FxNews—On Friday, U.S. stock futures showed little movement as investors paused, awaiting the release of the Producer Price Index (PPI) report early in the day. Attention was also directed toward incoming corporate earnings reports.

The Banking Sector Leads Quarterly Earnings

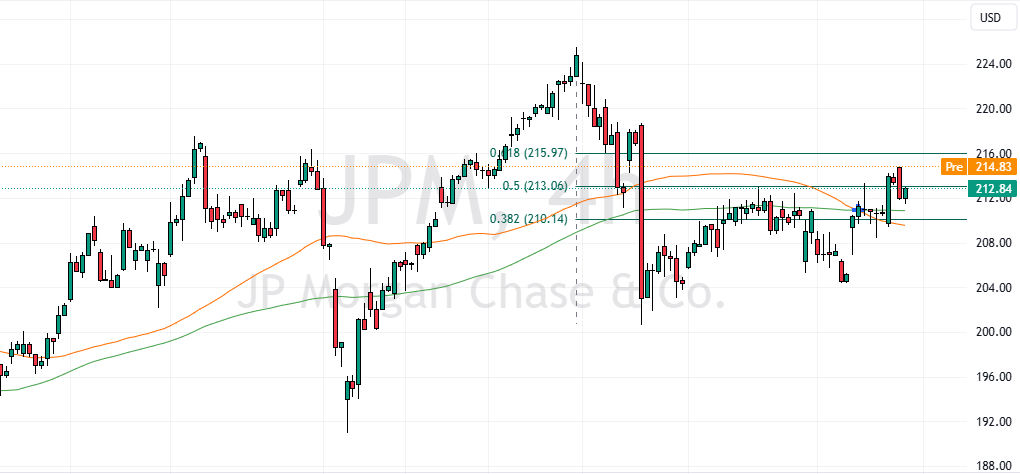

The third-quarter earnings season began with central banks stepping into the spotlight. JPMorgan saw a preliminary rise of about 2% in its shares during pre-market trading, following reports that surpassed expectations in both earnings and revenue.

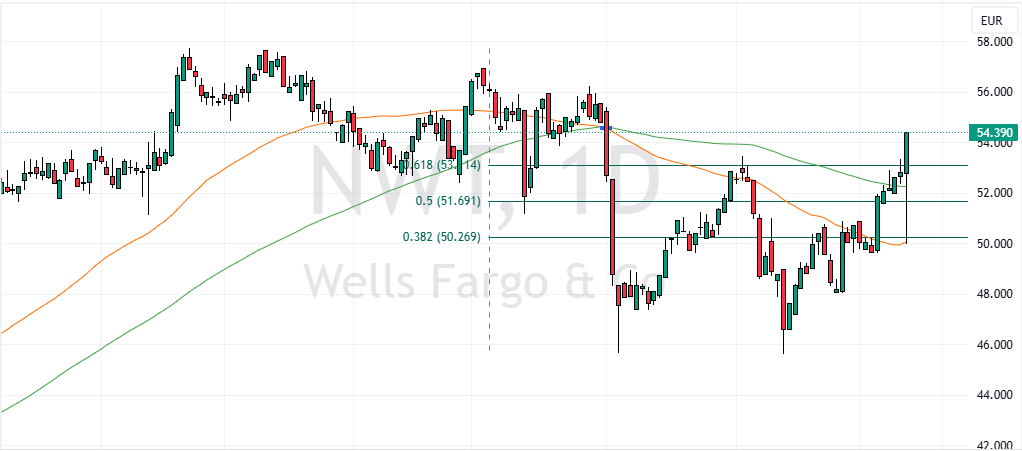

Conversely, Wells Fargo experienced a surge of over 4% before the market opened despite reporting earnings and revenue that fell short of forecasts and presenting a slightly less optimistic outlook for the remainder of the year.

Bank of New York Mellon’s stocks remained relatively stable, yet earnings and revenue exceeded expectations.

BlackRock’s Assets Soar to $11.5 Trillion

Meanwhile, BlackRock observed a modest pre-market increase of 0.5% as its assets under management reached an unprecedented $11.5 trillion.

On the other hand, Tesla’s shares declined more than 6% after its new Cybercab concept vehicle did not meet investor expectations.

- Also read: UK House Prices Exceed Forecasts

Nasdaq Up 0.8%, S&P Gains 0.5%

Reviewing the week’s performance, the S&P 500 was up by 0.5%, while the Dow Jones Industrial Average increased by 0.2%.

The Nasdaq showed a notable gain of 0.8%, reflecting a cautiously optimistic trend in the technology sector amidst varying corporate fortunes.