FxNews—Gold’s bullish momentum that began on Friday has resumed today, and as of writing, XAU/USD broke above the 61.8% Fibonacci retracement level, trading at about $2,350.

Insights on Gold’s Pullback from $2,330

The pullback initiated on Friday from $2,330 was expected because this support area was once a strong resistance, tested by bulls twice on May 1 and May 6 in 2024. In addition, the $2,330 was tested as support on May 13. Considering gold’s history after reaching this level, traders and investors should take Friday’s pullback more seriously.

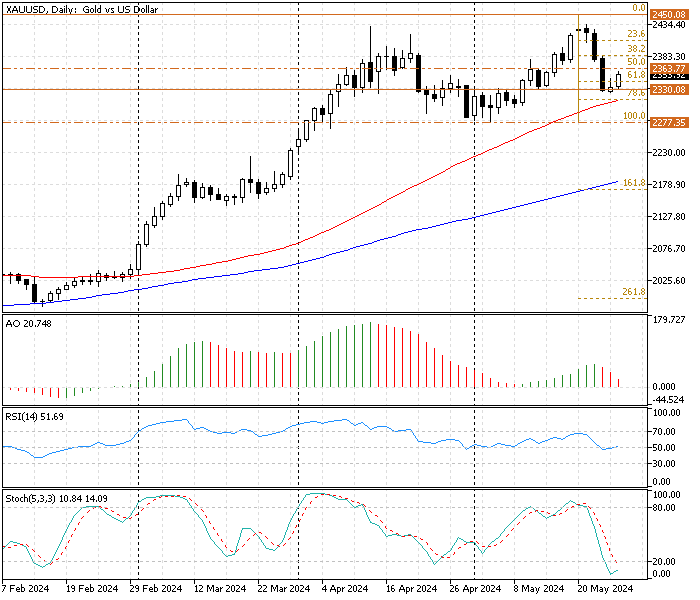

XAUUSD Technical Analysis – May-27-2025 (Daily Chart)

The technical indicators in the daily chart give mixed signals.

- The awesome oscillator signal divergence. The bars are red, with a value of 20 in the description, demonstrating a bearish trend. The AO’s divergence signal forecasted the dip from $2,450, which consequently caused the price of gold to dip to $2,330.

- The RSI hovers around the median line, showing 51 in the description. This indicates low market volatility. Please note that these indicators are lagging; therefore, we must also dissect these technical tools in a shorter time frame.

- The Stochastic oscillator provides an exciting signal. The %K value is 11, hovering in the oversold area, signaling the market will likely have a pullback. As depicted in the daily graph above, the price of gold is currently climbing toward the %50 Fibonacci level.

The technical indicators in the daily chart suggest the market is bearish, but a pullback or a consolidation phase could be on the horizon. That said, we zoom into the Gold 4-hour chart to find key levels and patterns to predict the next possible price moves.

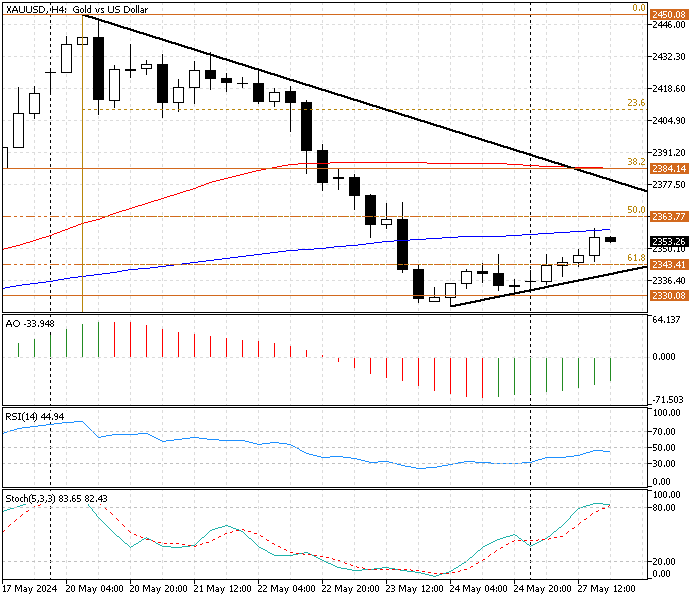

XAUUSD Technical Analysis – May-27-2025 (4-Hour Chart)

The technical indicators in the 4-hour chart are on the rise.

- The awesome oscillator bars are green, approaching the zero line, and the description states that their current value is -39. This means the market is bullish.

- The relative strength index value is 45, closing the median line from below, indicating an uptrend market.

- The stochastic oscillator stepped out of oversold territory today. As of this writing, the %K period value is 46 and increasing, signifying the trend can reverse from a bear market to a bull market.

These developments in the technical indicators in the daily chart suggest the pullback from $2,330 can expand further and result in a surge in the gold price. This scenario is supported by the fact that the RSI and stochastic oscillators have room to become overbought.

Gold Chart Pattern and The Role of Moving Averages

Currently, the XAU/USD bulls are testing the simple moving average 100 as resistance. The uptick in momentum might ease near this level.

Regarding the chart pattern, the price is in a symmetrical triangle, approaching the apex. Interestingly, the apex is in conjunction with the %50 Fibonacci retracement level at $2,363, which makes this resistance area robust.

Gold Price Forecast – A Potential Rise Amid Bearish Trends

The primary trend is bearish from a technical perspective, but the XAU/USD price can rise toward the apex at about $2,363. The technical indicators in the 4-hour chart support this scenario. That said, if the bulls maintain a position above the ascending trendline of the triangle, the consolidation phase will likely target the critical resistance level at $2,363.

If the buying pressure exceeds the critical resistance, the road to the 38.2% Fibonacci level at $2,384 will be paved.

Gold Bearish Scenario

On the flip side, if the bears break below the ascending trendline and the immediate support at $2,330, the bearish trend initiated on May 17 resumes, and the first target could be the %78.6 Fibonacci at $2,314. If the selling pressure exceeds this level, the next target will likely be May’s all-time low at $2,277.

Gold Key Support and Resistance Level

Traders and investors should closely monitor the XAU/USD key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $2,343, $2,314

- Resistance: $2,363, $2,384

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.