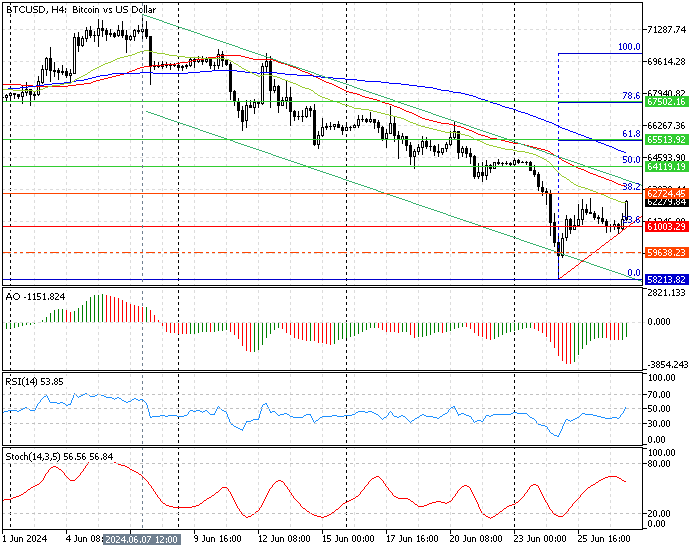

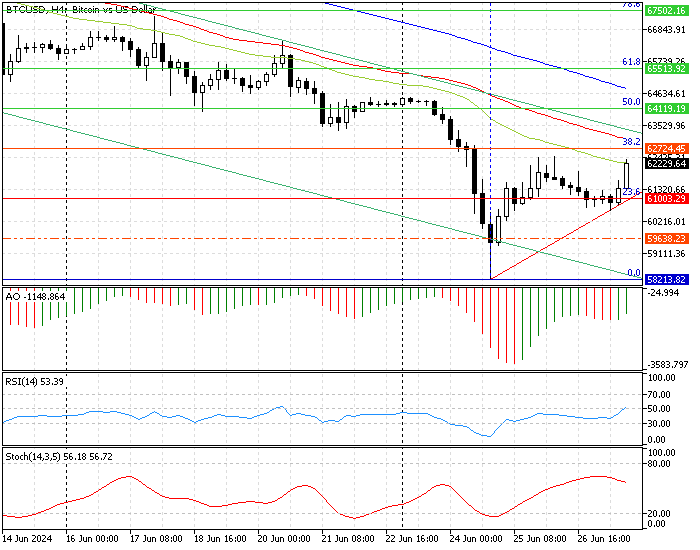

FxNews—Bitcoin has been in a bear market since June 7, approaching the 38.2% Fibonacci retracement level at $62,724, resistance backed by the descending trendline. The BTC/USD 4-hour chart below demonstrates the key Fibonacci levels and the technical indicators utilized in today’s analysis.

Bitcoin Technical Analysis – 27-June-2024

As of this writing, bitcoin is trading at about $62,340 and rising. The technical indicators suggest the bullish wave initiated from $58,213 should resume and test the 38.2% Fibonacci, a level backed by the 50-period simple moving average and the descending trendline.

- The awesome oscillator depicts -1148 in the description and rises with green bars approaching the signal line. This development in the AO signifies that the bullish wave is strengthening.

- The relative strength index indicator flipped above 50, recording 54, meaning the market is not overbought, and the bitcoin price could rise further.

- The stochastic oscillator value is 57 and declining, suggesting the bullish momentum weakens.

Bitcoin Price Forecast – 27-June-2024

The primary trend is bearish, but Bitcoin’s price is climbing toward the key resistance level of $62,724. The price will likely test the 50-period moving average at $62,724. Traders and investors should monitor this resistance area closely for bearish signals, such as an overbought RSI or stochastic oscillator, and bearish candlestick patterns.

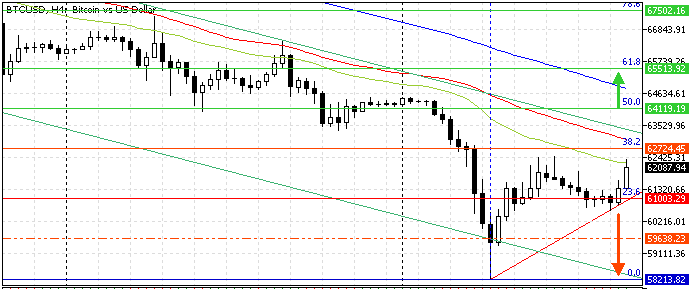

If the price remains below the key resistance at $62,724, the uptrend momentum will likely ease; furthermore, if the price flips below the 23.6% Fibonacci at $61,000 and the ascending trendline in red, the downtrend will likely be triggered. If this scenario unfolds, the Bitcoin price could dip to $59,638. Likewise, if the selling pressure exceeds $59,638, the next supply zone will be June’s all-time low at $58,213.

The 50-period moving average is the key resistance to the bearish scenario. If the price crosses above the 50 SMA, the bearish outlook should be invalidated.

Bitcoin Bullish Scenario

The key bullish barrier is the 38.2% Fibonacci at $62,724. If the BTC/USD bulls (buyers) push the price above this barrier, the wave that began at $58,213 could extend to the 50% Fibonacci at $64,119.

The immediate support at $61,000 supports the bullish scenario. Should the bears (sellers) breach this level, the bullish outlook should be invalidated.

Bitcoin Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $61,000 / $59,638 / $58,213

- Resistance: $62,724 / $64,119 / $65,513