FxNews—On Friday, the price of WTI crude oil futures climbed toward $71 per barrel, marking the third day in a row of gains. This increase occurred as market focus returned to tensions in the Middle East. Reports have emerged suggesting that Iran might be planning to attack Israel from Iraqi territory in the coming days. According to media outlets, such an attack could involve drones and ballistic missiles.

Oil Prices Rise as Israel Warns of Strike on Iran

Investors grew more anxious following a warning from Israel’s military chief, who stated that Israel would deliver a “very hard” strike on Iran if missile attacks continued.

Additionally, oil prices were boosted by expectations that OPEC+ may delay their planned oil production increase for December by at least a month.

China Manufacturing Growth Boosts Oil Prices

Moreover, private and official surveys indicated that China’s manufacturing sector grew in October. This suggests that the country’s stimulus measures are starting to have a positive effect.

Despite these factors supporting oil prices, the commodity is still expected to end the week with an overall decline.

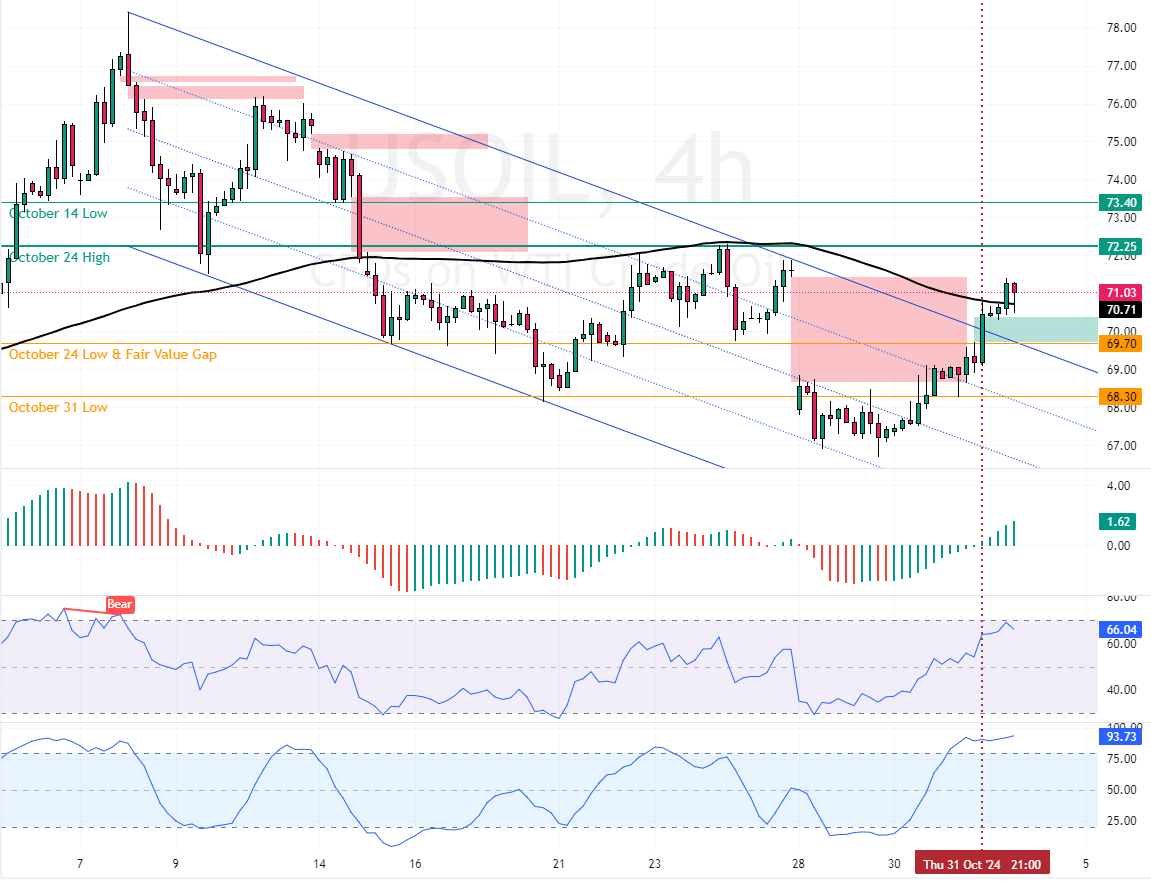

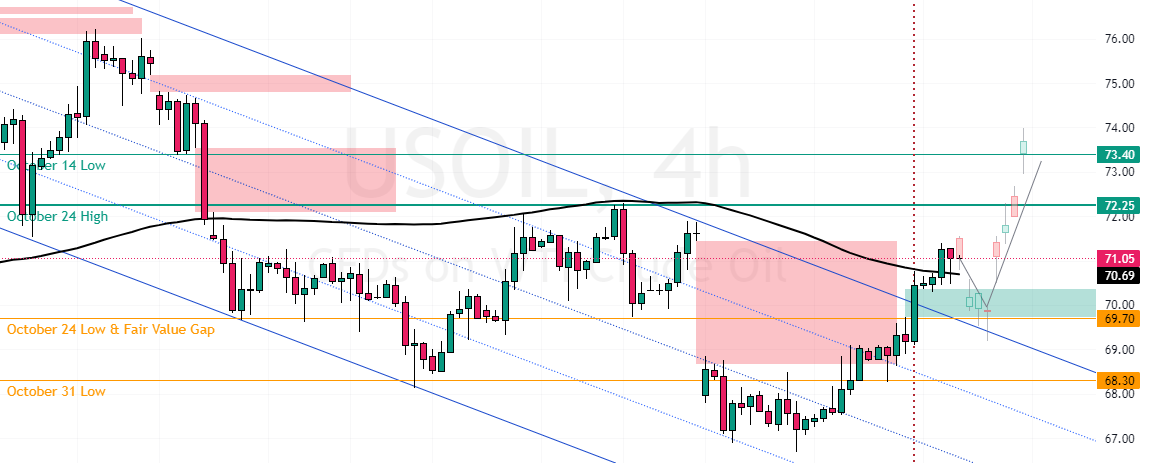

Oil Technical Analysis – 1-November-2024

Crude Oil broke above the descending trendline on October 24, causing a fair value gap, which resulted in the price stabilizing above the 50-period simple moving average.

As of this writing, Crude Oil trades at approximately $71, while the Stochastic Oscillator is overbought, signaling that Oil is overpriced in the short term. Furthermore, the Awesome Oscillator histogram is green, above the signal line, indicating that the bull market should prevail.

Overall, the technical indicators suggest that while the primary trend is bullish, the Oil price is overbought. Hence, the price could consolidate near or in the Fair Value Gap area before the uptrend resumes.

Oil Price Aims for $72.25 as Iran-Israel Tensions Mount

The October 24w at $69.7 is the critical support level for the current bullish trajectory. From a technical perspective, Oil is likely to revisit $72.25 (OctOctober 24gh) resistance as long as the price is above the $69.7.

Furthermore, if the buying pressure exceeds $72.5, the next bullish target could be $73.4, the October 14 low.

Bearish Scenario

The bullish outlook should be invalidated if the Crude Oil price falls below $69.7 support. If this scenario unfolds, a new bearish wave will likely form, targeting $68.30 (the October 31 Low) support.

Crude Oil Support and Resistance Levels – 1-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 69.7 / 68.3

- Resistance: 72.25 / 73.4

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.