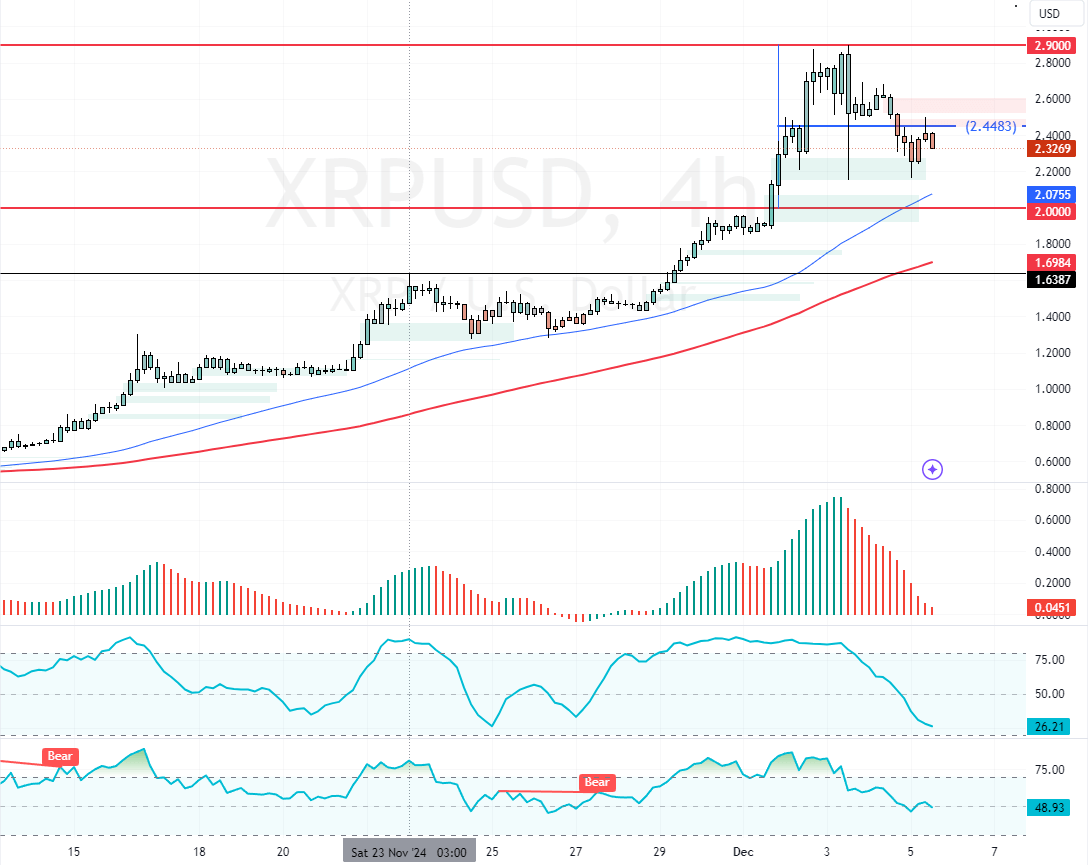

Ripple (XRP) began consolidating after its prices peaked at $2.9. As of this writing, the cryptocurrency trades at approximately $2.3 and lost 1% of its value in today’s trading session.

The recent decline in XRP’s value was expected due to the Stochastic’s overbought signal. However, the primary trend is bullish, with prices above the $2.0 support.

XRP Holds Strong Above $2.0

As for the technical indicators, the Awesome Oscillator histogram is red and nearing zero, meaning the current momentum downtick could strengthen. Additionally, RSI 14 and Stochastic declined, depicting 26 and 49 in the description, indicating that the market is not oversold and the downtrend can extend to the lower support levels.

Overall, the technical indicators suggest that while the primary trend is bullish, the current consolidation phase could lower the XRP prices.

Watch XRP at $2.0 for Bullish Market Entry

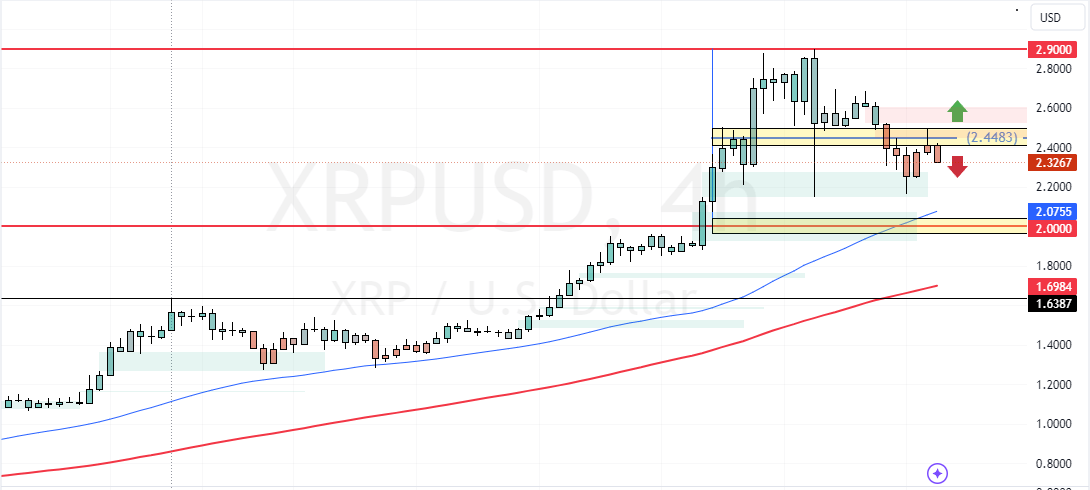

The immediate resistance for the XRP/USD pair is $2.44. If bears (sellers) keep the prices below this level, Ripple (XRP) will likely aim to test the $2.0 support, which offers a decent bid to join the bull market.

If this scenario unfolds, traders and investors should monitor the $2.0 support for bullish signals, such as candlestick patterns.

The Bullish Signal

Conversely, a close above the immediate resistance ($2.44) would trigger the uptrend. In this scenario, XRP/USD could target the December 3 high at $2.9.