Crude Oil Recovered to $69.3 and gained 1.0% in today’s trading session. This rise occurred during a period of low trading activity before a holiday. The recent uptick in oil prices was supported by new data from the U.S. showing the economy remains robust as the year closes.

India’s Crude Oil Imports Up 2.6% in November

India reported a 2.6% increase in crude oil imports for November, reaching 19.07 million metric tons, thanks to heightened economic and travel activities.

Despite these positive indicators, the fear of an excess supply next year dampened the bullish sentiments. Additionally, concerns over the European oil supply decreased following the news that the Druzhba pipeline was back in action after a halt caused by mechanical issues in Russia.

China Oil Demand to Peak in 2027

The strong U.S. dollar posed challenges for Oil. Adding to the concerns, Sinopec, Asia’s largest refiner, predicted that China’s oil demand might reach its highest point in 2027, suggesting a potential decline thereafter.

Crude Oil Technical Analysis – 24-December-2024

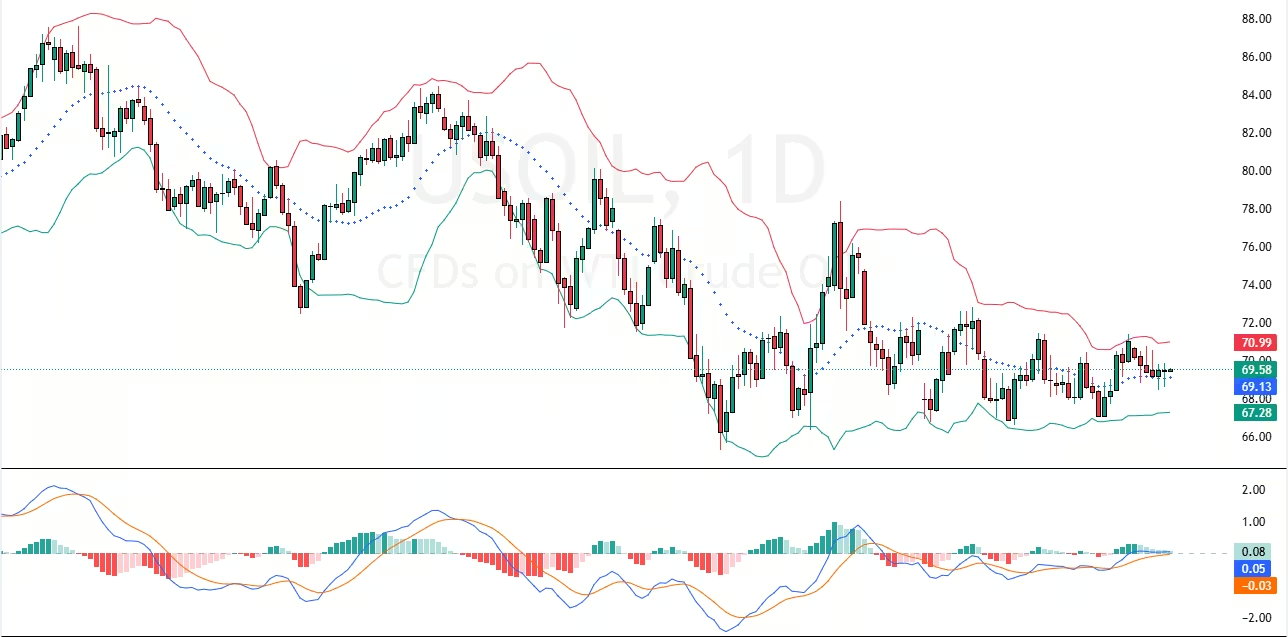

Crude Oil Recovered $69.3 after it tested the 61.8% Fibonacci retracement level ($68.7) as support. As of this writing, the commodity trades at approximately $69.3, nearing the descending trendline.

Please note that the market outlook remains bearish as long as the prices are below the immediate resistance of $69.8. However, bears must push the prices below the critical support level of $68.7. If this scenario unfolds, the Crude Oil prices could dip toward the $67.8 support.

- Good read: Silver Drops to $29 as Fed Slows Rate Cuts

The Bullish Scenario

Conversely, the downtrend should be invalidated if Oil prices climb above $69.8. The bullish wave from $68.7 could target the $70.7 resistance in this scenario.