AUDUSD dipped from 0.631, trading in a bear market, but slightly above the 50-period SMA. The market outlook remains bearish as long as 0.631 resistance holds. In this scenario, the prices could retest the December 2024 low at $0.618.

AUDUSD Technical Analysis – 7-January-2025

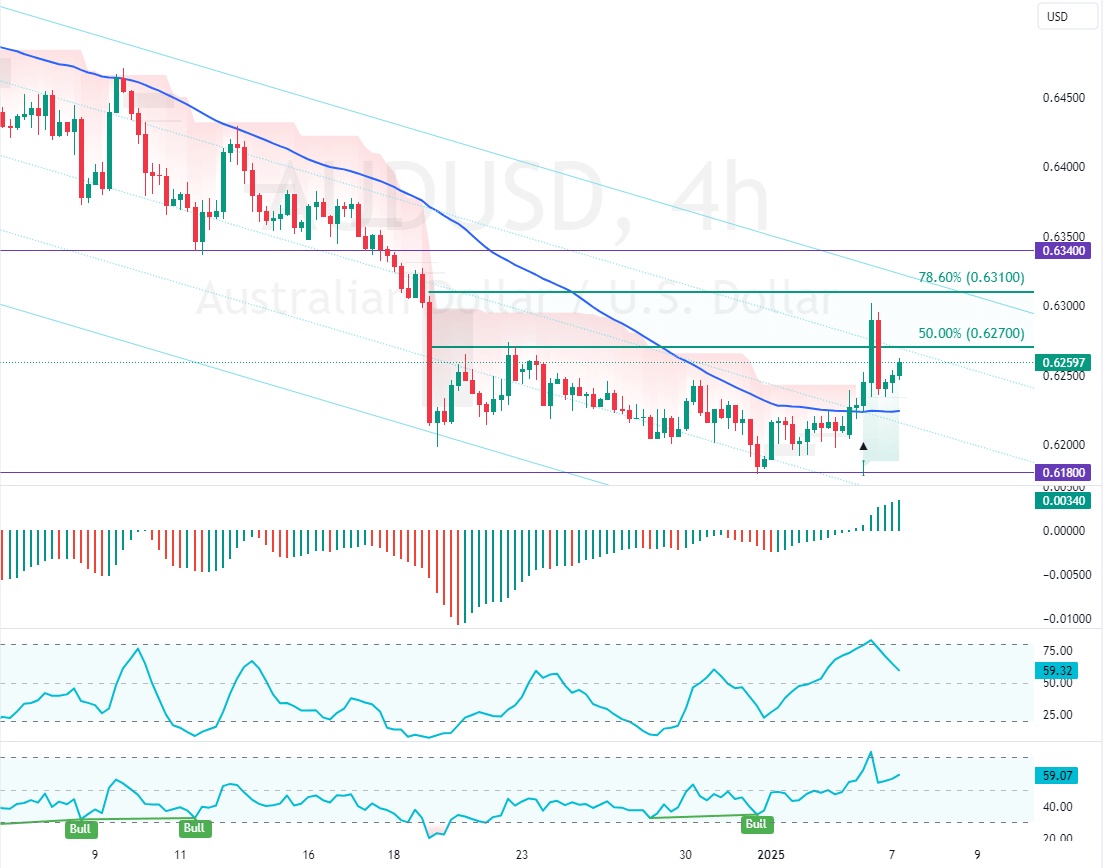

FxNews—The Australian dollar has been in a bear market against the Greenback, trading inside the bearish flag, as shown in the 4-hour chart above. In yesterday’s trading session, the currency pair erased 1.4% of its recent losses, but the uptick momentum eased at the 78.6% Fibonacci resistance level ($0.631).

As of this writing, AUD/USD trades at approximately $0.625, testing the %50.0 Fibonacci level as resistance.

Regarding the technical indicators:

- The RSI 14 depicts 58 in the description and rising, meaning the bull market gains momentum.

- The Stochastic Oscillator shows 59 in the description and is declining, indicating the selling pressure increases.

- The Awesome Oscillator histogram is green, above zero, interpreted as the bull market should prevail.

Overall, the technical indicators suggest that while the primary trend is bearish below $0.631, AUD/USD can potentially began a consolidation phase before the downtrend resumes.

AUDUSD Dipped From 0.631: The Forecast

The immediate support is at $0.635. From a technical perspective, the downtrend could extend to lower support levels if bears (sellers) push AUD/USD prices below $0.635.

If this scenario unfolds, the next bearish target could be revisiting the December 31 low at $0.618. Furthermore, if the selling pressure persists, the bears’ path to $0.575 could be paved.

Please note that the bearish outlook should be invalidated if AUD/USD exceeds $0.631, a resistance area backed by the descending trendline.

- GBPUSD Analysis: Technical, Fundamental & News

- EURUSD Analysis: Technical, Fundamental & News

- EURUSD began consolidating from 1.017: rose 0.85%

The Bullish Scenario

The immediate resistance is at $0.631. From a technical standpoint, the uptick in momentum from $0.618 could resume if the value of AUD/USD exceeds $0.631. In this scenario, the next bullish target could be $0.634.

AUDUSD Support and Resistance Levels – 7-January-2025

Traders and investors should closely monitor the below AUD/USD key levels to make informed decisions and adjust their strategies accordingly as market conditions shift.

| AUDUSD Support and Resistance Levels – 7-January-2025 | |||

|---|---|---|---|

| Support | 0.623 | 0.618 | 0.575 |

| Resistance | 0.627 | 0.631 | 0.634 |