Explore the best Forex swing trading strategies in our comprehensive guide. Learn how to profit from price swings, identify trends, and understand popular strategies such as reversal and retracement trading. It is ideal for both beginners and experienced traders.

Swing trading in Forex is a strategy that involves holding onto trades for a medium length of time, typically from a couple of days to several weeks. This approach is about profiting from the ups and downs in currency prices. It’s a style that requires patience, as you’ll need to hold onto your trades for several days at a time.

Swing trading sits comfortably between two other well-known trading styles: day trading, where trades are entered and exited within a single day, and position trading, where traders hold onto positions for weeks or even months.

Identifying Trends in Swing Trading

The first step in swing trading is spotting a potential trend. This could be an upward or downward movement in the price of a currency pair. Once a trend is identified, swing traders will hold onto their trades for some time, ranging from a minimum of two days to several weeks.

For example, if the EURUSD pair has increased over the past week, this could indicate an upward trend. A swing trader might then decide to buy this pair, expecting the price to continue rising. This trading style is perfect for those who can’t watch their charts all day but can spare a few hours each night to analyze the market.

Analyzing the Market in Swing Trading

Swing traders use two main types of analysis to predict whether a currency pair’s price might rise or fall shortly: fundamental analysis and technical analysis.

Fundamental analysis involves looking at economic indicators, news events, and political developments that might affect the value of a currency. For instance, if the US Federal Reserve announces an interest rate increase, this could cause the USD to strengthen against other currencies.

On the other hand, technical analysis involves studying price charts to identify patterns that might predict future price movements. For example, if a chart shows that the GBPUSD pair has been hitting higher highs and lows, this could indicate an upward trend.

Making Trades in Swing Trading

The goal of swing trading is to identify swings within a medium-term trend and make trades when there’s a high chance of making a profit.

For instance, during an uptrend (when prices are generally rising), you aim to buy (or “go long”) at “swing lows” (the lowest point in a price swing). Conversely, during a downtrend (when prices are generally falling), you aim to sell (or “go short”) at “swing highs” (the highest point in a price swing).

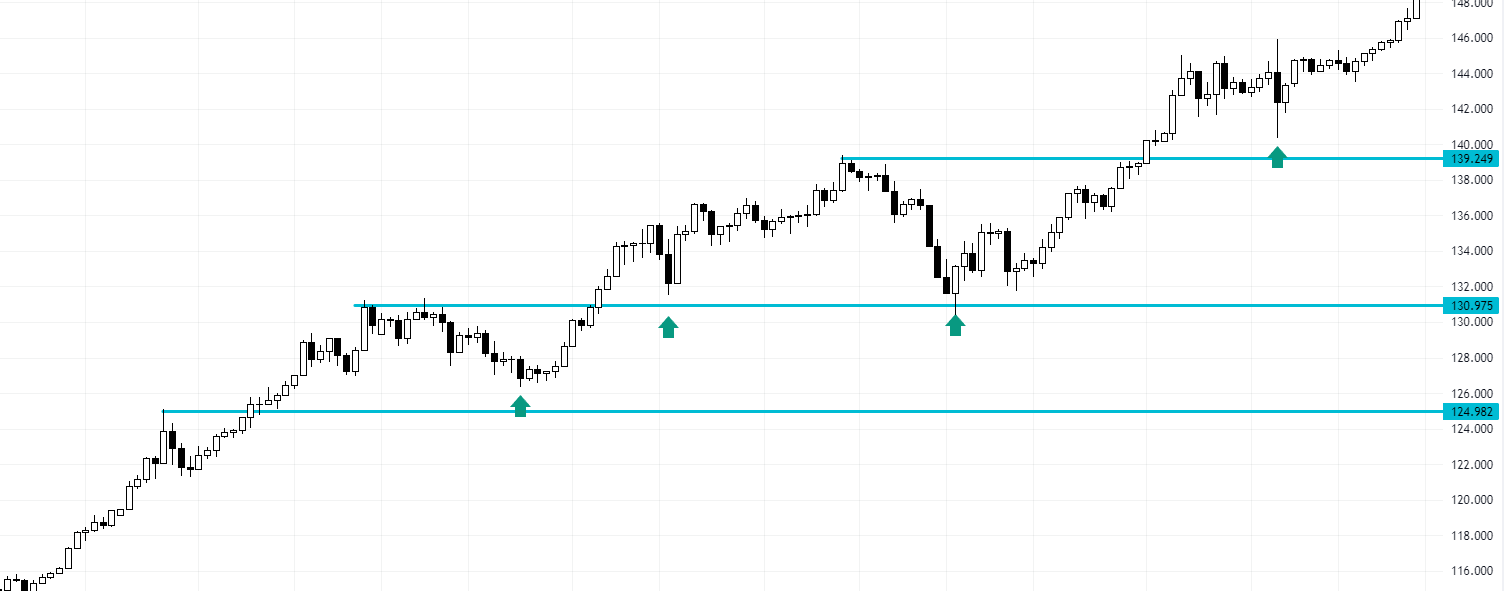

For example, suppose you notice that the USDJPY pair has been trending upwards but has recently dipped to a lower price before rising again. In that case, you might buy at this “swing low” in anticipation of further price increases.

