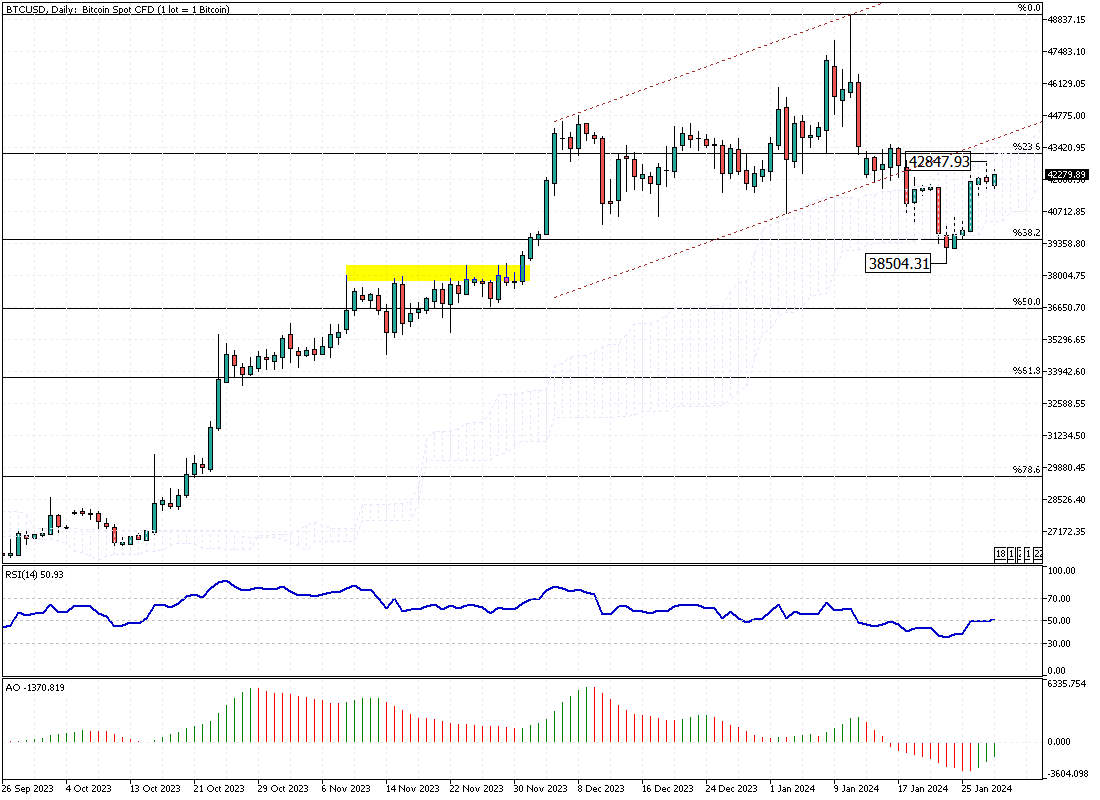

Bitcoin‘s price bounced from the $38,504 mark, which coincides with the mid-November high. The price of digital gold is hovering around $42,300 at the time of writing.

While the technical indicators promise a continuation of the trend, a long wick candlestick pattern is formed in BTCUSD’s daily chart, with the highest price point at $42,847. As a result, the daily chart suggests the possibility of a correction phase, and the Ichimoku cloud backs up this idea.

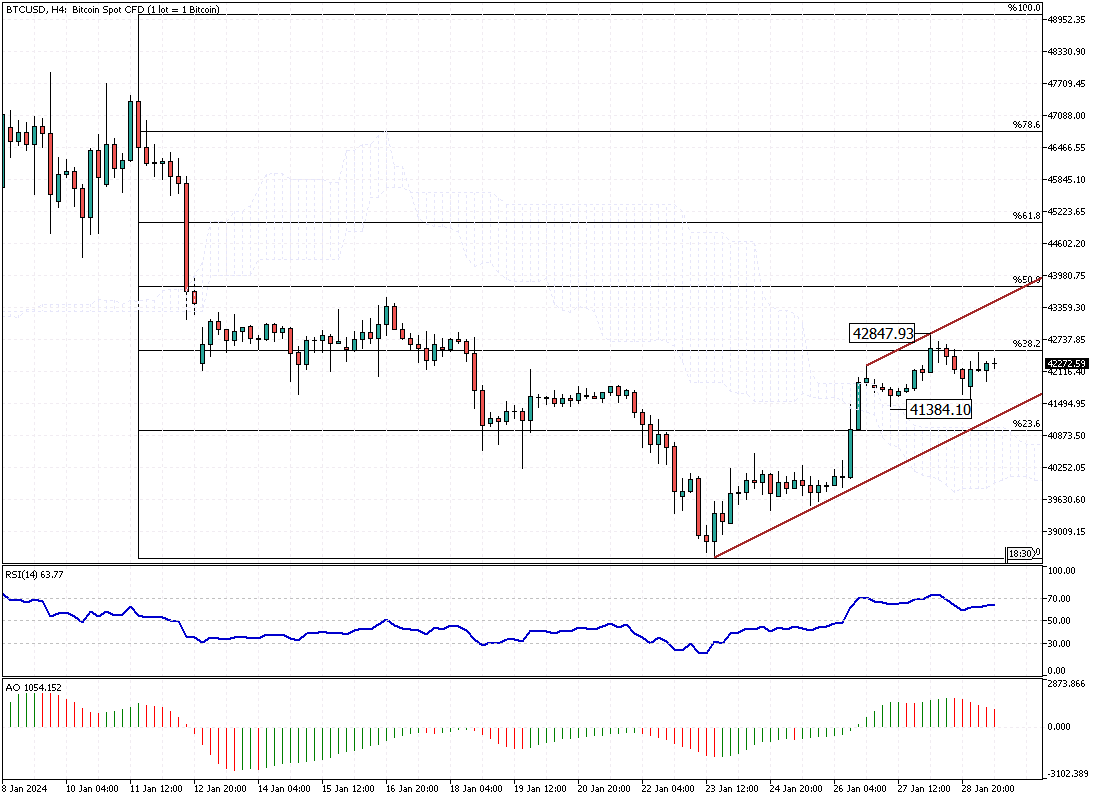

However, we should zoom in on the 4-hour chart to gain better insight.

Bitcoin Technical Analysis: Correction Phase in Horizon

The BTCUSD pair successfully flipped above the Ichimoku cloud, which can be interpreted as a shift in trend from bearish to bullish. The RSI indicator is approaching the overbought area, and the awesome oscillator‘s bars are red.

Considering the Bitcoin price action and candlestick pattern in the daily chart, the trend might range between last day’s high, $42,847, and the lower band of the bullish flag, the $41,384 mark. If the price can maintain its position inside the bullish flag, the next bullish target could be the %50 level of Fibonacci resistance.

Conversely, the bullish scenario is canceled if the price exceeds 23.6% of the Fibonacci resistance. In this case, the $42,847 will be the near-higher low, and the bearish bias that began on January 11 is likely to expand, initially targeting the January 2024 all-time low, the $38,504 mark.