In today’s comprehensive EURCHF forecast, we will first scrutinize the current economic conditions in the Eurozone. Following that, we will meticulously delve into the details of the technical analysis of the EURCHF pair.

European Markets Trend Lower on Rate Cut Doubts

Bloomberg—Monday’s opening for European equity markets pointed towards a downward trend, continuing the widespread decline in global stocks. This shift comes from comments from John Williams, President of the New York Federal Reserve Bank, who refuted the likelihood of interest rate cuts in the upcoming year in a recent CNBC interview. Williams emphasized the Fed’s current focus on evaluating if existing rates are sufficiently stringent to steer inflation back to its target.

Investors are also gearing up to evaluate key economic indicators, including the December German Ifo Business Climate Index and Spain’s October trade balance data. In the premarket trading phase, Euro Stoxx 50 futures dropped by approximately 0.4%, while futures for the FTSE 100 experienced a slight decrease of 0.05%.

EURCHF Forecast – Potential Dip to December Low

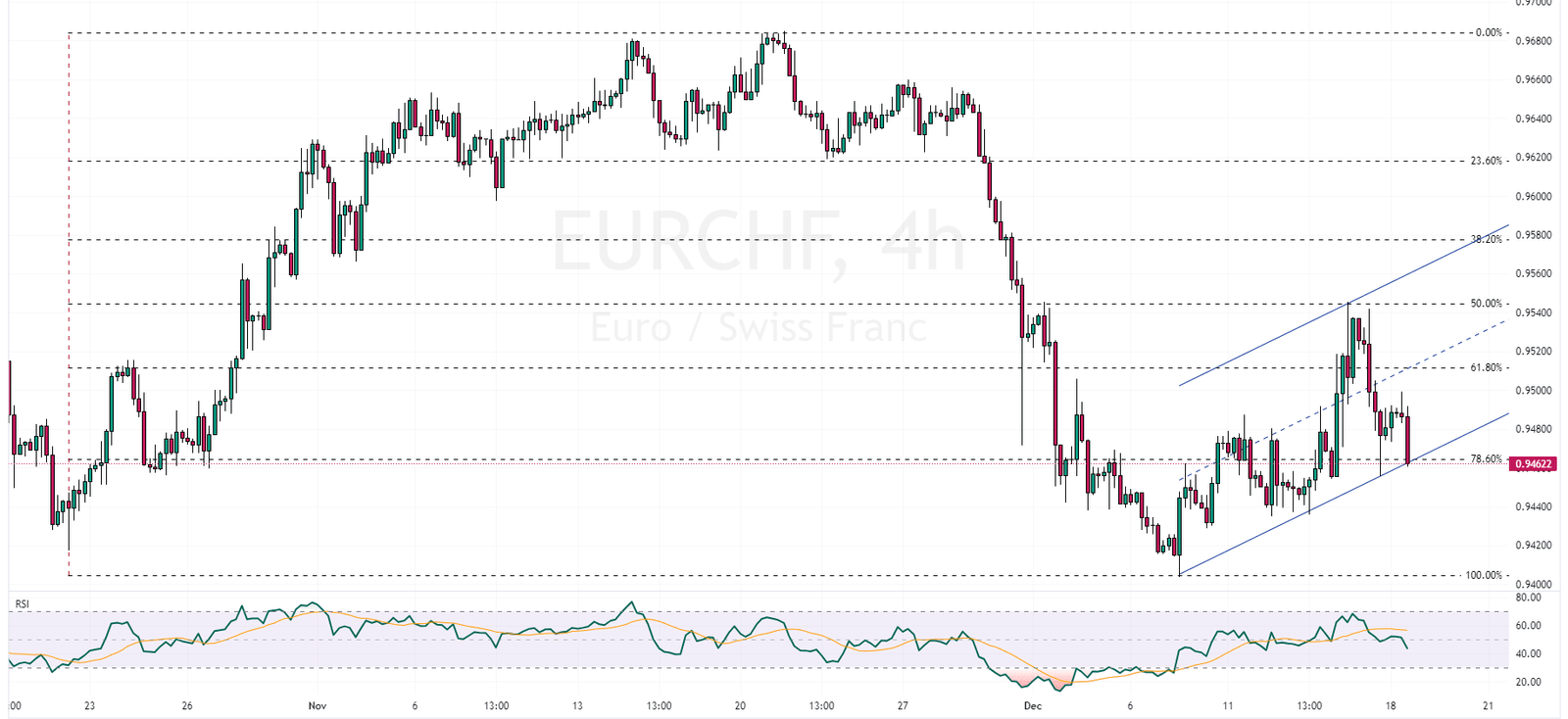

FxNews – The EURCHF currency pair recently encountered a setback as it failed to surpass the 50% Fibonacci support level. Consequently, the EURCHF price experienced a decline, falling below the 78.6% level. The Relative Strength Index (RSI) indicator has shifted below the 50 mark, a movement typically interpreted as a signal to sell.

Analysts at FxNews have expressed skepticism regarding the sustainability of the bullish channel for the EURCHF pair. We predict that the price might soon break below this channel. If this technical analysis proves accurate, the next bearish target for the EURCHF could be its December low, identified at the 0.9404 mark.

It’s important to note that as long as the EURCHF price remains below the median line of the bullish flag, the aforementioned technical analysis remains relevant and indicative of the market’s direction.