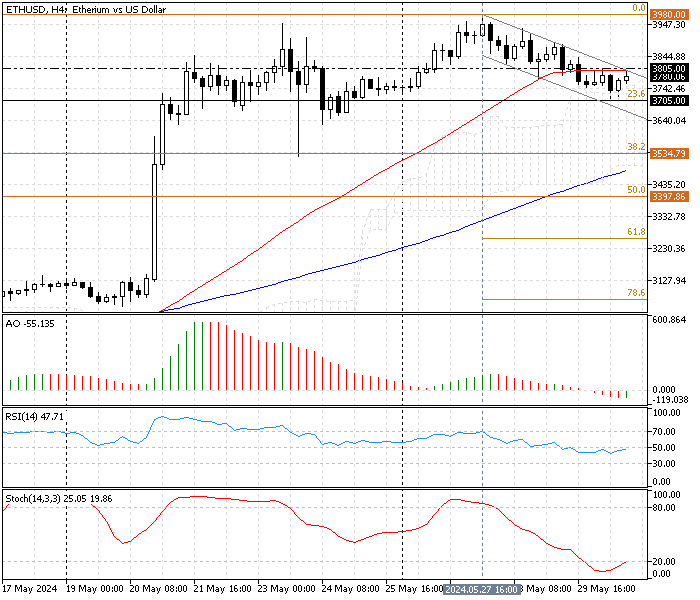

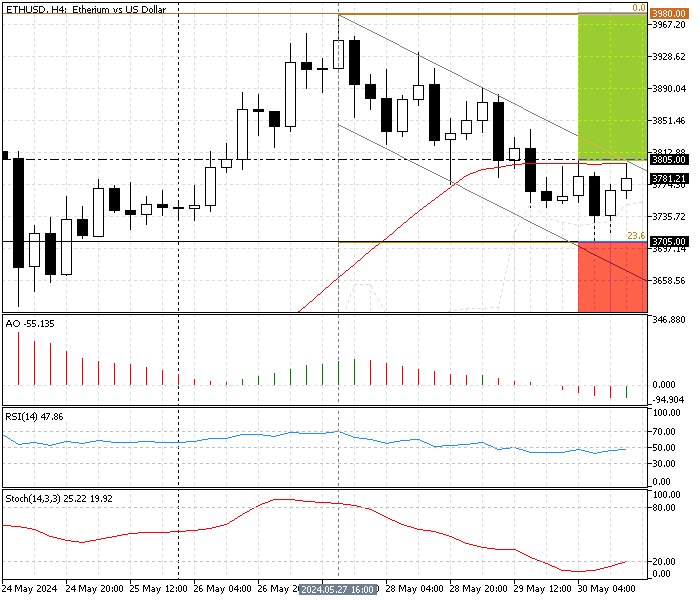

The Ethereum price has been in a short-term downtrend from $3,980 against the U.S. As of writing, the ETH/USD currency pair bounced from the 23.6% Fibonacci level at $3,705, testing the broken SMA 50 as immediate resistance. The 4-Hour Chart below shows the digital currency trading in a bearish flag since May 27. The momentum eased after the price dipped to as low as $3,705.

Technical Indicators Reveal Mixed Signals

The technical indicators provide the following information and signals:

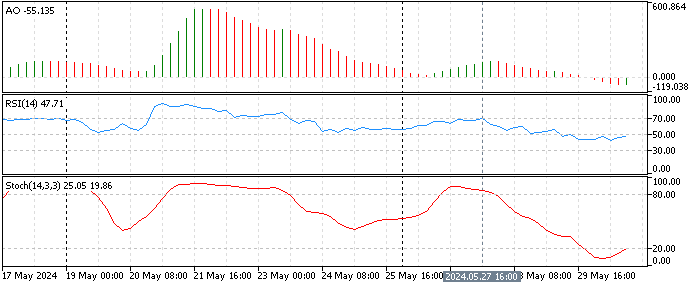

- The awesome oscillator value is -55, and the recent bar changed its color from red to green, but it is still below zero. This indicates the market is bearish, but the downtrend is losing momentum.

- The relative strength index indicator value is 48, hovering below 50 and moving horizontally along the middle line. This means the asset is neither overbought nor oversold, and the market doesn’t have strong momentum in either direction.

- The stochastic oscillator is trying to step out of oversold territory. The %K period value is 19 and increasing, meaning ETH/USD is gaining upward momentum.

These developments in the technical indicators in the 4-hour chart suggest that the pullback from the 23.6% Fibonacci level might expand to a higher resistance level.

Ethereum Price Forecast – May-30-2024

From a technical perspective, the primary trend is bullish because the ETH/USD price is above the SMA 100 and Ichimoku Cloud. That said, the price must exceed the SMA 50 at $3,805 for the bullish trend to resume. In this case, the pullback will likely result in the bull market resuming, initially targeting the May all-time high at $3,980.

Please note that the immediate resistance is at $3,705. The bullish outlook should be invalidated if the price dips below this resistance.

Ethereum Bearish Scenario

The bulls are testing the immediate resistance at $3,805. If this resistance level holds, the price might decline and surpass the immediate resistance at $3,705. If this scenario unfolds, the downtrend started on May 25 will likely extend to the lower resistance level, starting with the %38.2 Fibonacci at $3,534.

Ethereum Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $3,705 / $3,534

- Resistance: $3,805 / $3,890

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.