FxNews—European stock markets were poised to open with significant declines on Wednesday, continuing the downturn from the previous day. Poor financial results from tech companies and decreasing oil prices contributed to the negative mood in the markets.

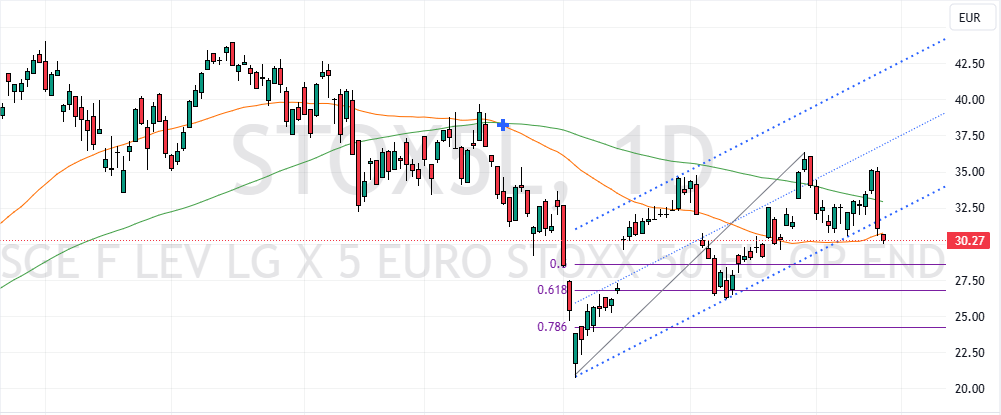

Euro Stoxx 50 Futures Down 0.7%

In the UK, the inflation rate for September fell unexpectedly to 1.7%, below the Bank of England’s target of 2%. This marks the first time inflation has dipped under this target since April 2021.

Before the markets opened, Euro Stoxx 50 futures were down by 0.7%, and Stoxx 600 futures had decreased by 0.4%.

EURJPY Technical Analysis – 16-October-2024

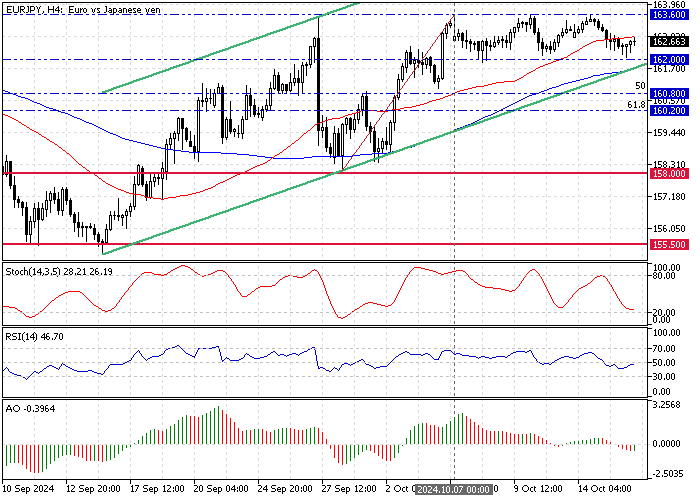

The Euro, which is in a bull market against the Japanese Yen, tested the 162.0 (October 8 Low) support in today’s trading session. As of this writing, the EUR/JPY currency bounced from the mentioned support at approximately 162.6.

The primary trend should be considered bullish because the price is above the 100-period simple moving average. Additionally, the Awesome Oscillator‘s recent bar turned green as the histogram is above the signal line, meaning the bull market could resume.

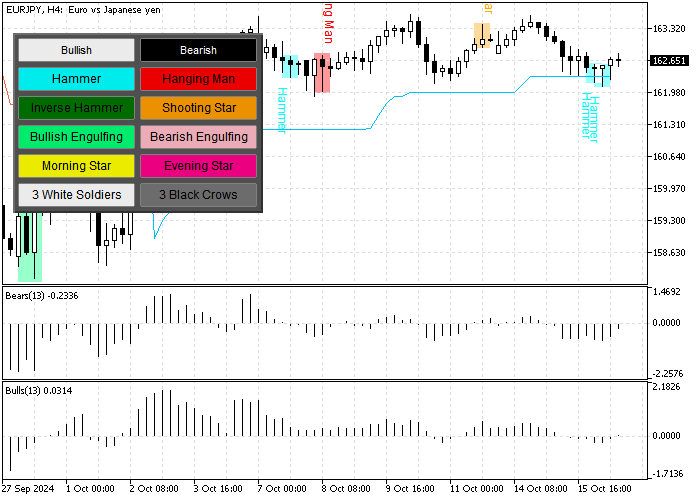

Interestingly, the 4-hour chart formed a hammer candlestick pattern, signaling a new bullish wave could be imminent.

EURJPY Forecast – 16-October-2024

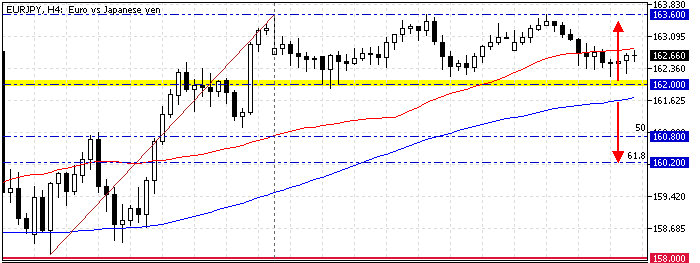

From a technical standpoint, the uptrend will likely resume if the EUR/JPY price holds above the 162.0 support. The next bullish target in this scenario could be revisiting the October 7 high at 163.6.

Furthermore, if the buying pressure pulls the price above the 163.6 mark, the bull’s path to the next resistance area at 165 (the September 25 low) will likely be paved.

Conversely, a dive below the 162.0 immediate resistance, which coincides with the 100-period SMA, can trigger a bearish wave that might spread to the %50 Fibonacci retracement level at 160.8.

EURJPY Support and Resistance Levels – 16-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 162.0 / 160.8 / 160.2

- Resistance: 163.6 / 165.0