In this comprehensive EURHUF forecast, we delve into the intricate dynamics of the EURHUF currency pair. Our focus is to provide you with a detailed understanding of the current market trends, key resistance levels, and potential future scenarios. Let’s dive in.

A Tough Month for Hungary’s Construction Industry

Reuters – Hungary’s construction industry didn’t do well in August 2023. It saw a decrease of 0.5% compared to last year, a big change from the 3.4% increase it had in the previous month. This was mainly because less building activity happened (7.6% compared to 11.6% in July). On the other hand, engineering projects saw a bit of a boost, increasing by 13.6% after falling by 5% a month before. However, considering seasonal and calendar changes, the construction industry was still doing 5% worse than the previous month.

EURHUF Forecast – 3 Keys to Profit from October

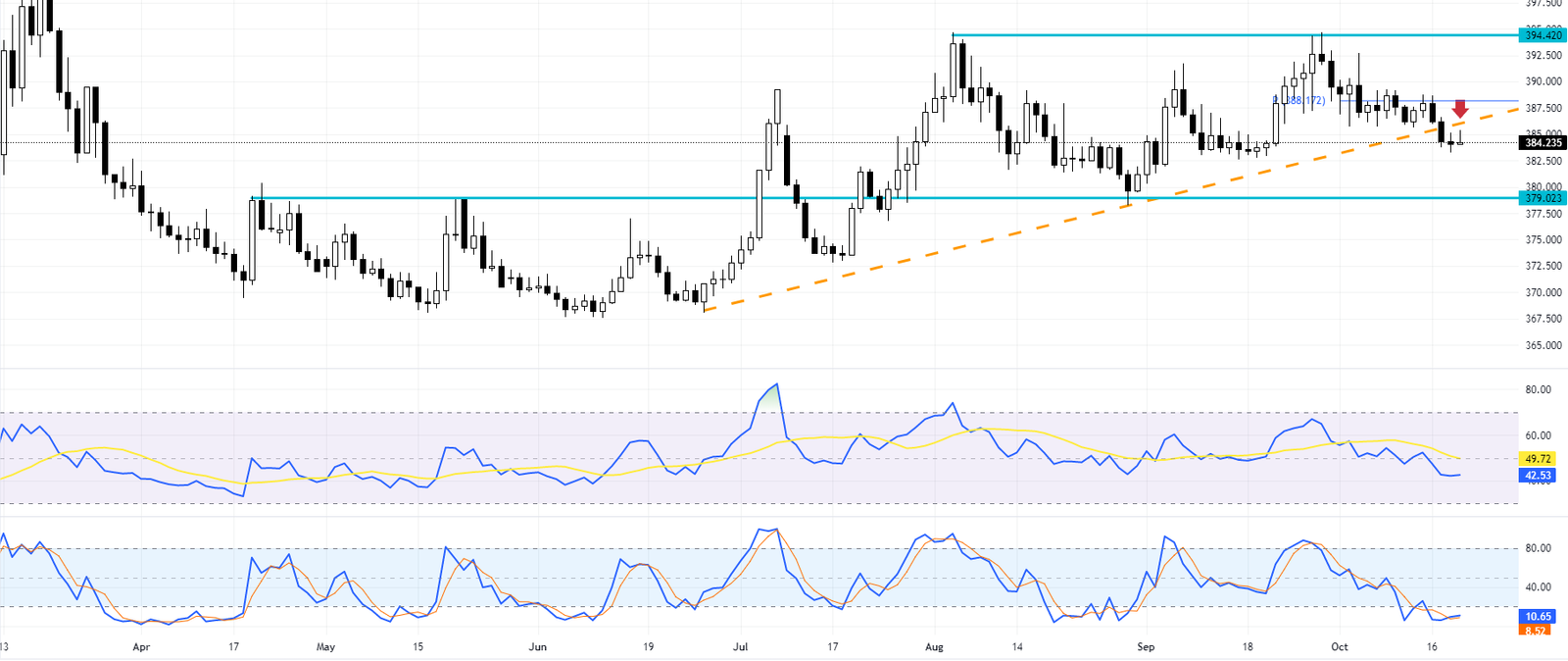

The EURHUF currency pair recently broke out from its bearish channel, a significant event that caught the attention of many traders and analysts. However, the bullish momentum was not strong enough to break through the 391.6 resistance level, as evident from the long wick candlestick pattern observed in the weekly chart.

The Relative Strength Index (RSI) and the Stochastic oscillator, two key technical indicators, have turned below their respective signal lines. This suggests that the outlook for the EURHUF pair remains bearish for now.

When we zoom into the daily chart of the EURHUF pair, we can see that it broke down the bearish trendline on Tuesday, October 23. Currently, the price is stabilizing itself below this level. The RSI indicator is below the 50 line, generally considered a bearish signal. However, the Stochastic oscillator is hovering in the oversold area. This could extend the correction to the 386 area before the decline continues.

With the EURHUF price trading below the 388 pivot point, the bears have set a preliminary target at 379. This could be an important level to watch in the coming trading sessions.

However, the current bearish scenario would be invalidated if the EURHUF price falls below the pivot point. In such a case, we could expect the market to rise and test—and possibly break—the 394-resistance level.

Conclusion

In conclusion, our EURHUF forecast suggests that traders should closely monitor these key levels and indicators. Proper risk management techniques are always important when trading in volatile markets.