FxNews – Any forex trader should ask themselves, what is Awesome Oscillator? In this comprehensive article, we will be scrutinizing the Awesome Oscillator indicator. We’ll delve into its history, popularity, advanced strategies, and provide real-time examples using the AO indicator. We’ll also discuss what to appreciate and what to be cautious of when using this tool. So, if you want to know the Awesome Oscillator secrets, stay with this article until the end.

Introduction

People often recall the times when traders would track the stock market and prices in newspapers. They’d sit behind their desks, sipping their morning coffee, and reading the latest news and updates about the market. To place a trade, they had to pick up the phone and call their broker, and all orders had to wait in a long queue before processing. But those days are long gone. The internet has taken over everything in the forex trading industry. Traders worldwide have moved from subscribing to newspapers to going online and using websites to fetch the latest updates and news.

As time passed, new trading platforms emerged. Thanks to technology and fast internet, anyone can access the global market within seconds. Nowadays, trading platforms are available on mobile phones, tablets, and computers. Despite the evolution of trading and the abundance of tactics, the classic strategies remain the fundamental core of trading.

One of the classic methods to trade is what Mr. Bill Williams invented: The Chaos Theory! He is a remarkable individual, and his priceless contribution to the world of forex trading is highly valued. The focus of this article is on how to trade forex using Bill Williams’ Awesome Oscillator indicator. I’m sure that’s why you’ve stayed with me so far. If you wish to know more about Bill Williams and the history of his work, you may visit his page on Wikipedia.

The first thing you should be aware of with technical indicators is that they are tools to gather information and data from the chart. Forex technical indicators cannot predict price movements. The forex indicators, as we know, are lagging. That means the information they offer is current or old.

Trading forex involves risks! Understanding this concept will help you know what you’re getting into. So, this is not just about the awesome oscillator. This rule covers all sorts of technical indicators. But in this article, you will learn how to use these tools as leverage in your strategy. Remember, nothing here is doctrine. This is just one of many available strategies that you can apply to your day-to-day trading ideas.

What is Awesome Oscillator

The Awesome Oscillator, or AO, is a key tool for traders. It was made by Bill Williams, a big name in trading. The AO is simple to use, yet its functionality is impressive. The AO works by looking at the middle price of a product. It takes the average of the high and low prices. Then it looks at how this changes over time. It uses a zero line to show if the market is going up or down.

What made the Awesome Oscillator Popular?

Easy to Use: In my opinion, the primary reason most traders use the AO is its simplicity. The indicator is easy to read, simple to use, and doesn’t have complex settings.

The indicator consists of three elements: the green bars, the red bars, and the middle line, also known as the signal line. Before we delve into the details, I want to demonstrate how straightforward it is to read the indicator.

Green bars suggest an ascending market, while red bars indicate a descending market.

Awesome Oscillator bars above the signal line suggest a bullish trend. Conversely, if the bars are below the middle line, the indicator signals a bearish trend.

As you can see, it takes only a few seconds to understand what Mr. Williams’s legacy is trying to convey on the chart. Trust me, in the fast-paced world of forex trading, every second counts when a trader is analyzing the market. After all, you wouldn’t want to miss a good opportunity to enter the market.

Versatility: The Awesome Oscillator indicator can be attached to any chart. Whether you’re trading stocks, forex, indices, or cryptocurrencies, it doesn’t matter. The AO indicator provides you with valuable data, regardless of the trading asset or time frame. So, whether you’re trading on an hourly chart or a higher time frame, you can consider this indicator as one of your go-to tools.

Compatibility: Syncing your trading strategy with other indicators can be challenging. However, the Awesome Oscillator has the feature of being compatible with alternative tools. Believe it or not, you need more than one indicator to understand what’s happening in the market. Therefore, consider adding the Awesome Oscillator to your chart, as things are about to get more interesting.

Real-time Feedback: The forex market moves in waves. Some waves are slow (ranging), and some are trending. Consequently, you need to be ready, and you need an indicator that provides real-time data. Since this indicator is based on moving averages, it offers real-time information, especially if you use the tool in lower time frames such as 1 hour or 30 minutes. Like all other indicators, it’s not perfect, but it gets the job done.

