The British pound recently fell to $1.273, marking its lowest point in three months. This drop is mainly due to a stronger U.S. dollar. Many expect that policies under Donald Trump’s leadership could increase inflation. As a result, the Federal Reserve might find it harder to lower interest rates.

UK Wages Dip Matches Bank of England Forecast

Meanwhile, new labor market data from the U.K. supports the Bank of England’s careful approach to cutting interest rates. Regular wages, not including bonuses, slightly decreased to 4.8% in the three months leading up to September, matching the central bank’s predictions.

Job vacancies have dropped to the lowest since May 2021 in the U.K.

However, there are some concerns. Unemployment in the U.K. has risen to 4.3%. Additionally, the number of job vacancies has dropped to its lowest level since May 2021. Last week, the Bank of England reduced interest rates by 25 basis points for the second time this year. They continue to be cautious about making further cuts.

Looking ahead, more important economic daU.K.rom the U.K., including the third-quarter Gross Domestic Product (GDP) growth figures, are expected this week.

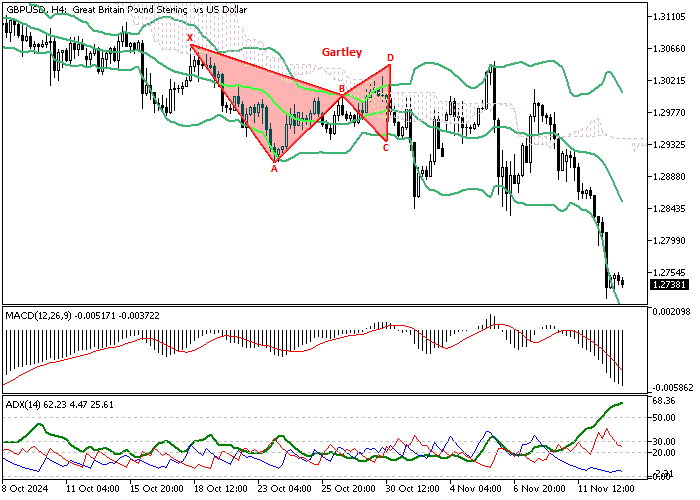

GBPUSD Technical Analysis – 13-November-2024

The GBP/USD 4-hour chart shows the U.S. dollar is overpriced, at least in the short term. Therefore, going short or entering a sell position at the current price of $1.273 is not advisable. Hence, we suggest waiting patiently for the prices to consolidate near upper resistance levels, such as $1.290.

- Good read: Watch USDMXN for a Potential Rise to 20.81

Wait Out GBP/USD Fluctuations: Key Levels to Watch

For the consolidation scenario, GBP/USD bulls must pull the prices above the immediate resistance of $1.284. If this occurs, the path to the 100-period simple moving average at approximately 1.290 could be paved. These resistance levels can offer a decent bid to join the bearish trend.

Traders should monitor these levels meticulously for bearish signals such as candlestick patterns.

- Support: 1.267 / 1.26

- Resistance: 1.284 / 1.290 / 1.304