The Australian dollar remained around $0.652 on Wednesday, close to its lowest point in three months. This decline is mainly because the U.S. dollar is getting stronger, driven by “Trump trades.” These trades mean investors believe Trump’s inflation-related policies will prevent the Federal Reserve from lowering interest rates.

Australian Dollar Drops as Commodity Prices Fall

The Australian dollar is also under pressure because commodity prices like iron ore, copper, gold, and oil have dropped. Since Australia exports these commodities, lower prices can hurt its economy.

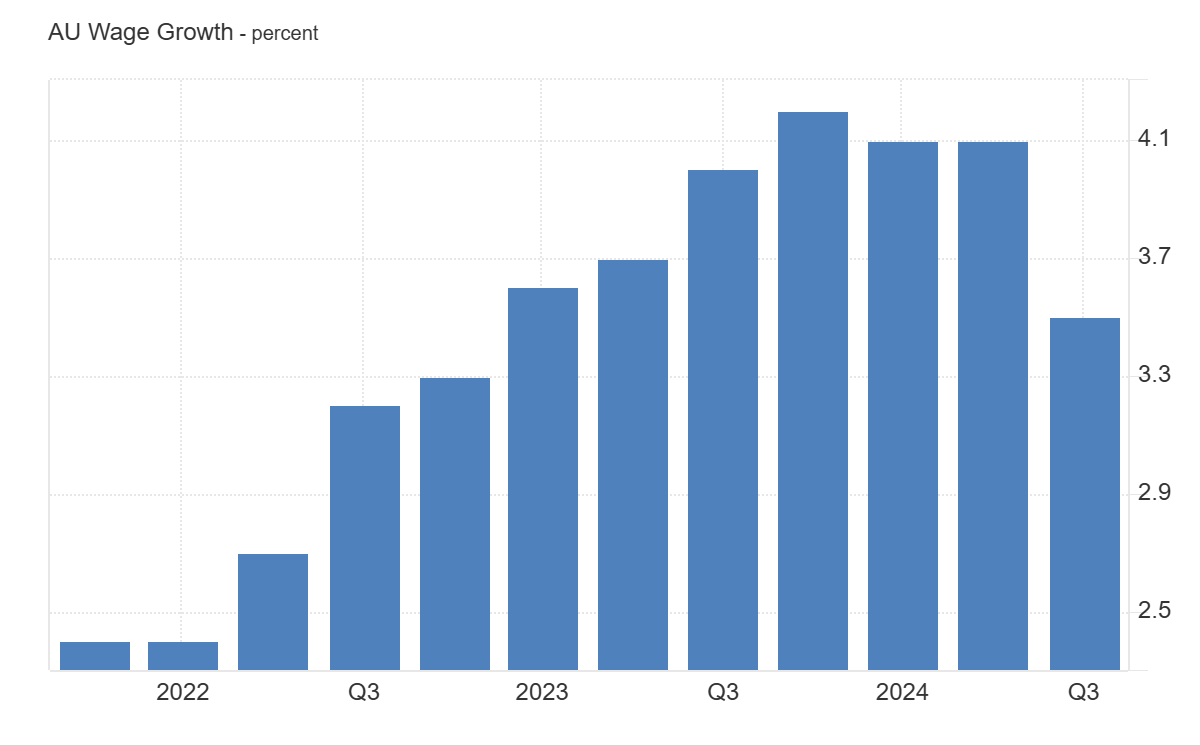

Australia Sees Slowest Wage Growth in Two Years

In Australia, wage growth slowed to 3.5% in the third quarter. This is the slowest rate in nearly two years, just below what experts predicted (3.6%). On a brighter note, consumer confidence increased to its highest level in November in two and a half years. This boost is mainly because people are less worried about interest rate hikes.

Financial markets do not expect the Reserve Bank of Australia to cut interest rates anytime soon. The earliest possible rate cut is predicted for mid-2025.