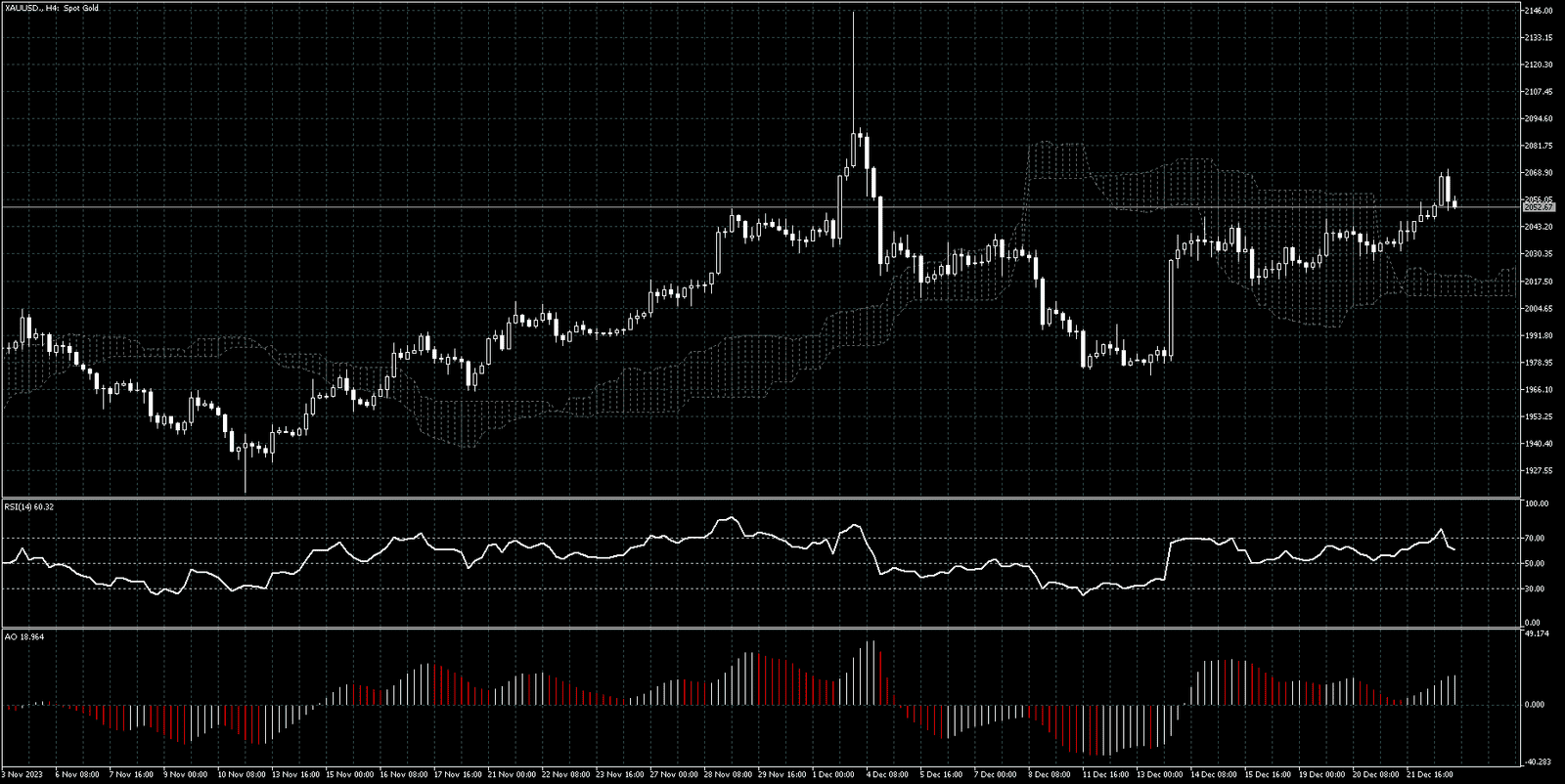

The chart below represents LTCUSD on the 4H chart. The indicator gives false signals when the market is ranging in a narrow area. Traders can avoid these false signals by combining other technical tools such as RSI, Ichimoku Cloud, trendlines, and Fibonacci support and resistance levels.

