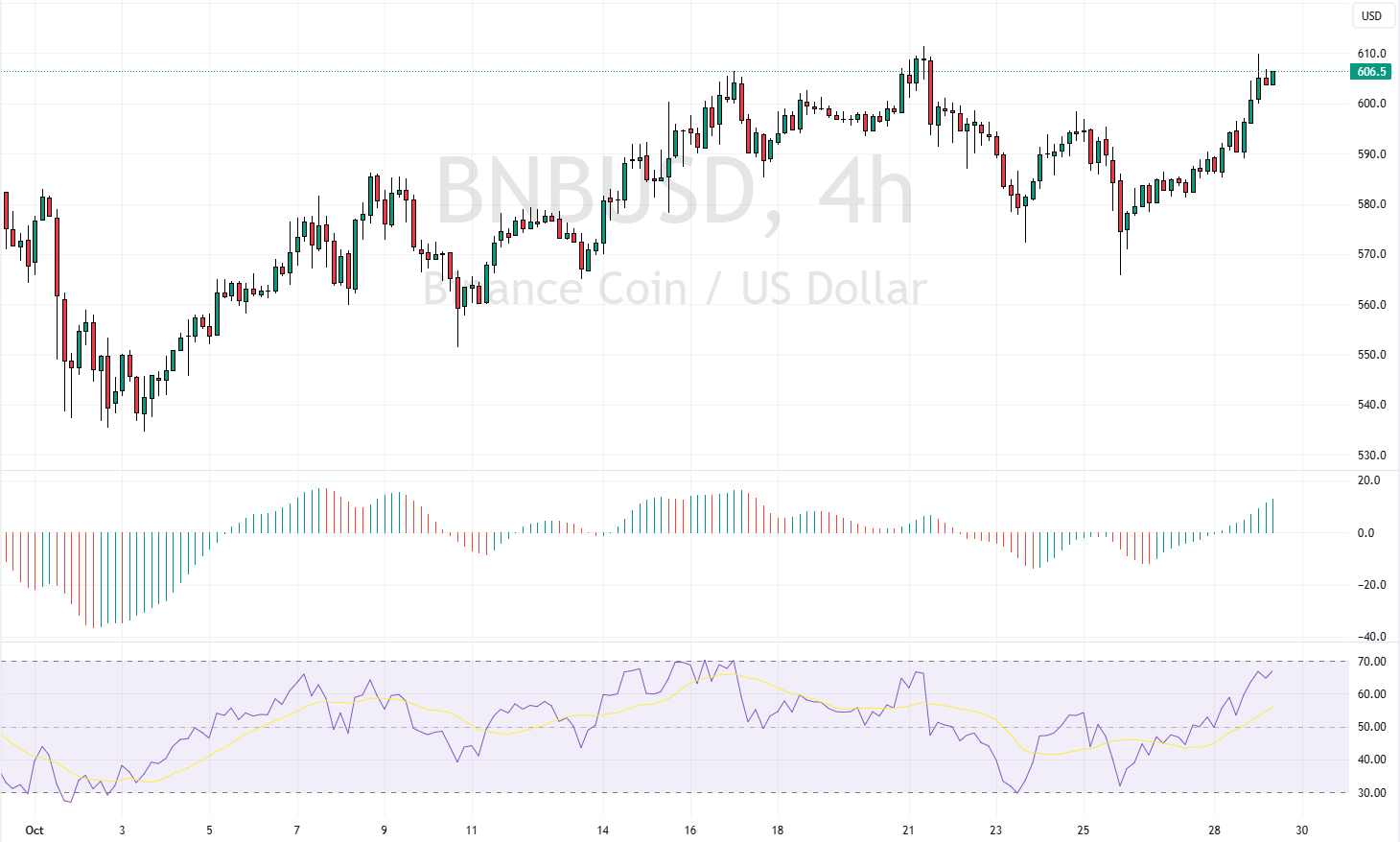

FxNews—The Binance Coin (BNB) has been climbing steadily, with its price nearing $600. This rise in value follows a noticeable shift in market mood, where investor confidence grew as funding rates turned favorable after a long decline.

Moreover, the technical view shows a stronger market framework. BNB has solid support at $555.4 and stays well above the historical mark of $462.6. Both these levels are crucial as they have been tested and held strong against recent price drops.

Bullish BNB Momentum as Liquidation Leverage Soars

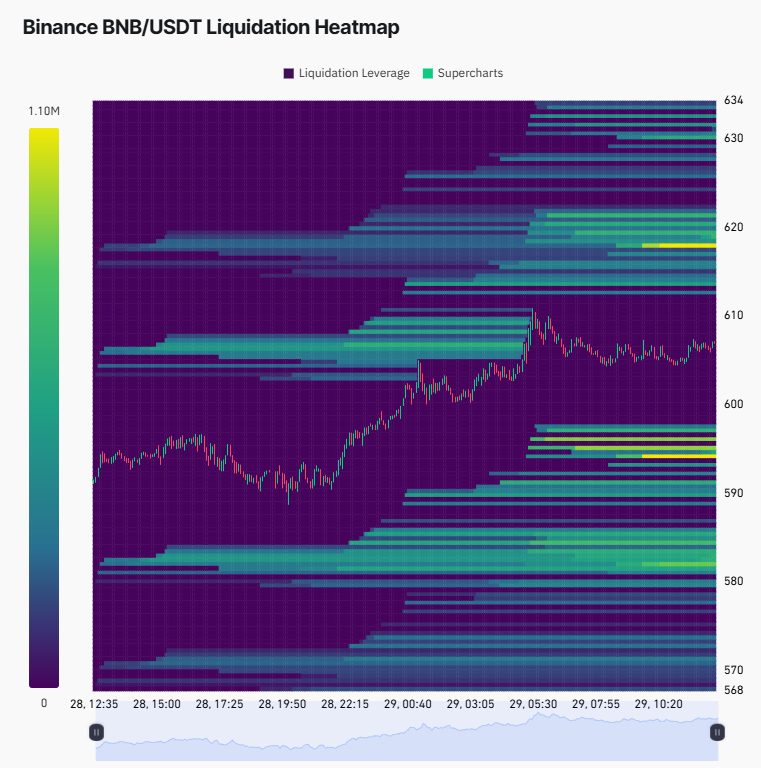

Additionally, liquidation leverage has surged, exceeding 2 million, indicating sustained investor confidence in the market.

