FxNews—The British pound is in a robust uptrend against the U.S. dollar, trading at approximately $1.337 in today’s trading session.

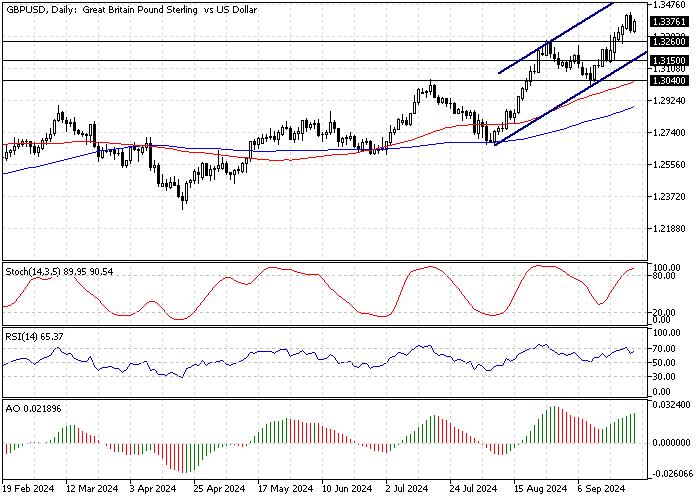

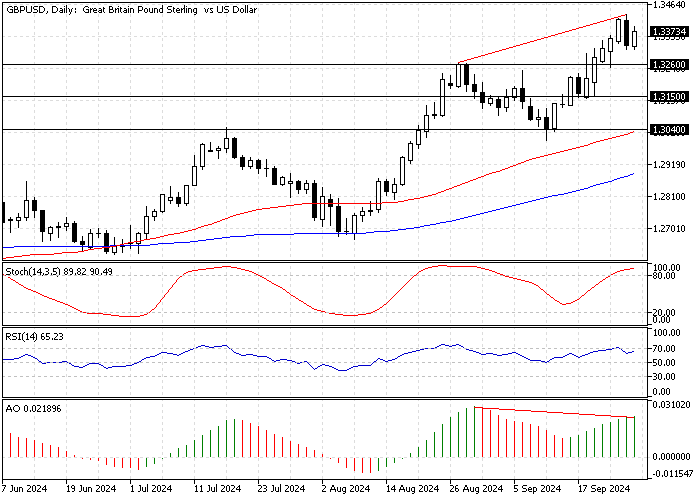

The GBP/USD value has been increasing nonstop since September 11, when the price was $1.304. The daily chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

GBPUSD Technical Analysis – 26-September-2024

The primary trend is bullish because the value of the GBP/USD pair is above the 50- and 100-period simple moving averages. However, the stochastic oscillator hovers in overbought territory, signaling that the market is saturated with buyers.

Additionally, the Awesome oscillator signals divergence, meaning the GBP/USD pair can potentially consolidate near the lower support levels.

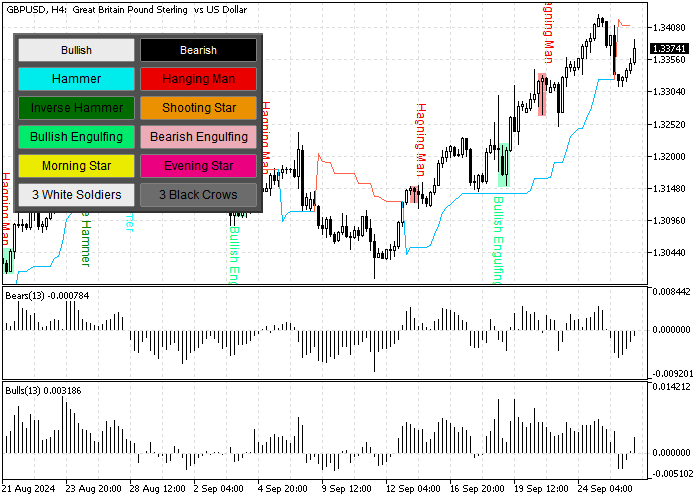

Interestingly, the GBP/USD price dipped below the Suprttrend indicator, signifying a bearish wave could be on the horizon.

Overall, the technical indicators suggest the primary trend is bullish, but the U.S. dollar might erase some of its recent losses against the British pound.

GBPUSD Forecast – 26-September-2024

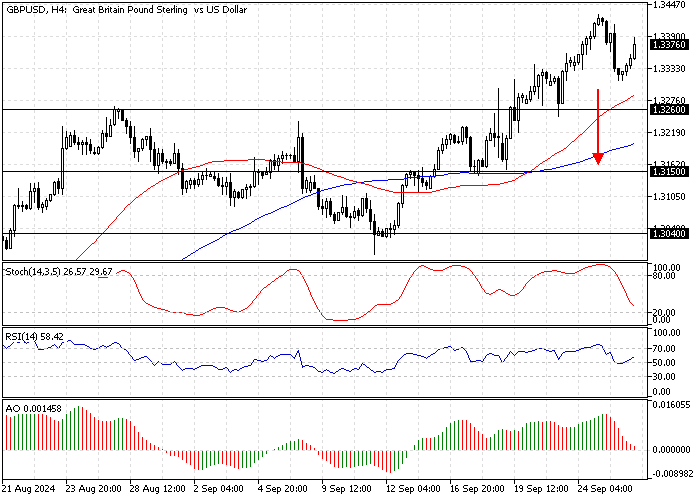

As explained earlier in this article, the GBP/USD pair is overbought. Therefore, we expect it to test the broken resistance at $1.326 (August 27 High).

This level provides a decent bid and opportunity for retail traders and investors to join the bull market. Therefore, monitoring the $1.326 mark for bullish signals, such as a bullish engulfing candlestick pattern, is vital.

Furthermore, the uptrend will likely resume if the GBP/USD price exceeds $1.326. If this scenario unfolds, the next bullish target will likely be the $1.349 mark.

GBPUSD Bearish Scenario – 26-September-2024

The immediate support is at $1.326, and if the price dips below $1.326 in the ascending trendline, the GBP/USD will likely consolidate near $1.315 (September 17 Low) and then $1.304 (September 11 Low).

Please note that the primary support for the bull market remains at $1.304, neighboring the 50-period simple moving average. That said, the trend should be considered bearish if the GBP/USD value drops below this resistance.

GBPUSD Support and Resistance Levels – 26-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.326 / $1.315 / $1.304

- Resistance: $1.349