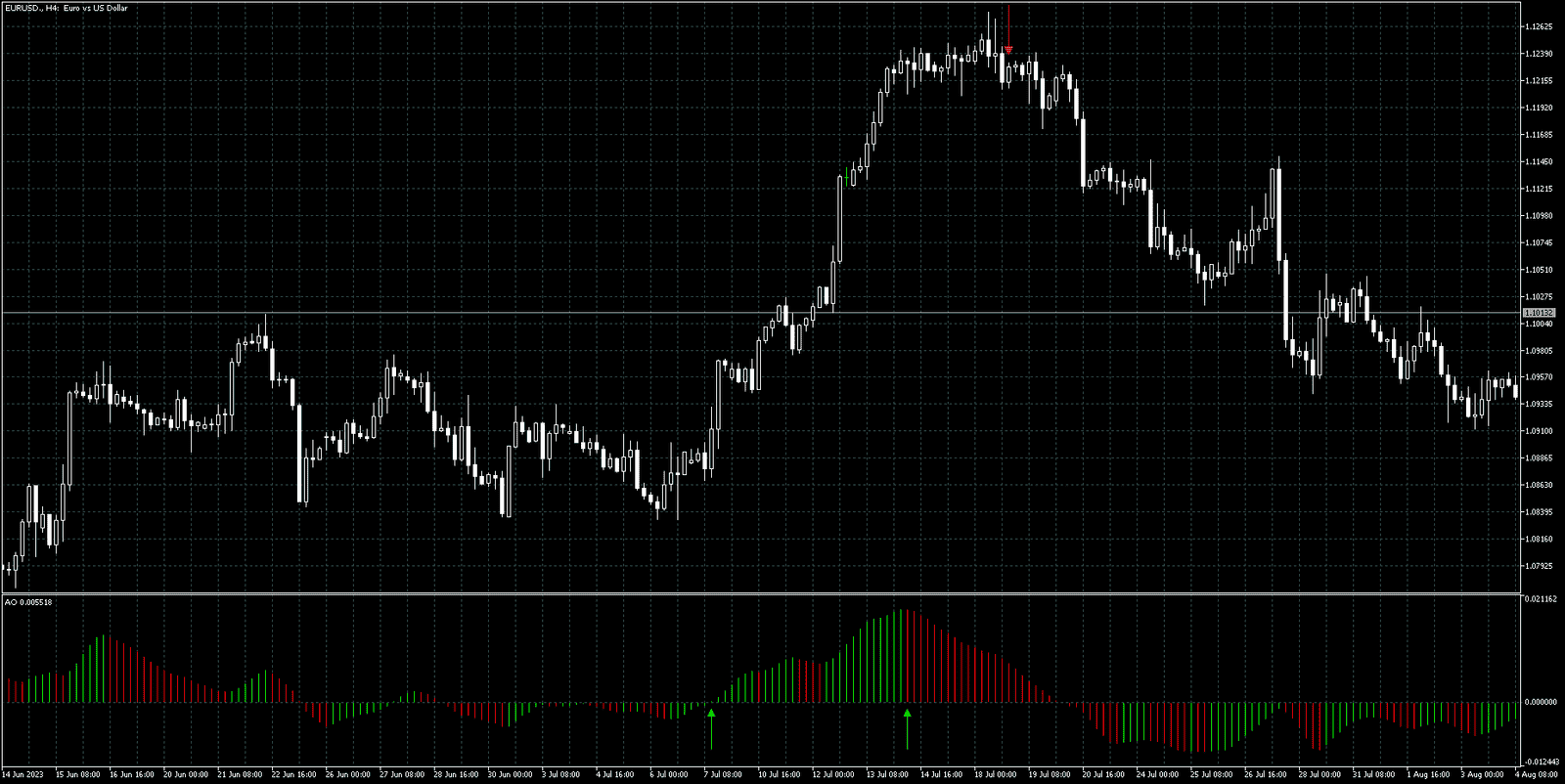

Risk Management: Let’s say you have a long position in the EURUSD pair. The indicator’s bars are green, you’re in profit, but you’re unsure when the best time to close the trade is. The Awesome Oscillator assists you in managing your open positions efficiently. Example: Consider the image below. When the bars change from green to red, you’re informed that the trend might ease or reverse. This is the time when you should consider closing your long position and secure your trade.

The same principle applies if you have a short trade. Once the bars change from red to green, the Awesome Oscillator alerts you about a possible trend reversal. Consequently, you can either adjust your stop-loss order or exit the trade.

The aforementioned strategy also applies when markets trend against us. Refer to the chart below.

Example: We had a buy order on GBPUSD with the Awesome Oscillator bars being green. Unfortunately, the indicator’s signal turned out to be false. We became aware of the false signal as soon as the next bars changed their colors from green to red. The Awesome Oscillator’s risk management capability aids forex traders in exiting bad trades and minimizing their losses.

Awesome Oscillator Trading Strategies

Zero Line Crossover: This is when the AO goes above or below the zero line. It shows if the market is getting stronger or weaker. (Strong)

Twin Peaks: This is when there are two high points above the zero line or two low points below it. It can show if the market is about to change. (Weak)

Saucer Setup: This is when the AO goes from negative to positive. It can show if the market is going from bearish to bullish. (Weak)

Traders often use the AO with other tools. This helps them check trends and find reversals. The AO is good at finding saucer signals and divergences. These are times when the price and the AO are going in different directions. This can show if the market is about to change.

