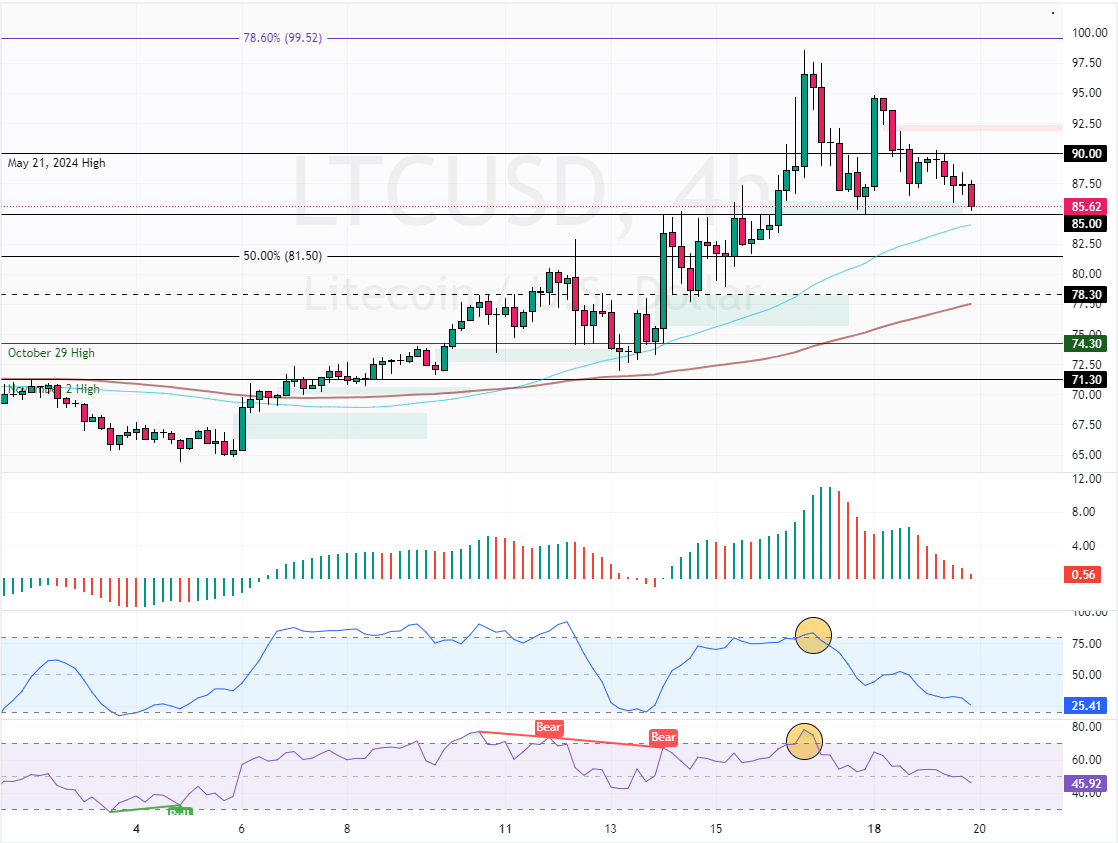

FxNews—Litecoin prices dipped from the 78.6% Fibonacci retracement level, testing the $85.0 support, backed by the 50-period simple moving average. The downtrend was promised by the Stochastic and RSI 14 when both indicators were hovering in overbought territory.

Bear Signs Strengthen but Litecoin Stays Bullish

Despite the recent bearish momentum, Litecoin’s primary trend remains bullish because the prices exceed the 100-period simple moving average. However, the Awesome Oscillator is about to flip below the signal line, indicating that the bearish market is strengthening.

The immediate resistance is at $85.0. From a technical perspective, the downtrend could resume if Litecoin falls below this level. In this scenario, the next bearish target could be the %50 Fibonacci level at $81.5.

On the other hand, the uptrend resumes if bulls stabilize above the immediate resistance, the May 21 high at $90. If this scenario unfolds, Litecoin prices could aim for the $99 threshold.