Because swing trades last longer than one day, they’re subject to more ups and downs in the market. This means you’ll need more considerable stop losses (an order to sell a security when it reaches a specific price) to protect against volatility. Forex traders need to factor this into their money management plan.

Top 4 Best Forex Swing Trading Strategies

Several different strategies swing traders often use. Here are four of the most popular ones:

1. Reversal Trading: This strategy is based on spotting changes in price momentum. A reversal happens when the direction of an asset’s price trend changes. For example, if the AUDNZD pair has been trending downwards but hitting higher highs and lows, this could indicate a reversal.

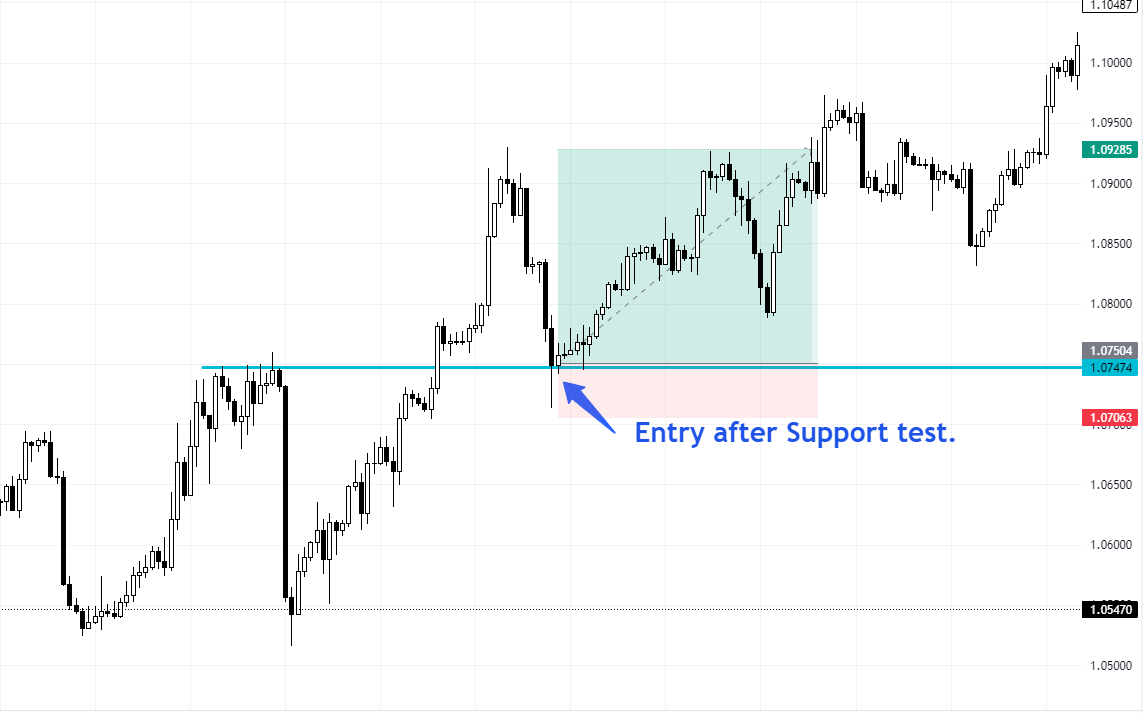

2. Retracement Trading: This involves temporarily looking for prices to reverse within a more significant trend. The price retraces to an earlier point before continuing to move in the original direction. For instance, if the EURGBP pair has been on an upward trend but dips down briefly before resuming its upward movement, this dip would be considered a retracement.

3. Breakouts Trading: Traders using this strategy enter a position as the price of an asset moves beyond a certain level, indicating potential for further price increases. For example, if the USDCAD pair breaks above a resistance level that it hasn’t been able to surpass in the past, this could signal a breakout.

4. Breakdowns Trading: This occurs when the price of an asset moves below a certain level, suggesting potential for further price declines. For instance, if the NZDUSD pair drops below a support level from which it has previously bounced back multiple times, this could indicate a breakdown.

Final word

In this article, you discovered the best Forex swing strategies to help you navigate the volatile world of Forex trading. These strategies are designed to take advantage of price swings in currency markets, allowing traders to profit from short-term price fluctuations. Whether you’re a novice trader just starting or an experienced trader looking for new strategies, understanding the best Forex swing trading strategies is crucial.

These strategies include identifying potential trends, calculating entry and exit points, and managing risk effectively. By mastering these strategies, you can potentially increase your chances of success in the forex market.

Remember, the key to successful swing trading lies in choosing the right strategy for your trading style and risk tolerance.