Awesome Oscillator for Advanced Strategies

So far, you’ve learned how this trading tool can assist you with entering and exiting a trade, as well as managing risks. These three elements are the foundation and the first block of trading. The AO can be considered the foundation and the first block of our analysis since it covers the three key elements in trading:

- Defining the market’s trend

- Execution

- Risk management

Therefore, we can utilize this trading tool in more complex strategies that incorporate additional indicators such as the Ichimoku cloud, RSI, and moving averages.

Trading Strategies Involving the Awesome Oscillator

Crossing the Zero Line: This strategy involves watching when the awesome oscillator (AO) crosses the zero line. An upward cross suggests short-term momentum is stronger than long-term momentum, hinting at a potential long position for traders. Conversely, a downward cross indicates that short-term momentum is declining faster than long-term momentum, possibly signaling a short position. Remember, this method works best when combined with other technical indicators and fundamental analysis.

Analyzing Dual Peaks: Here, we look for two peaks on the AO, either above or below the zero line.

Bullish signals occur when two upward peaks appear under the zero line, with the second peak closer to zero than the first. For a valid bullish pattern, the AO should stay under the zero line during both peak formations, and the histogram bar after the second peak should be green.

Bearish signals happen when two downward peaks appear above the zero line, with the second peak closer to zero. A subsequent red histogram bar confirms the bearish pattern.

Easy Guide to the Saucer Pattern in Trading

To spot a bullish saucer in trading, look for the Awesome Oscillator (AO) to be above the zero line. Then, watch for three bars in this order: a red bar, another red bar that’s smaller than the first, and then a green bar right after. This pattern looks like a tiny dip, much like a saucer, in the histogram chart. If you see a bullish saucer, it could be a good time to buy. Traders often do this during the third bar, the green one, or they wait for the fourth bar, especially if it’s green too.

On the other hand, a bearish saucer happens below the zero line. Here, you’ll see two green bars in a row, with the second one smaller than the first, followed by a red bar. This is when traders might think about selling. They often do this during the third bar, the red one, or wait to see if the fourth bar is also red before deciding.

Differences Between Awesome Oscillator and MACD

The Awesome Oscillator (AO) and Moving Average Convergence Divergence (MACD) stand out as key tools, each harnessing moving averages but with a distinct approach. It’s essential to master the nuances of these indicators, as their interaction can be a gateway to pinpointing optimal trading moments. The MACD shines a light on the complicated connection between two exponential moving averages (EMAs) of a security’s price, typically over 12 and 26 periods. This is complemented by a 9-period signal line and a histogram, offering a multifaceted view of market trends.

Contrast this with the AO, which leans on simpler moving averages. The EMA’s rapid response to market shifts, as employed by MACD, offers a distinct advantage over AO’s approach. However, the real magic happens when these two are used in couple. Combining MACD’s insights with AO’s confirmation can open doors to strategic decisions, whether you’re eyeing a long or short position.

What is the best setting for an Awesome Oscillator?

The default setting! That’s it. There is no holy grail setting for the AO indicator. The default setting works fine. It has been tested for years and you don’t have to start fiddling with the indicator’s options. Sure, you can change the colors of the bars if you want, but don’t waste your time on finding the perfect settings. Traders before us have gone down this road, traders after us will go after that holy grail setting, but they all will wind up using the indicator with its default settings.

Avoiding Common Mistakes with the Awesome Oscillator

- Delayed Signals: Since the AO is based on moving averages, it might not keep up with fast market changes. This can sometimes lead to missed opportunities.

- Risk of Misleading Signals: The AO isn’t always right, especially in markets that don’t have a clear direction. It’s better used in markets with a strong trend.

- Don’t Rely on It Alone: It’s risky to make trading decisions based only on the AO. It’s smarter to use it alongside other tools and methods.

- Subjective Interpretations: Some parts of the AO, like reading saucer signals, depend on personal judgment and can vary from trader to trader.

- Trouble with Volatile Markets: The AO might not be reliable in very unstable markets, leading to confusing signals.

