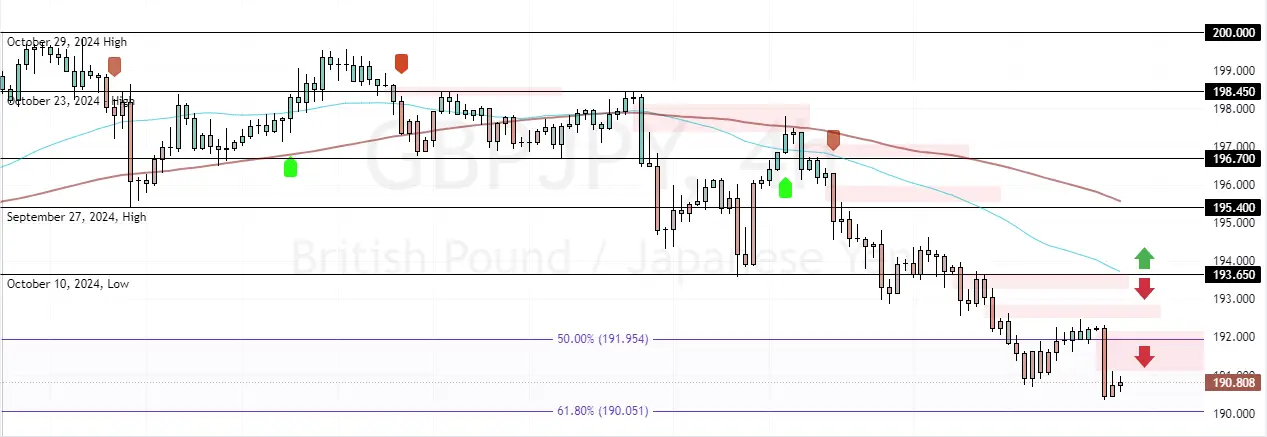

FxNews—The GBP/JPY prices dipped below the %50 Fibonacci retracement level, ignoring the oversold signals given by RSI 14 and Stochastic. As of this writing, the currency pair trades at approximately 190.8, nearing the 61.8% Fibonacci support level.

The primary trend should be considered bearish because GBP/JPY is below the 50-period simple moving average. Therefore, the downtrend remains valid as long as the currency pair trades below the 193.65 mark.

GBPJPY Faces Bearish Gap at 191.9 Level

Please note that the GBP/JPY 4-hour chart formed a massive bearish fair value gap at approximately 191.9, which could absorb the prices. Therefore, it is not advisable to trigger a sell order when the market seems saturated with sellers. That said, traders and investors should wait patiently for GBP/JPY to consolidate near upper resistance levels.

- Good read: EURJPY Targets 157.6 As Euro Weakens

In this scenario, the 191.95 and the 193.65 can potentially offer a decent ask price to join the bearish trend. Therefore, it is recommended that you monitor these levels for bearish signals, such as a candlestick pattern.