FxNews—In mid-October, silver reached $31.80 per ounce, fueled by falling Treasury yields and similar gains in gold. As 10-year Treasury yields dropped due to disappointing U.S. manufacturing outcomes, the attraction of non-yielding assets like silver grew.

Investors are now looking ahead to forthcoming U.S. economic reports, which may guide the Federal Reserve’s decisions regarding interest rates.

China’s Stimulus: Billions to Support Real Estate, Banks

China announced efforts to revive its economy, including plans for increased government borrowing to aid the real estate market, financial support for low-income families, and enhanced funding for state banks, shared by Finance Minister Lan Foan.

The specifics of the stimulus amount were limited, but expectations were high, with forecasts ranging from 2 to 10 trillion yuan.

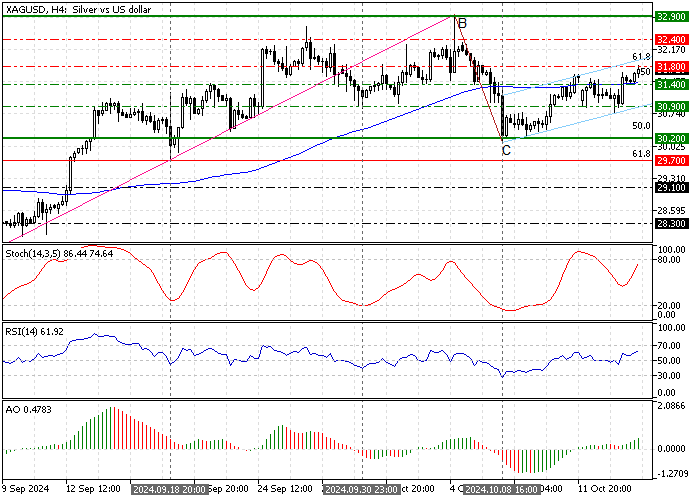

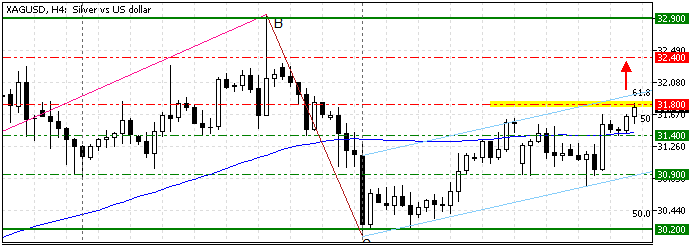

Silver Technical Analysis – 16-October-2024

Silver formed a new bullish wave from $30.2, which resulted in the price exceeding the 100-period simple moving average. As of this writing, the XAG/USD pair is testing $31.8, the 61.8$ Fibonacci retracement level of the BC wave.

The primary trend should be considered bullish because XAG/USD is above the 50- and 100-period simple moving averages.

Furthermore, the Awesome Oscillator bars are green, above the signal line, which indicates that the bull market prevails. Additionally, the Relative Strength Index indicator hovers above the median line, signaling that the bull market will likely resume.

Overall, the technical indicators suggest the primary trend is bullish, and the Silver price has the potential to target upper resistance levels.

Silver Price Forecast – 16-October-2024

The 100-period SMA immediately supports the current bullish momentum. From a technical perspective, the bull market will likely resume if Silver buyers close above the $31.8 resistance. In this scenario, the next target could be the October 4 High at $32.9.

On the flip side, the Silver price will likely consolidate if sellers push XAG/USD below the $31.4 immediate support. If this scenario unfolds, XAG/USD could dip to the $30.9 support, backed by the ascending trendline.

Silver Support and Resistance Levels – 16-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $31.4 / $30.9 / $30.2

- Resistance: $31.8 / $32.4 / $32.9