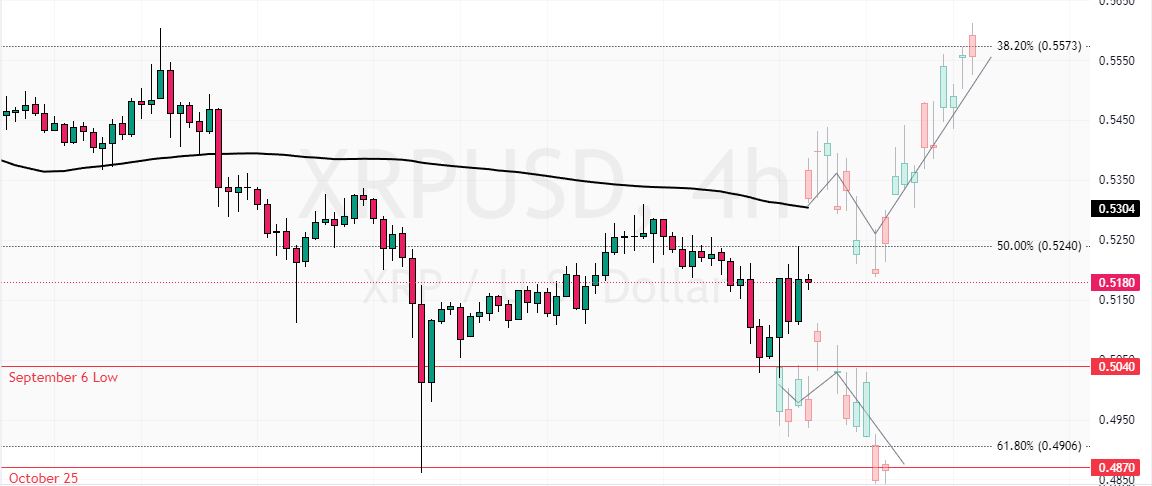

FxNews—Ripple (XRP) pulled back from $0.504 (September 6 Low) support in today’s trading session, testing the %50 Fibonacci retracement level.

As of this writing, the XRP/USD pair trades at approximately $0.518, below the 23.6 % Fibonacci retracement level. The 4-hour price chart below demonstrates the price, support, and resistance levels and technical indicators utilized in today’s analysis.

Ripple (XRP) Technical Analysis – 1-November-2024

The indicators demonstrate signs of a bullish bias while the price is below the 100-period simple moving average. The Awesome Oscillator histogram is green, approaching the signal line from below. Meanwhile, the Stochastic and RSI 14 values are rising, recording 51 and 50 in the description, respectively.

Overall, the technical indicators suggest that while the primary trend is bearish, XRP has the potential to test upper resistance levels.

Will XRP Rally Beyond $0.524 to Hit $0.557?

The immediate resistance rests at the 50% Fibonacci retracement ($0.524). From a technical perspective, the bullish wave from $0.487 will resume if XRP/USD bulls close and stabilize above $0.524. If this scenario unfolds, the next buyers’ target could be the 38.2% Fibonacci retracement level at $0.557.

On the flip side, the bearish trend will likely be triggered if sellers push XRP below the immediate support of $0.504. If this scenario unfolds, the price could revisit the October 25 low at $0.487.

Ripple (XRP) Support and Resistance Levels – 1-November-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.504 / 0.487

- Resistance: 0.524 / 0.557