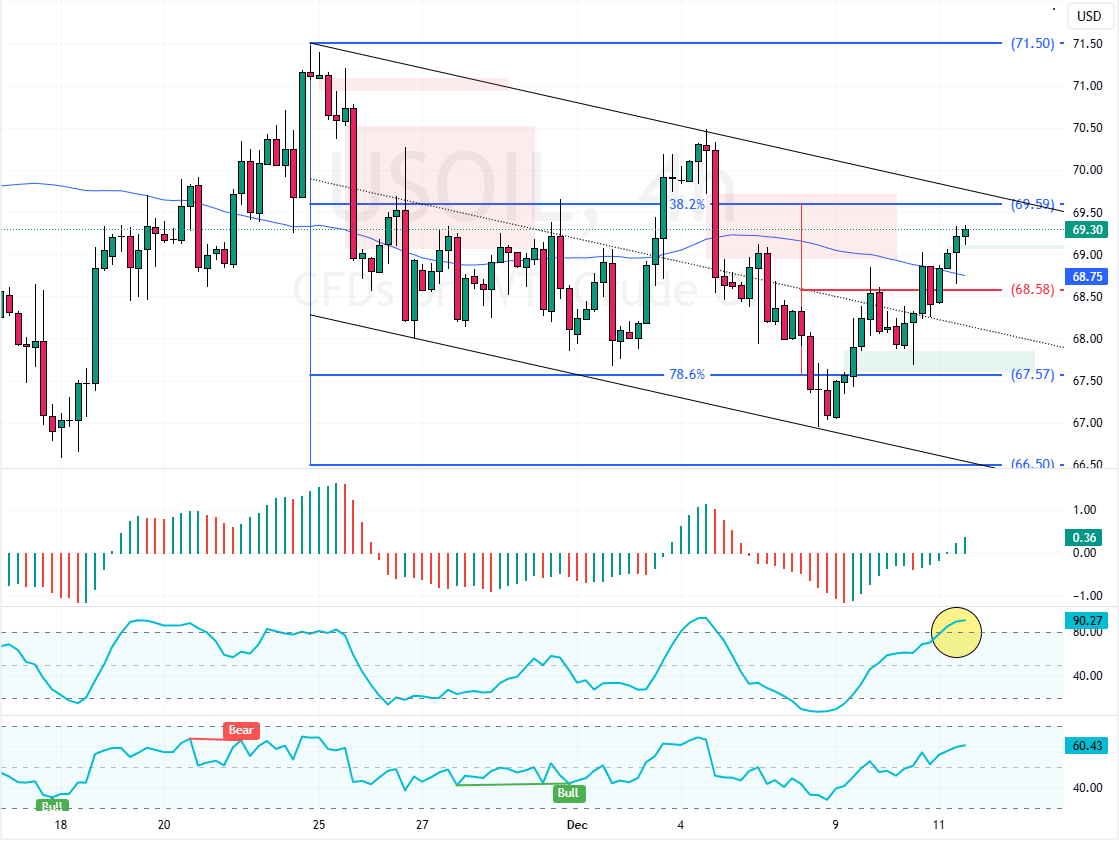

FxNews—WTI crude oil futures recently reached about $69 per barrel, showing growth for a third straight session.

- China’s shift toward looser monetary policy

- November’s surge in China’s oil imports

- OPEC’s forthcoming monthly report

- Key US inflation data affecting interest rates

China’s Financial Strategy Spurs Hope in Oil Markets

China’s decision to maintain an easy monetary stance in the coming year suggests brighter prospects for economic revival. Such steps could lift energy consumption by the world’s top crude importer.

In November, China’s oil imports rose for the first time in seven months, signaling a possible rebound in long-term demand.

Unexpected Rise in US Crude Stocks Signals Change

On the supply side, recent data showed a slight increase in US crude inventories, going against predictions of a tie.

Traders now look to OPEC’s next report for insights into output plans and upcoming US inflation figures that may guide the Federal Reserve’s policy decisions. Together, these factors will likely influence price trends in the months ahead.