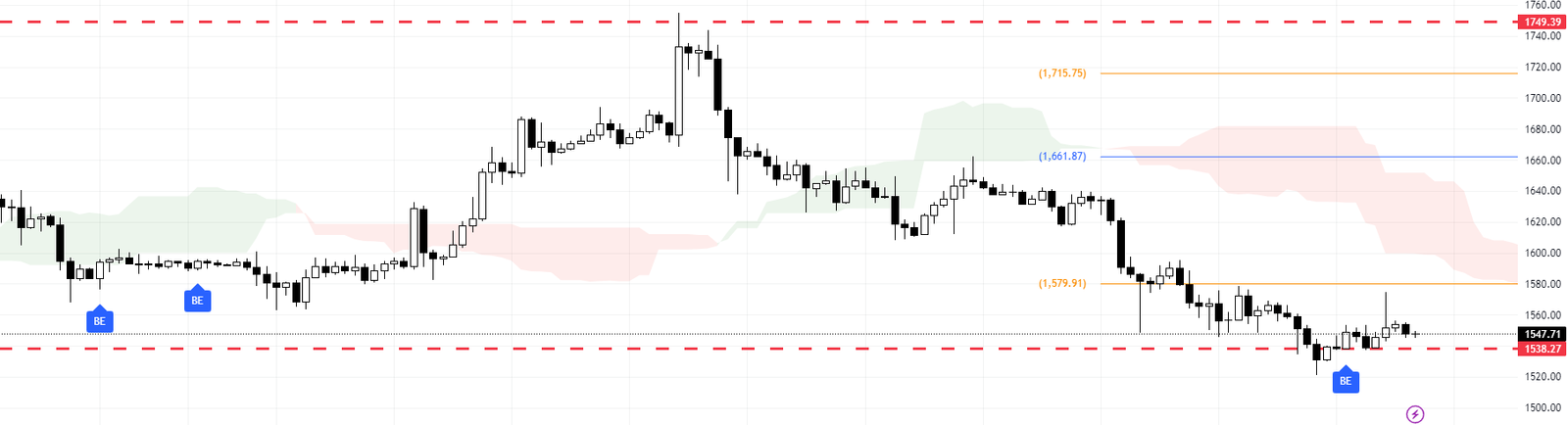

FxNews—Ethereum, the second-largest cryptocurrency by market capitalization, is currently undergoing a critical test of its $1,538 support level on the daily chart.

In recent weeks, Ethereum prices have bounced off this crucial supply area twice, indicating strong buying interest at this level. The Stochastic oscillator, a momentum indicator, has entered the oversold territory, suggesting that selling pressure may wane. Additionally, the Relative Strength Index (RSI) displays bullish divergence with the price action, signaling a potential reversal in the currency pair.

Ethereum Poised for Bounce with Key $1,538 Support

Suppose Ethereum can maintain its price above the $1,538 support level, with the RSI indicating divergence and the Stochastic oscillator signaling that ETHUSD has been oversold. In that case, we can anticipate a potential increase in value for this cryptocurrency pair in the upcoming trading sessions. At the very least, ETHUSD bulls may attempt to test the $1,631 pivot point before further decline occurs.

Examining the 4-hour (4H) chart, we observe a bullish, engulfing candlestick pattern, a positive sign for Ethereum’s price action. For this bullish scenario to be validated, it is advisable to wait for the bulls to close above the broken support at $1,579. With this confirmation, our expectations for a rise in Ethereum’s price will be reinforced, and the first target will be the pivot point at $1,631, followed by $1,715.

Conversely, if the bears close below the $1,538 support level, Ethereum’s price decline may continue, rendering the bullish signals mentioned above invalid for the time being.

Ethereum Technical Analysis: Final Thoughts

In conclusion, this Ethereum analysis highlights the importance of key support and resistance levels in determining future price movements. Traders and investors should closely monitor these levels and other technical indicators to make informed decisions in this dynamic market.