In today’s comprehensive EURCHF forecast, we will first examine the Eurozone’s current economic conditions. Then, we will meticulously examine the EURCHF pair’s technical analysis. Stay tuned for insightful observations and key takeaways.

Euro Area’s August 2023 Financial Upswing

Bloomberg—In August 2023, the Euro Area did well. They had an extra EUR 30.67 billion, a big change from the previous year when they were short EUR 26.57 billion. They made a profit of EUR 25.48 billion from selling goods, a massive turnaround from the EUR 30.99 billion loss they had last year. They also reduced their secondary income deficit to EUR 12.22 billion from EUR 14.19 billion.

However, their earnings from services dropped slightly to EUR 12.38 billion from EUR 13.09 billion, and their primary income surplus dropped slightly to EUR 5.04 billion from EUR 5.52 billion.

EURCHF Analysis – Euro Areas August 2023 Upswing

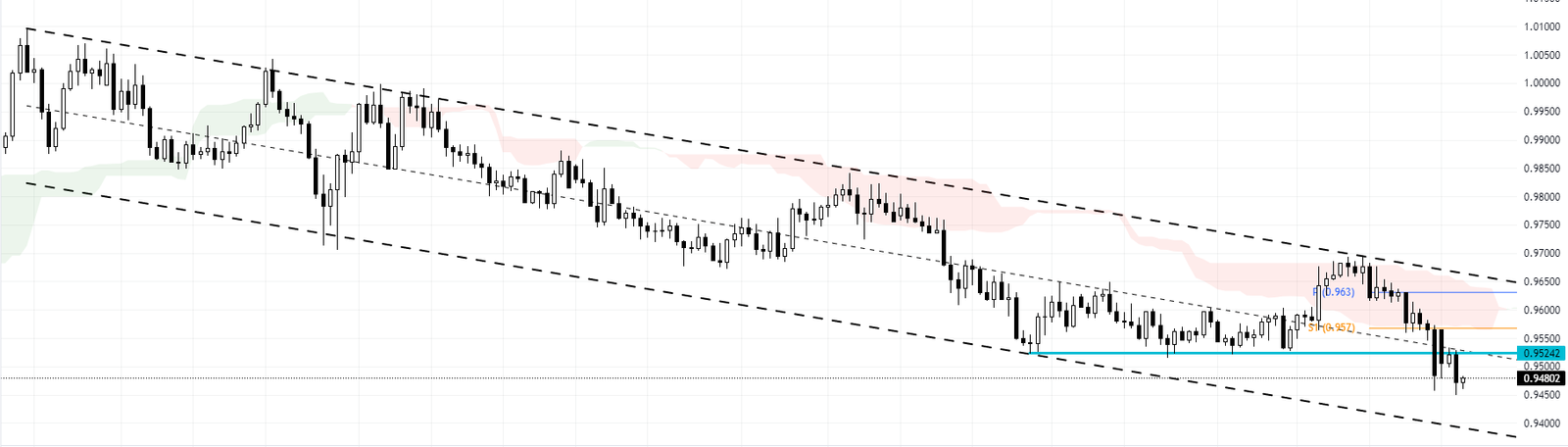

FxNews – We’ve observed that the EURCHF is currently trading within a bearish channel. It’s positioned below the significant resistance level of 0.9524, tested on October 17. This resistance level has proven a formidable barrier for the bulls, leading to a bearish outlook for the EURCHF in the daily chart.

