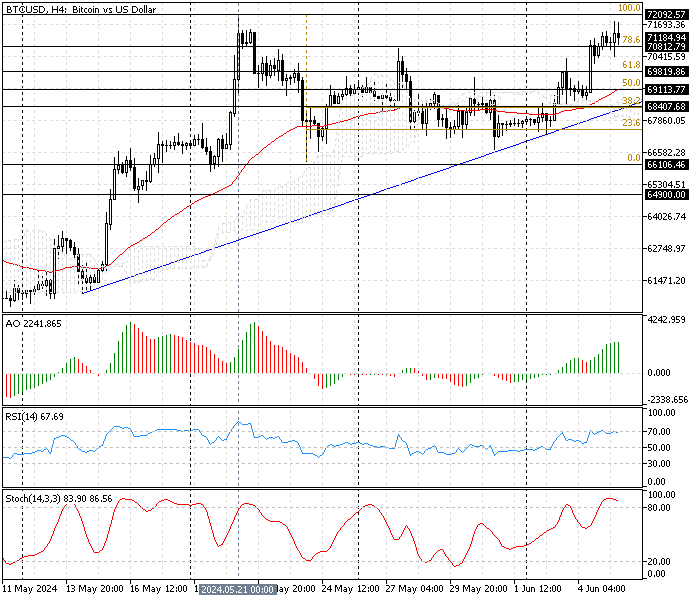

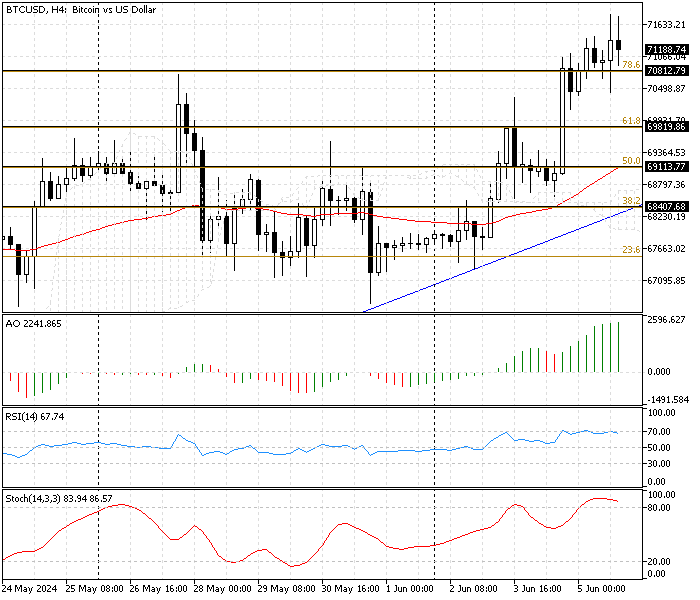

Bitcoin’s bullish wave neared the May all-time high at $72,092 in today’s trading session. As of this writing, the BTC/USD trades at about $70,812, testing the 78.2% Fibonacci support level.

Bitcoin Technical Analysis – 5-June-2024

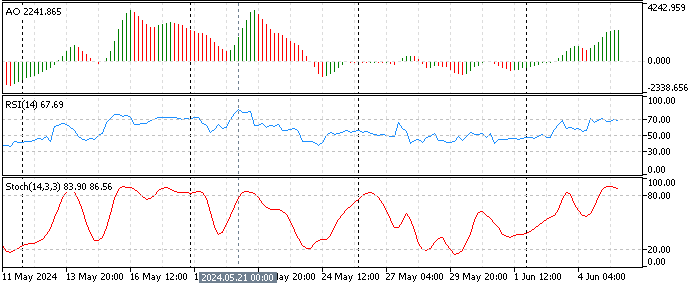

This BTC/USD price development drove the stochastic oscillator into the overbought zone. The indicator %K line value is 85, meaning the Bitcoin is overbought, and the price might consolidate or test the lower resistance levels.

- The relative strength index indicator value is 65, clinging to the overbought territory, which suggests that the market might become overbought soon.

- The awesome oscillator bars are green and above the zero line, depicting 2241 in the value. This growth in the AO bars indicates that the bull market prevails.

These developments in the technical indicators in the Bitcoin 4-hour chart suggest the primary trend is bullish, but digital gold is saturated from buying pressure.

Bitcoin Forecast – 5-June-2024

From a technical perspective, Bitcoin is in a bull market, but momentum indicators suggest that the market is overbought. That said, the bitcoin price may decline despite the robust uptrend. If the Bitcoin price stays below the key resistance at $72,092, the consolidation phase will likely extend to the 61.8% Fibonacci at $69,819, followed by 50% Fibonacci at $69,113.

If this scenario occurs, traders and investors should monitor the key Fibonacci levels mentioned above for bullish candlestick patterns, such as hammer or bullish engulfing candlestick patterns, to join the bull market.

Bullish Scenario

The critical resistance level that passed the current bullish momentum is the $72,092 ceiling. For the uptrend to resume, bulls must close and stabilize the price above it. If this scenario unfolds, the next bullish target will be the March 14 high at $73,862.

Bitcoin Key Support and Resistance Level

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $70,812 / $69,819 / $69,113

- Resistance: $72,092 / $73,862