The European stock markets experienced declines. The STOXX 50 index dropped by 0.2%, trading at approximately 4,731, and the STOXX 600 decreased by 0.1%. These downturns put both indexes on track for their fifth consecutive day of losses. This negative trend emerged as investors grew cautious again due to corporate earnings reports and escalating tensions in the Russia-Ukraine conflict.

Meanwhile, Nvidia reported earnings that exceeded expectations. However, its sales forecast for the upcoming period failed to impress investors.

ASML and LVMH Stocks Dip

In other European market movements, shares of ASML Holding fell by 1.5%, and LVMH’s stock went down by 0.9%. Additionally, JD’s stock plunged approximately 13% after the company warned that its annual profits would likely be at the lower end of its projected range.

On the other hand, Novartis’s shares remained mostly unchanged, even though the Swiss pharmaceutical company raised its medium-term sales outlook.

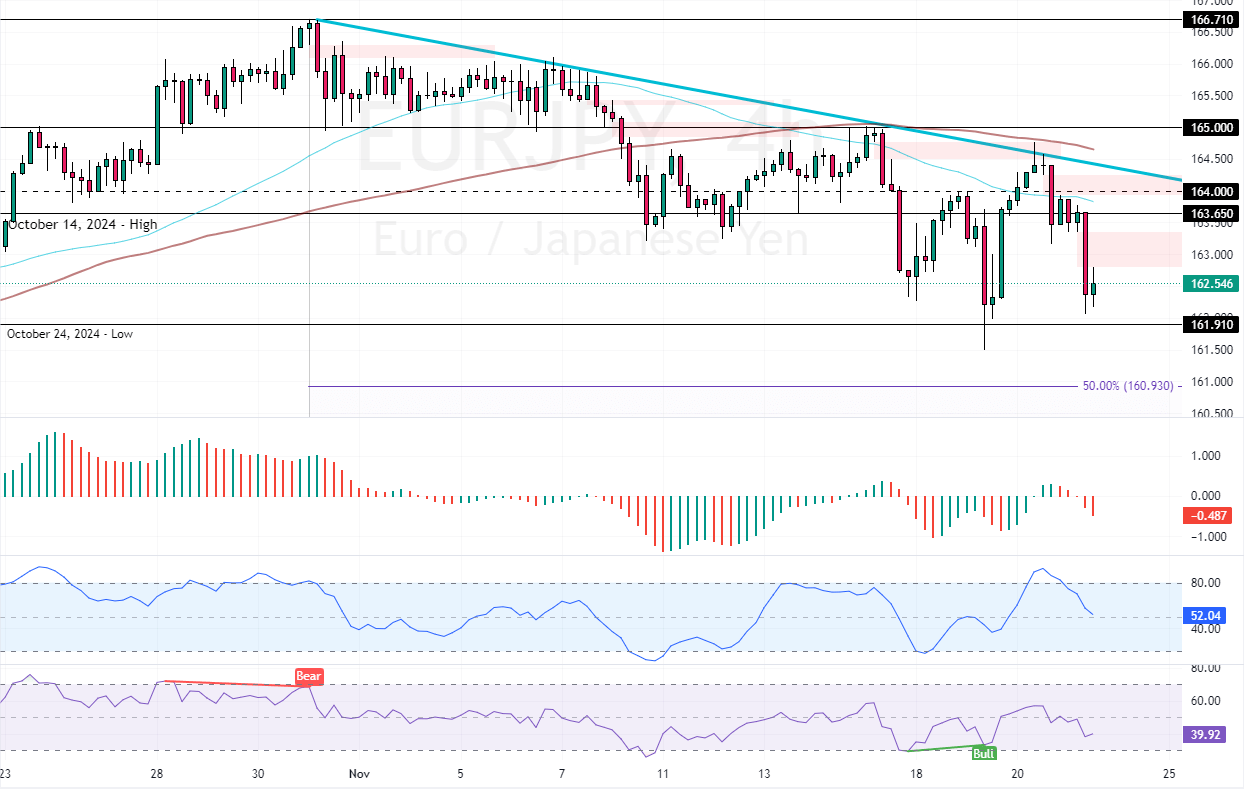

EURJPY Technical Analysis – 21-November-2024

The disappointing figures from the European stock market affected the euro against the Japanese yen. The currency pair started dipping from the 100-period simple moving average at approximately 165.0, a resistance area backed by the descending trendline.

This downtrend was signaled earlier by the Stochastic’s overbought signal, which caused the EUR/JPY pair to fall sharply. As of this writing, the EUR/JPY pair trades at approximately 162.5.

EURJPY Forecast – 21-November-2024

The immediate support is at 161.9, the low for October 2024. From a technical perspective, the downtrend could extend to the %50 Fibonacci retracement level at 160.9 if bears push the prices below the immediate support.

Please note that the EUR/JPY primary trend remains bearish as long as the prices are below the 165.0 critical resistance.

EURJPY Support and Resistance Levels – 21-July-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 161.9 / 160.9

- Resistance: 163.65 / 165.0

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.