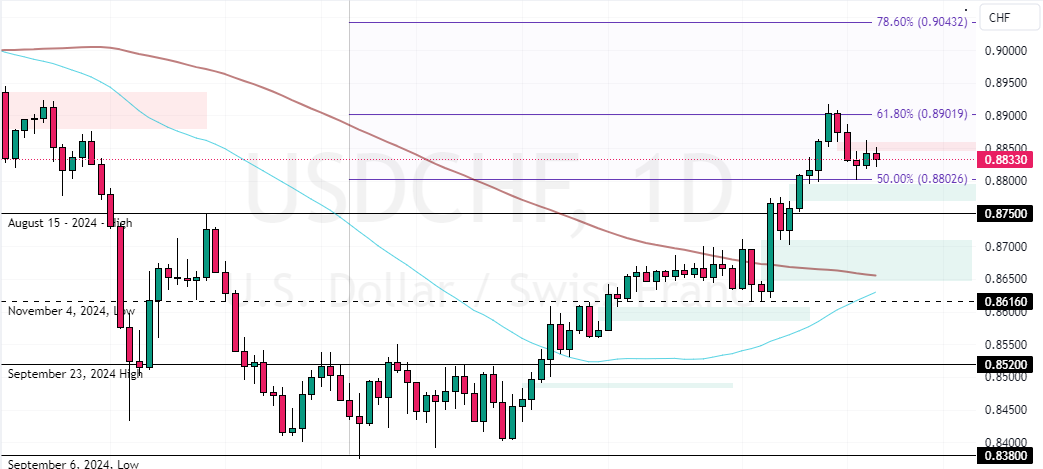

The USD/CHF pair bounced from the %50 Fibonacci retracement level at 0.880, trading at approximately 0.883 as of this writing. This increase comes as investors seek safer investments due to growing tensions between Russia and Ukraine. President Vladimir Putin has updated Russia’s nuclear policy, stating that if a country supported by a nuclear power attacks Russia with conventional weapons, it will be seen as a collective assault.

At the same time, strong US economic reports and the likelihood of inflation from new tariffs lead to speculation that the Federal Reserve might reduce the pace of interest rate cuts.

Will SNB Cut Rates After Swiss Inflation Surprise?

In Switzerland, the inflation rate dropped unexpectedly to a low not seen in more than three years—0.6% in October. This has led to predictions that the Swiss National Bank might lower rates again in December.

Yet, SNB Vice Chairman Antoine Martin has advised that the bank has not decided on any rate cuts for December, emphasizing that any decisions will depend on the economic situation.

USDCHF Technical Analysis – 21-November-2024

The primary trend should be considered bullish because the prices are above the 100-period simple moving average, as the 4-hour chart above shows. The pullback from the %50 Fibonacci at 0.880 was expected on the technical front due to Stochastic’s oversold signal.

However, the bulls face the bearish fair value gap as a barrier, resting at 0.886.

Watch USD CHF Target New Highs at 0.904

From a technical standpoint, the uptrend will likely resume if USD/CHF closes and stabilizes above the immediate resistance at 0.880. In this scenario, the price can rise toward revisiting the 68.8% Fibonacci at 0.890.

Furthermore, if the buying pressure exceeds 0.890, the next bullish target could be 0.90, followed by 0.904, backed by the 78.6% Fibonacci level.

Please note that the bullish strategy should be invalidated if USD/CHF falls below the November 7 high at 0.877.