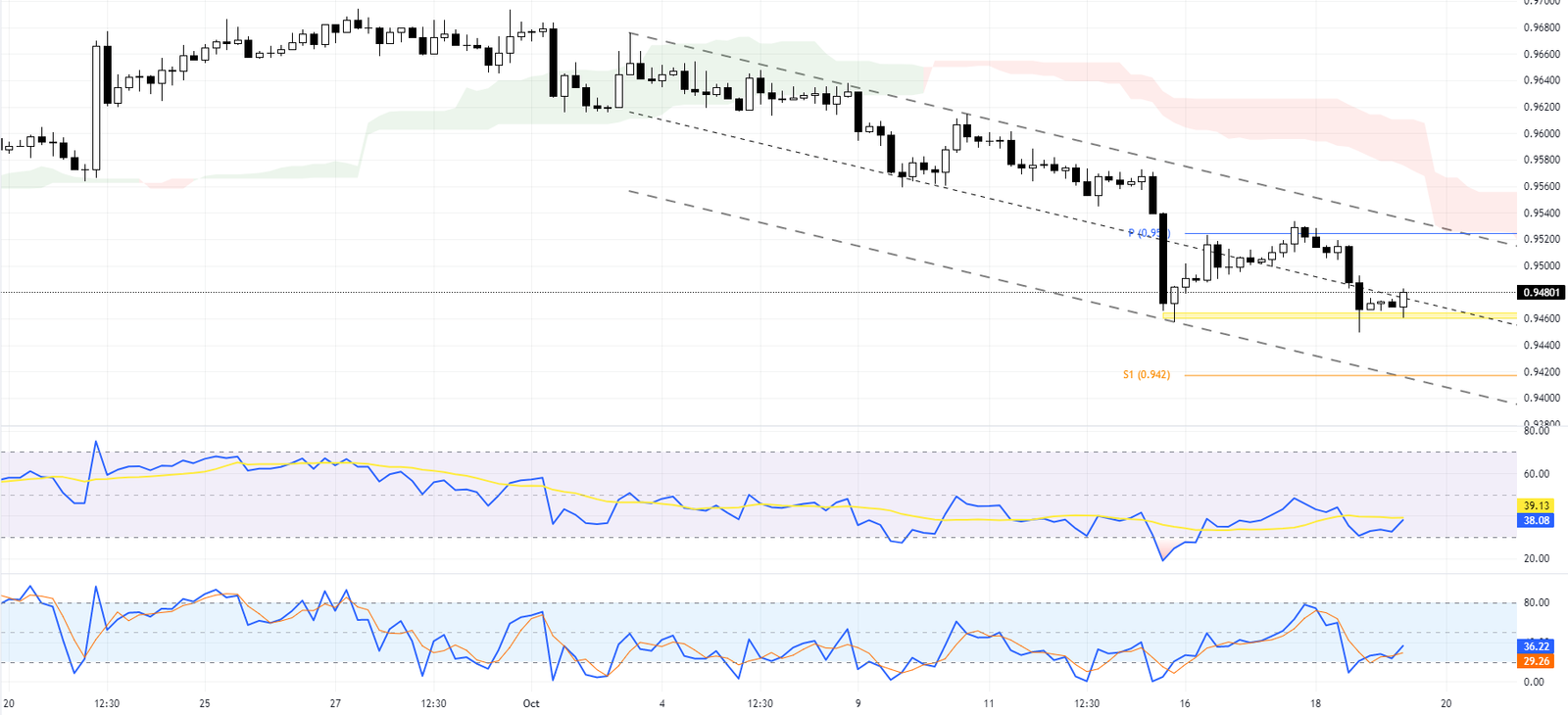

When we zoom into the 4-hour chart, it’s evident that the EURCHF currency pair has tested the recent lower low around 0.9481. Interestingly, the bears could not close below this support, leading to the emergence of a double-bottom pattern. With indicators such as the Stochastic oscillator exiting the oversold area and the RSI showing divergence, our EURCHF analysis suggests a potential slight increase for the EURCHF. The currency pair may target the 0.952 pivot or even reach the upper line.

EURCHF Analysis: Final Thoughts

It’s important to note that despite this potential bullish scenario, our overall EURCHF analysis remains bearish. However, swing traders might find an opportunity to bid on this bullish scenario with a stop below the 0.946 support and targeting the 0.952 pivot.

On the other hand, if the EURCHF bears manage to close below the aforementioned support, it would invalidate both the double bottom pattern and our bullish scenario derived from our EURCHF analysis. We could expect a continued decline towards the 0.942 support in such a case.