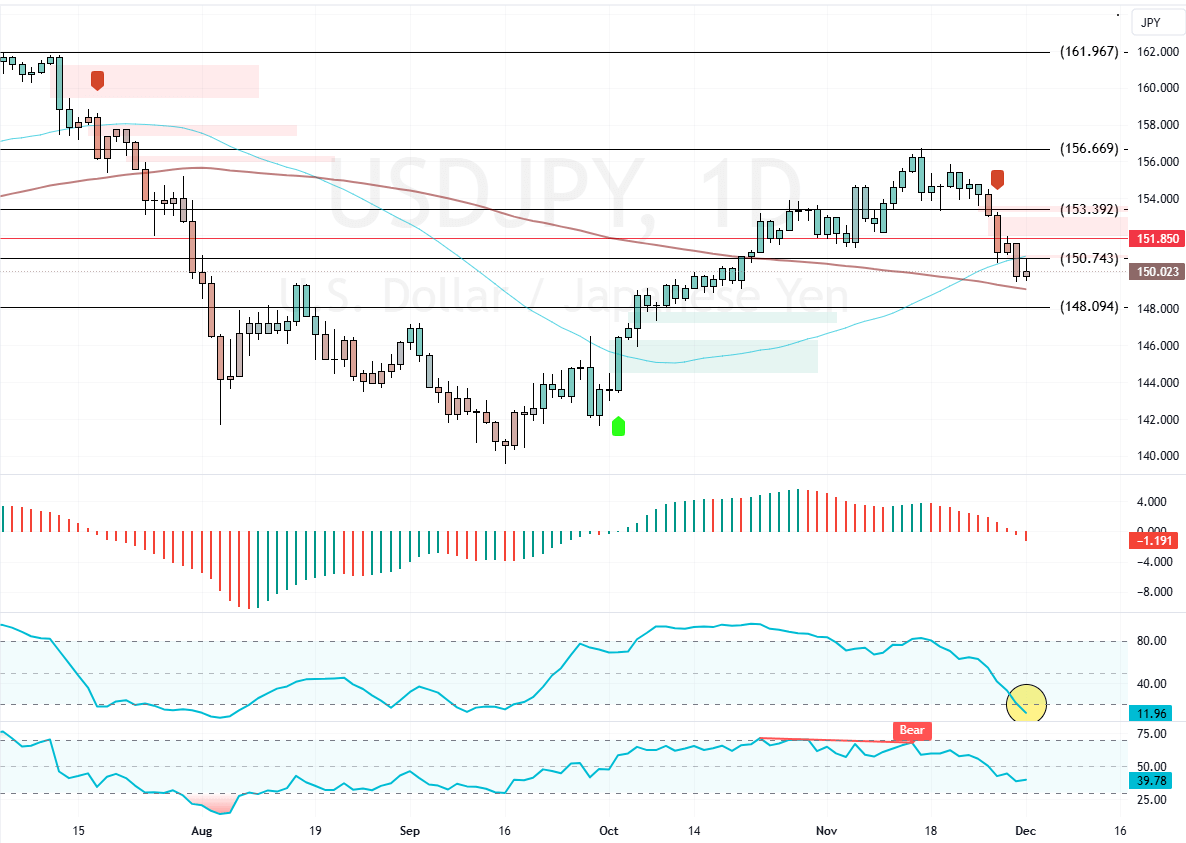

FxNews—The USD/JPY pair’s downtrend resumed after prices dipped below the 150.7 resistance. However, robust selling pressure caused the Stochastic to step into oversold territory, depicting 11 in its description on the daily chart.

As of this writing, the currency pair trades at approximately 150.0, testing the 100-period simple moving average as resistance.

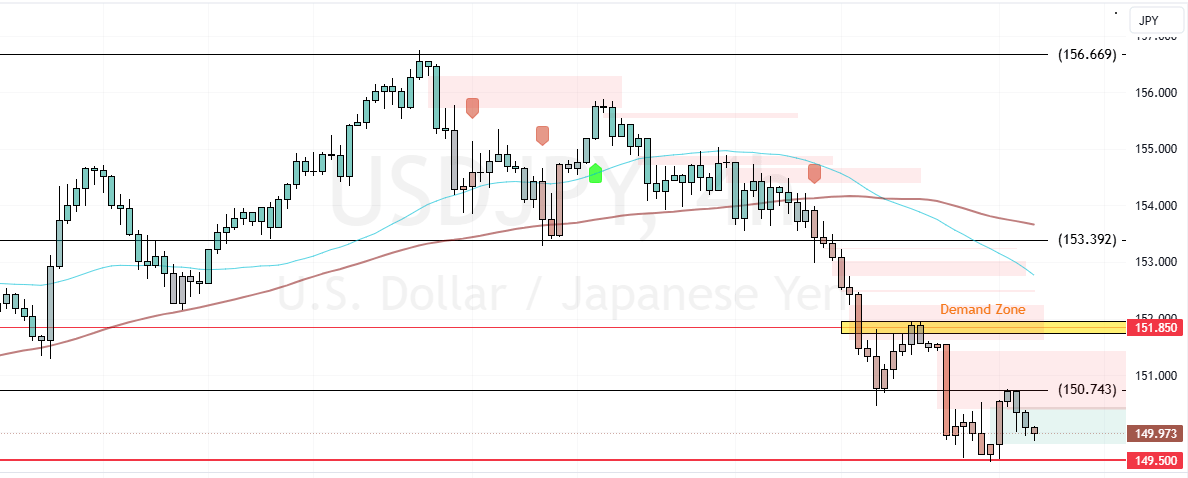

Yen Overpriced at 149.5: Market Expects Consolidation

Zooming into the 4-hour chart, we notice USD/JPY is below the moving averages, meaning the primary trend is bearish. But, the Japanese Yen faces critical resistance at 149.5, backed by the daily 100-SMA.

Due to Stochastic’s hint that Yen is overpriced, joining the bear market at the current price is not advisable. Therefore, traders and investors should wait patiently for the currency pair to consolidate near the upper resistance level, starting with the 151.8 mark.

Traders and investors should monitor this resistance for bearish signals, such as candlestick patterns.

Please note that the USD/JPY trend outlook remains bearish as long as the prices are below the 151.85 mark or the 50-period simple moving average in the 4-hour chart.