In today’s comprehensive EURCAD forecast, we will first scrutinize the current economic conditions in the Euro area. Then, we will meticulously delve into the details of the technical analysis of the EURCAD pair.

European Stocks’ Cautious Opening

Bloomberg—At the week’s outset, European stock markets were cautious. This cautiousness was in line with trends seen in Asian markets. It came in the wake of statements from various policymakers, which dampened expectations for interest rate reductions by key central banks in the coming year. Market participants are also keenly anticipating the monetary policy announcement from the Bank of Japan, scheduled for tomorrow.

In this context, the STOXX 50 and STOXX 600 indices witnessed declines, registering 0.4% and 0.3% respectively. This downturn contrasts with the substantial gains from the previous week, which propelled the STOXX 50 to a 16-year peak and the STOXX 600 to a high close to that of two years ago.

Notable among the underperformers were Kering, down by 1.8%; Deutsche Bank, by 1.6%; VW, by 1.5%; Vinci, by 1.4%; Mercedes-Benz, also by 1.4%; and BMW, which fell by 1.1%. Conversely, Philips and Sanofi bucked the trend, each rising by 0.9%.

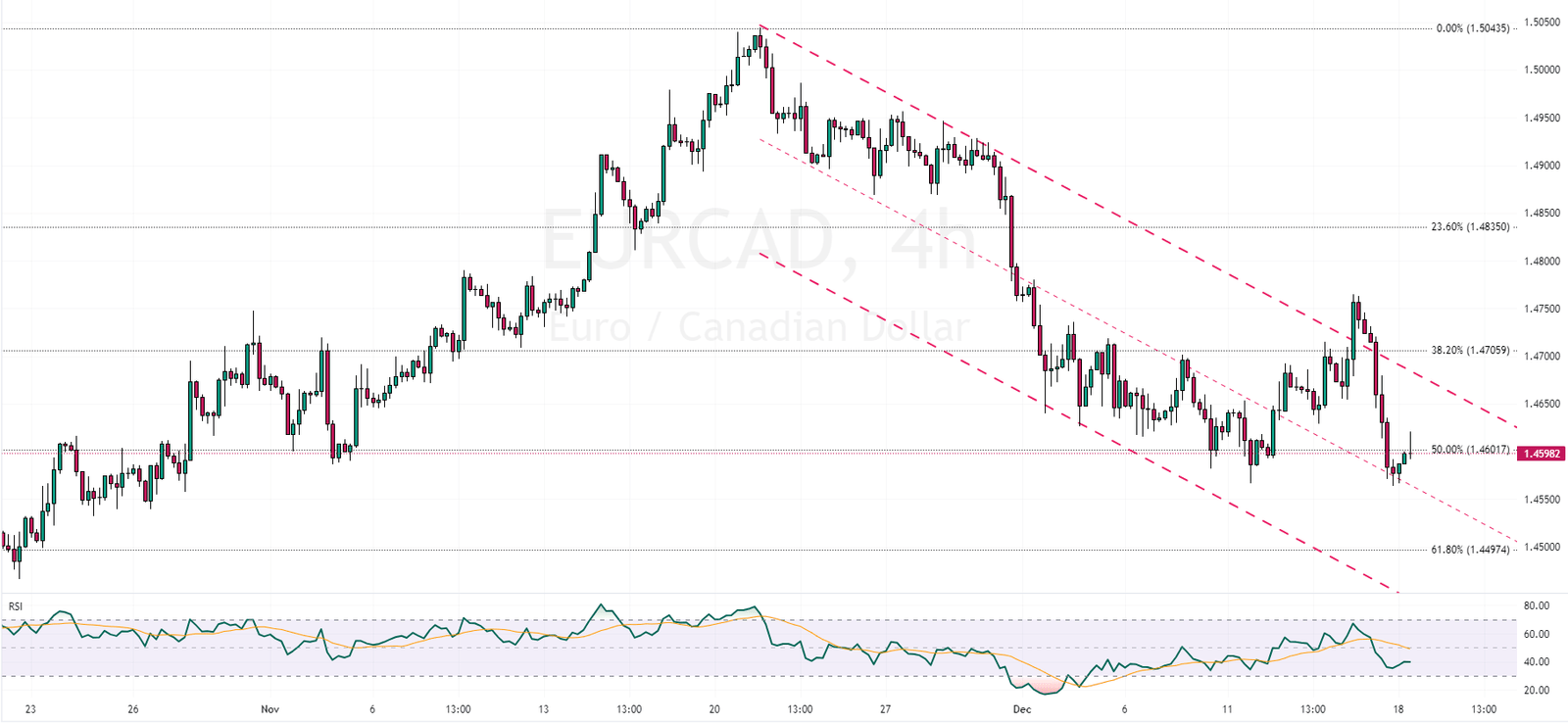

EURCAD Forecast Bearish Channel Insights

FxNews—The EURCAD currency pair recently closed below the crucial 50% Fibonacci level, which has attracted traders’ attention. The bears are actively testing the median line of the bearish channel, which is particularly interesting as it unfolds in real time.

Moreover, the RSI indicator, an important tool for technical analysts, hovers below the 50 level. This positioning is significant as it hints at a potential bearish trend continuation. In essence, the overall outlook for the EURCAD pair remains tilted towards the bearish side, especially as long as trading continues within the confines of the bearish flag pattern. In this context, the upper band of the channel serves as a key resistance level.

Given these technical indicators, analysts at FxNews are leaning towards predicting further declines. We closely watch the 61.8% Fibonacci level, the next critical support target.

However, it’s important to note that the current bearish technical analysis is precarious. Should the EURCAD pair manage to cross above the flag, this would effectively invalidate the bearish outlook. Such a move could signal a shift in market sentiment and potentially lead to a different trading dynamic.

In summary, while the bearish trend dominates the EURCAD pair, traders should remain alert to any shifts that could alter the technical landscape.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.