FxNews—The U.S. Dollar is erasing some recent losses against the Canadian currency, although the primary trend remains bearish. As of this writing, the USD/CAD currency pair tested and dipped from the 1.353 level (the September 19 low), trading at approximately 1.351 in today’s session.

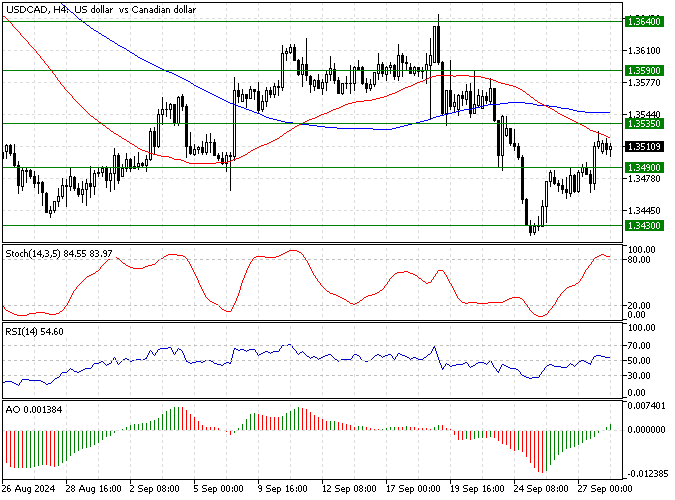

The 4-hour chart below demonstrates the price, support, resistance levels, and the technical indicators used in today’s analysis.

USDCAD Technical Analysis – 30-September-2024

The primary trend remains bearish, as the USD/CAD price is below the 50 and 100-period simple moving averages. Interestingly, the Stochastic oscillator has entered the overbought territory, signaling that a trend reversal or consolidation phase may be imminent.

However, the Awesome Oscillator and the Relative Strength Index (RSI) are signaling bullish market conditions by hovering above the signal and median lines, respectively.

Overall, the technical indicators suggest that while the USD/CAD is in a downtrend and overbought, the bear market will likely resume once the consolidation phase concludes.

USDCAD Forecast – 30-September-2024

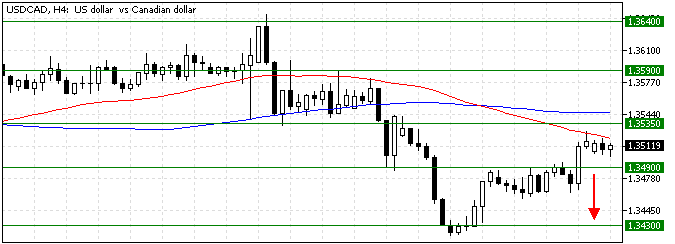

The immediate resistance is at 1.353, which paused the USD/CAD price to rise more. That said, the critical support lies at 1.349, the September 23 low.

From a technical standpoint, the downtrend will likely resume if the bears close below the 1.349 mark. In this scenario, the 1.343 level could be retested. Furthermore, if selling pressure pushes the price below 1.343, the next support level will be the January 2023 low at 1.336.

Please note that the bear market should be considered invalid if the USD/CAD price exceeds the immediate resistance of 1.353.

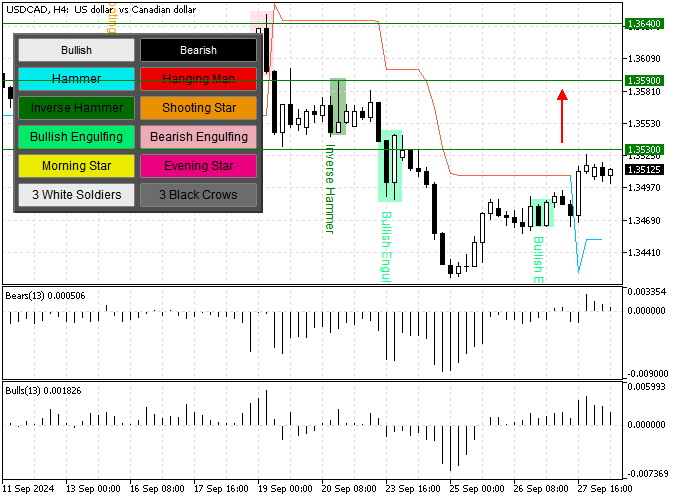

USDCAD Bullish Scenario – 30-September-2024

If the bulls close above the 1.353 level or the 100-period simple moving average, the bullish momentum that began from 1.343 could target 1.359. Furthermore, if buying pressure pushes the price above 1.359, the next bullish barrier will be the September 19 high at 1.364.

USDCAD Support and Resistance Levels – 30-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.349 / 1.343 / 1.336

- Resistance: 1.353 / 1.359 / 1.364