FxNews—Ripple (XRP) is stabilizing its price at approximately $0.530. Despite significant trading by large investors, it remains below the 100-period simple moving average. It was reported that a major investor moved 52 million XRP, valued at $28.67 million, out of Bybit, but this did not create positive momentum or enhance market sentiment.

Elon Musk, the CEO of Tesla and SpaceX and the owner of X (previously known as Twitter), was questioned about how financial institutions adopt XRP.

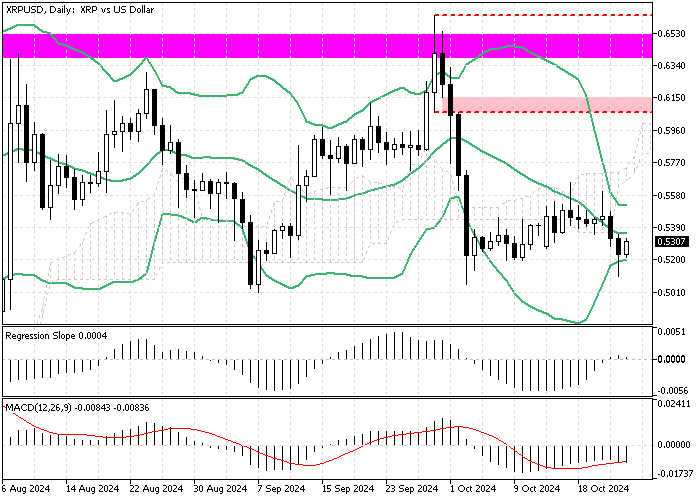

XRP Faces Drop But Eyes Recovery to $0.66

Looking at the daily XRP price chart, the outlook isn’t optimistic. The market appears strongly negative, and a sharp decline in early October has created a noticeable Fair Value Gap at approximately $0.615.

Despite this, XRP is expected to recover slightly, aiming for recent high points between $0.62 and $0.66. However, sellers are likely to remain active.

XRP Ledger Daily Transactions Surge Amid Market Drop

According to Wenry Seoul, Marketing Manager at Catalyze Research, in a post on CryptoQuant, the XRP Ledger saw daily transactions that rival those of primary blockchain networks from mid-September to mid-October.

Data on decentralized exchange activities indicates a 6.83% decrease in trade numbers, dropping from 6.88 million to 6.41 million. However, exchange volumes have increased by 17.64% to $4.6 million.

- Next read: Will Ripple Surpass Ethereum by 2025?

AMM Growth Signals $0.52 Support, Potential for $0.62

There’s been notable growth in the Automated Market Maker (AMM) Liquidity Provision. AMMDeposit facilitates investments in existing market setups, and AMMCreate allows for the establishment of new market opportunities for asset pairs.

The increase in AMMDeposit and AMMCreate activities shows a rise in liquidity contributions, indicating growing confidence.

Transaction counts were rising from the 7th to the 20th of October, though they have started to decrease recently. This growth in network activity is promising as it may boost demand.

- Editor’s pick: Oversold XRP Aims to Fill FVG if $0.519 Holds

This uptrend might support the currency’s price at the crucial $0.52 support level. Nevertheless, a dip to the $0.508 area might occur before any potential price increase to $0.62.