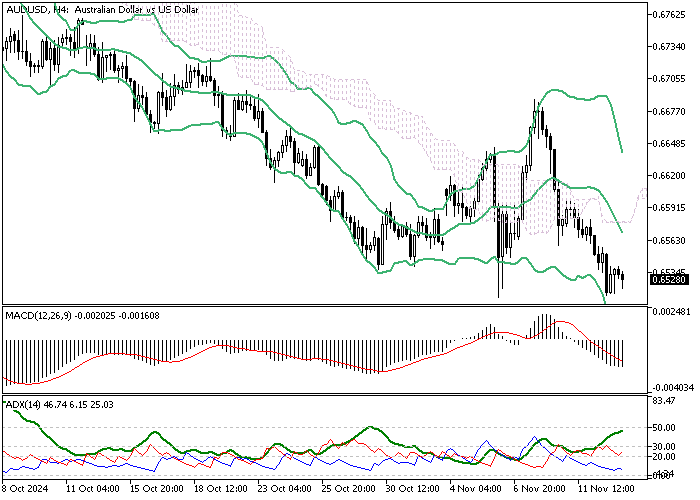

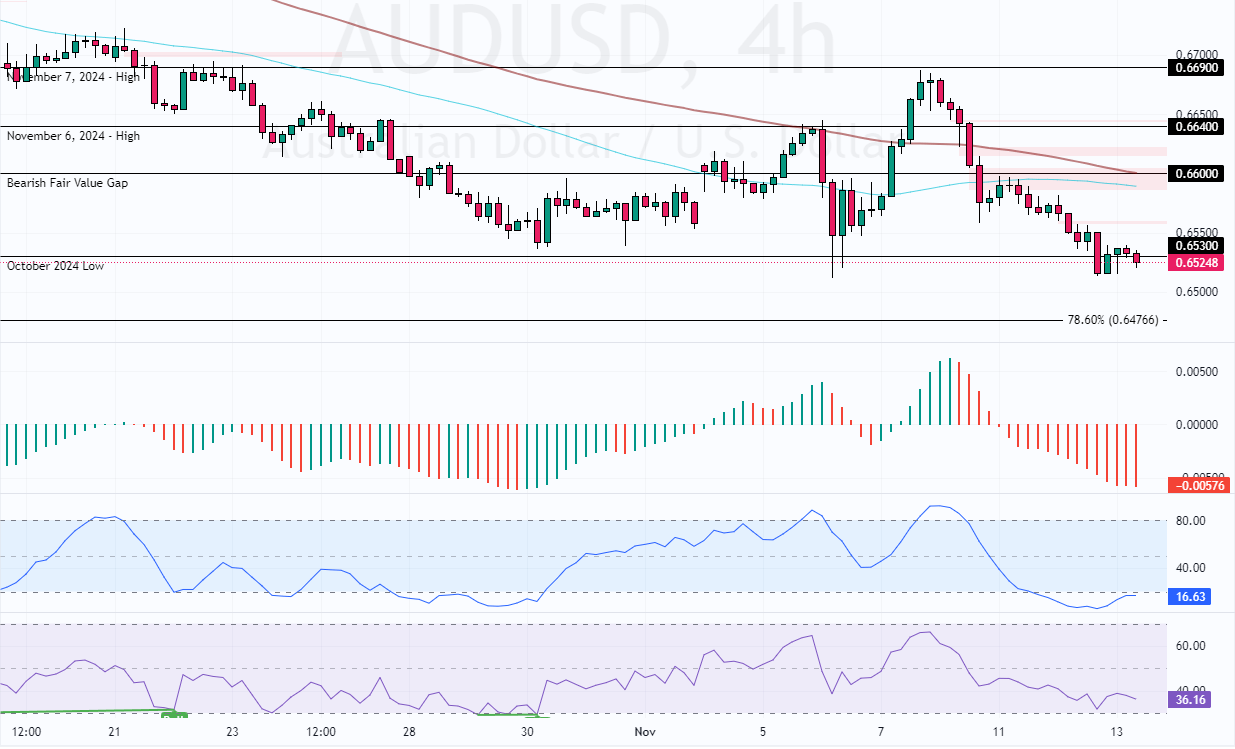

AUDUSD Technical Analysis – 13-November-2024

The AUD/USD currency pair is testing the October low at $0.652 as support. The 4-hour chart shows the market is oversold, meaning a consolidation phase could be on the horizon.

The Stochastic depicts 16 in the description, meaning the U.S. dollar is overpriced. That said, we expect the AUD/USD pair to begin a consolidation phase near the bearish Fair Value Gap at approximately $0.66, backed by the 100-period simple moving average. If this scenario unfolds, the 0.66 mark could provide a decent ask price to join the bear market.

AUDUSD Stays Bearish Below $0.664

That said, the outlook of the AUD/USD remains bearish as long as the currency pair’s value is less than $0.664. Furthermore, the next bearish target could be the 78.6% Fibonacci retracement level at $0.647.

- Support: 0.652 / 0.647

- Resistance: 0.66 / 0.664