The presence of a significant liquidation pool near the $600 mark could further drive BNB’s price upwards. The recent increase in bullish momentum, linked closely with the liquidity from this pool, plays a critical role.

At the same time, the change in funding rates significantly boosts market optimism. BNB moving from a negative to a positive funding state suggests a possible shift in trend direction, emphasizing the likelihood of upcoming price hikes. Such signs often lead to significant price movements.

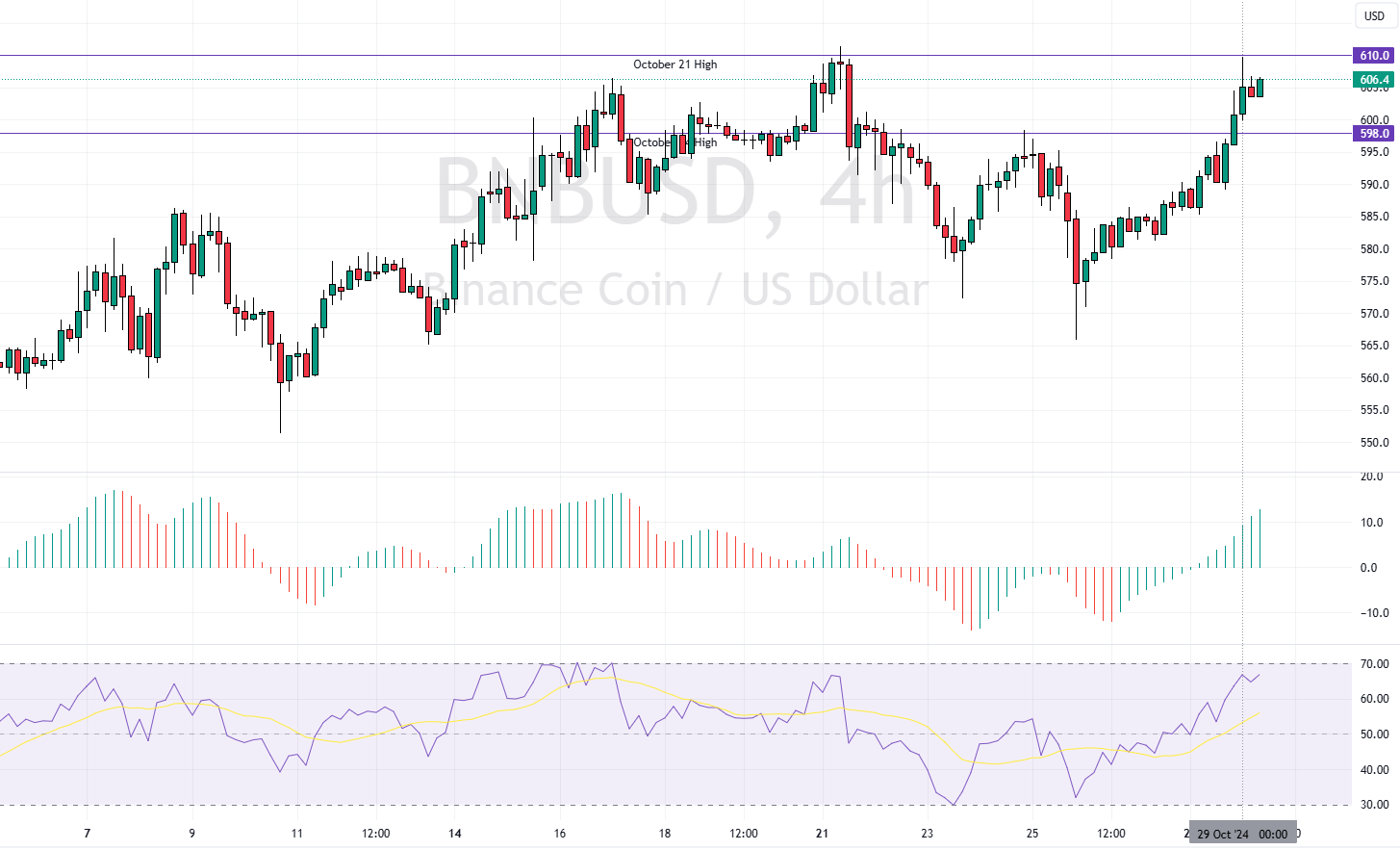

BNB Price Targets $620 Amid Bullish Momentum

The critical resistance level is at the October 21 high, the $610 mark. The Binance coin price bounced from this point on October 29. From a technical standpoint, the bull market could resume if buyers close and stabilize BNB/USDT above the $610 resistance. If this scenario unfolds, the next bullish target could be the $620 mark.

Please note that the immediate support rests at the October 24 high, the $598 mark. If bears (sellers) push the price below this level, the bullish outlook should be invalidated.