Awesome Oscillator Trading Example

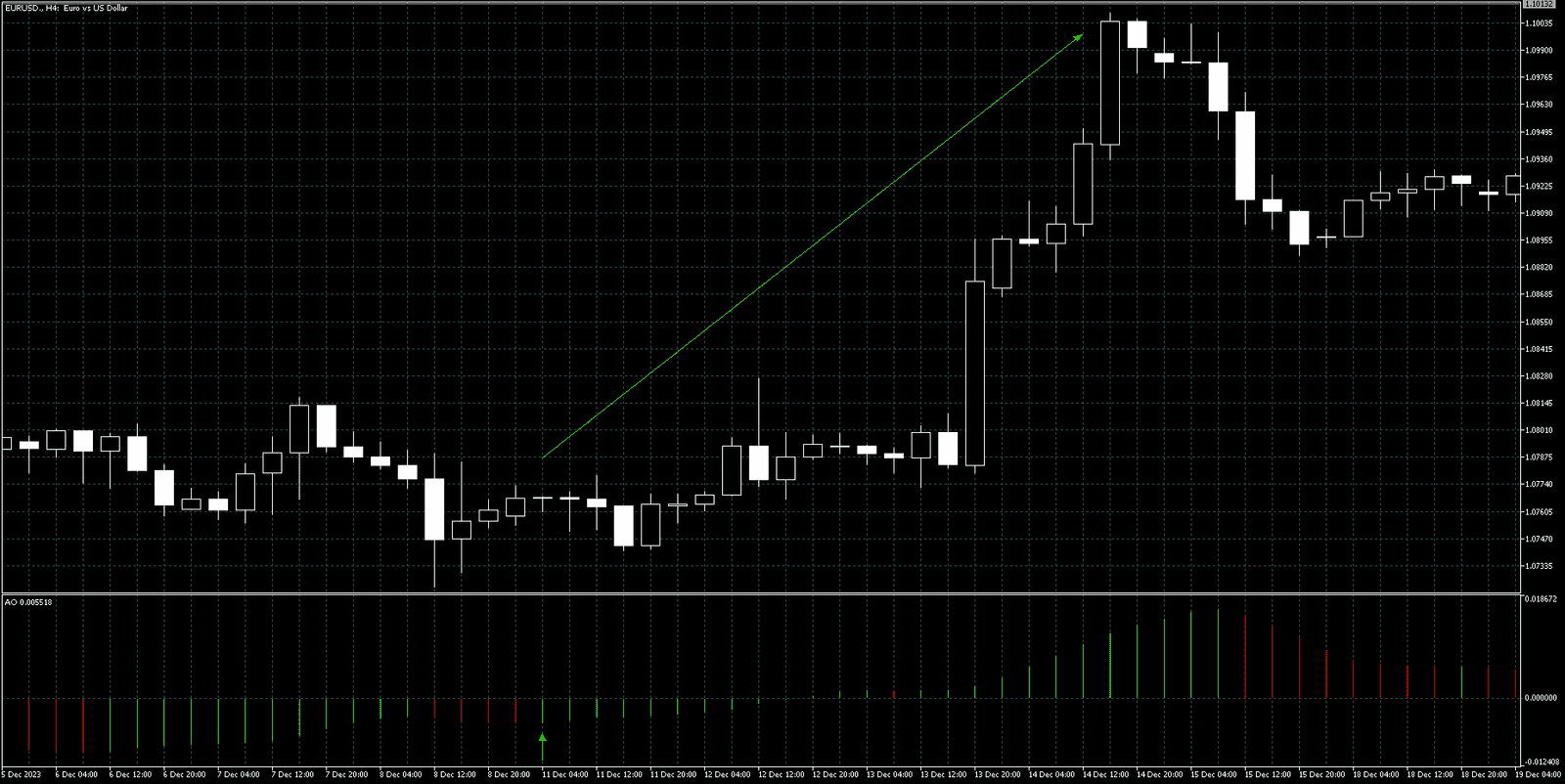

It’s time to examine a few real trading examples using the Awesome Oscillator indicator. As previously discussed, it’s not recommended to use this indicator on its own. Therefore, I’ve employed a support and resistance strategy to filter out false signals from the Awesome Oscillator. The chart below represents the EUR/USD pair on a 4-hour timeframe.

To simplify understanding, let’s break it down step by step.

Step 1: Identify the key support and resistance areas. These can be found by examining the chart and noting where the market has bounced more than twice. In this chart, the support and resistance areas are as follows:

- Support 1: 1.07237 to 1.07413

- Support 2: 1.08883

- Resistance: 1.1009 to 1.1016

Now that we’ve identified the horizontal support and resistance areas, it’s time to add trendlines. Trendlines help us anticipate potential changes in the market trend.

On December 8, 2023, the market dipped as low as 1.07237. This bearish wave eased up near this area, and on December 11, 2023, the market crossed above the bearish channel. With the Awesome Oscillator bars turning green (indicating upward momentum), we could have entered a buy order. As shown on the chart, the EUR/USD price surged to the November high, reaching the 1.1 support area.

This was a sample trading strategy using the Awesome Oscillator. I hope you found it helpful. If you have any questions about the strategy, please feel free to contact me via email. I’ll be more than happy to address your concerns and answer your questions.