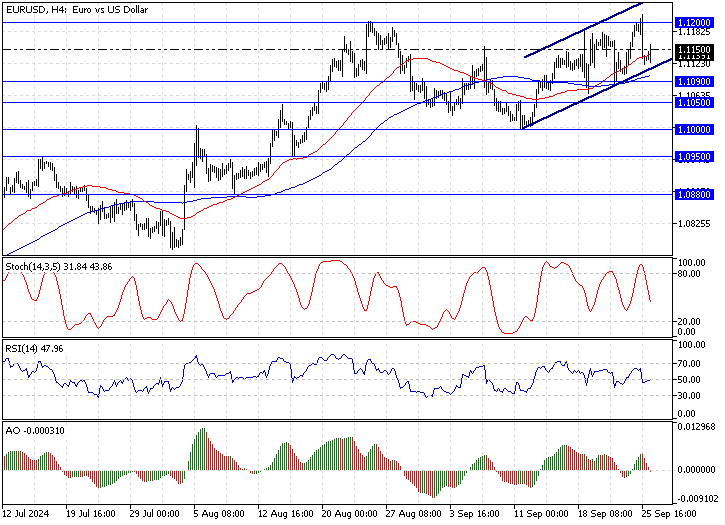

FxNews—The European currency trades sideways and below the $1.12 (August 26 High) resistance against the U.S. dollar. As of this writing, the pair is testing the 50-period simple moving average in the 4-hour chart at approximately $1.113.

The EUR/USD 4-hour chart below demonstrates the price, support, and resistance levels and the technical indicators utilized in today’s analysis.

EURUSD Technical Analysis – 26-September-2024

The primary trend is bullish because the trading asset’s price in discussion is above the 50- and 100-period simple moving averages. However, the momentum indicators are declining, signaling that the bear market gains more momentum and the bull market weakens.

Additionally, the Awesome oscillator flipped below the signal line, interpreted as the selling pressure rising.

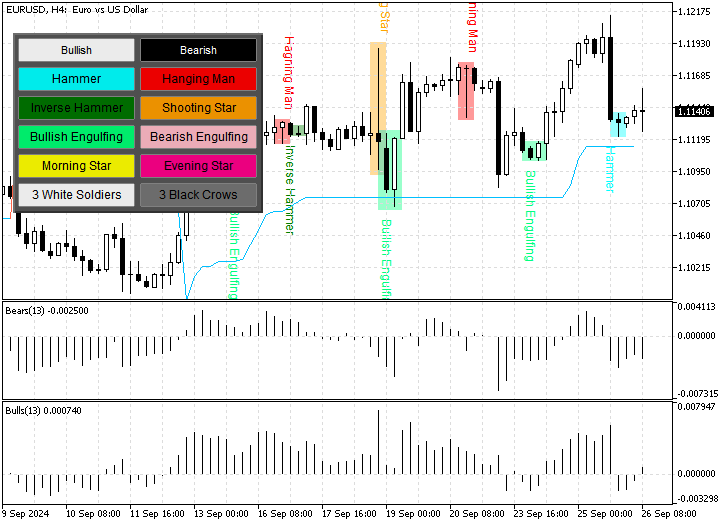

As for the candlestick patterns, the 4-hour chart formed a hammer candlestick pattern close to the Supertrend indicator, meaning the uptrend can potentially resume.

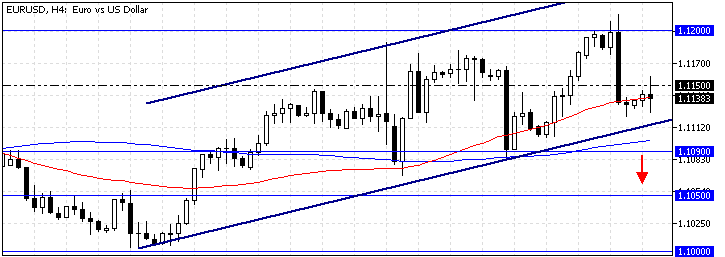

Overall, the technical indicators suggest the primary trend is bearish, but the EUR/USD price has the potential to consolidate near the lower support levels.

EURUSD Forecast – 26-September-2024

The immediate support rests at $1.109 (September 23 Low). If the EUR/USD price dips below $1.09, the bearish momentum that began at $1.12 can extend to the September 11 high at $1.105.

If this scenario unfolds, the EUR/USD price will be below the 100-period simple moving average. Hence, the primary trend should be considered bearish then.

Furthermore, if the selling pressure pushes the price below $1.105, the next support level will be the September 11 low at $1.10.

EURUSD Bullish Scenario – 26-September-2024

The uptrend is valid as long as the EUR/USD price is above the support of $1.109, which is neighboring the 100-period SMA. If the bulls (buyers) hold above $1.109, the uptrend will likely resume and initially retest the $1.13 resistance, the August 26 high.

Furthermore, if the EUR/USD price exceeds $1.13, the next bullish target will likely be $1.20.

EURUSD Support and Resistance Levels – 26-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.109 / $1.105 / $1.10

- Resistance: $1.115 / $1.12 / $1.20