WTI crude oil futures rose to approximately $69.5 per barrel, testing the October 24 low as resistance. This increase was driven by escalating geopolitical tensions that overshadowed concerns about the growing crude oil supplies in the United States.

For example, Ukraine deployed Western-supplied long-range weapons for the second time on Wednesday. This event occurred just a day after President Putin expanded Russia’s nuclear policy, broadening the conditions under which nuclear weapons might be used.

At the same time, the United States vetoed a United Nations resolution calling for a ceasefire in Gaza, which rekindled fears about potential disruptions to oil supplies from the Middle East.

Surplus US Oil Stock Suppresses Price Rise Fears

However, these price gains in the Oil sector were limited due to signs of abundant oil supply in the market. The Energy Information Administration (EIA) reported that US crude oil inventories increased for the third week, rising by 0.5 million barrels last week. This was slightly more than the expected increase of 0.4 million barrels.

Additionally, gasoline inventories grew by 2.1 million barrels, surpassing the forecasted rise of 1.6 million barrels. These figures suggest that, despite geopolitical risks, the oil market remains well-supplied.

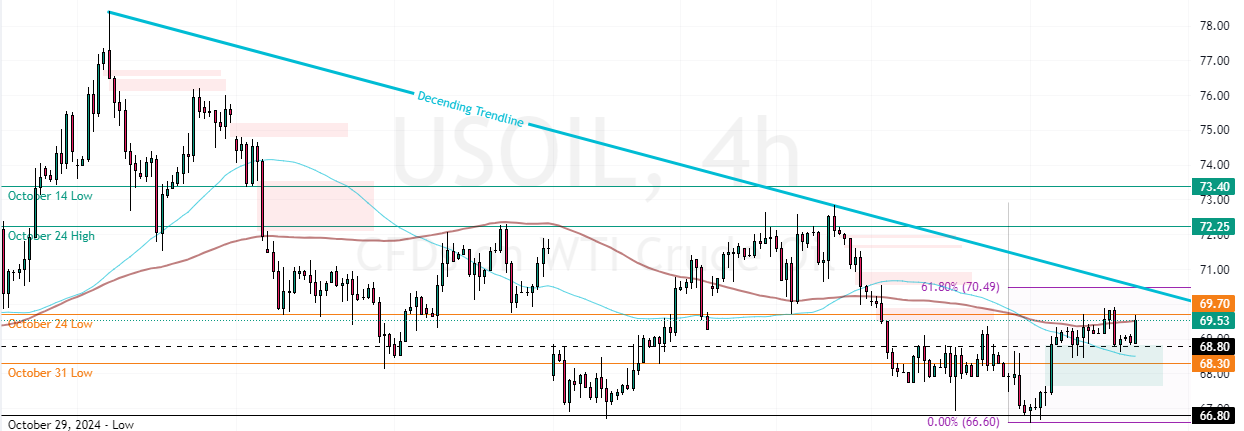

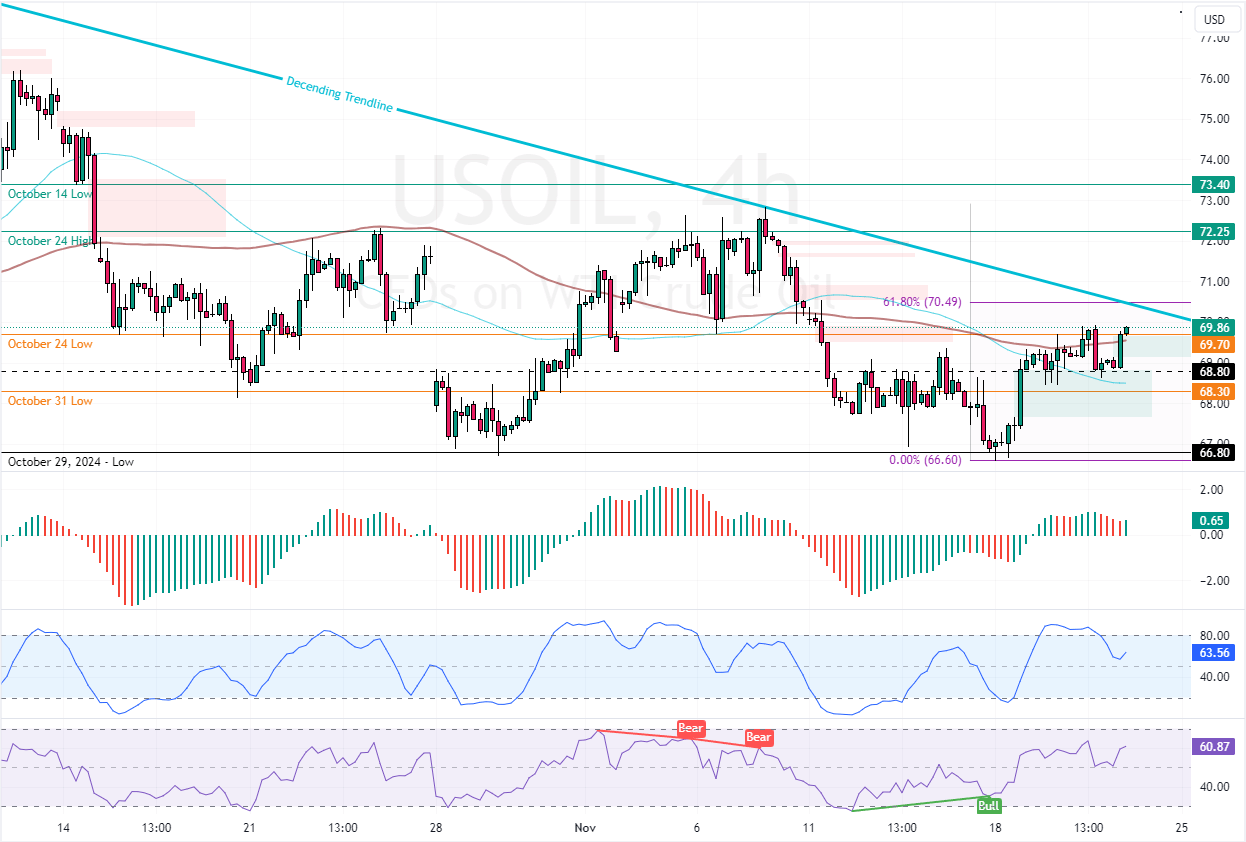

Crude Oil Technical Analysis – 21-November-2024

Black gold’s primary trend is bearish because the prices are below the descending trendline, as the 4-hour chart above shows. As for the technical tools, the Awesome Oscillator histogram is red, while the Stochastic returned below 80, indicating the bear market should resume.

Overall, the technical indicators suggest the primary trend is bearish and should resume.

Curde Oil Price Forecast – 21-November-2024

That said, the 61.8% Fibonacci level at $70.5 plays the immediate resistance. The bearish outlook remains valid as long as Oil prices are below this resistance. Furthermore, if bears push the prices below the $68.3 support, the downtrend will be triggered again. In this scenario, the October 29 low at $66.8 could be revisited.

On the other hand, the downtrend should be invalidated if oil prices exceed the 61.8% Fibonacci level at $70.5. If this scenario unfolds, the current uptick momentum could extend to $72.2.