FxNews—The European currency trades bearishly against the Japanese yen. The currency pair began dipping again after peaking at 163.0 on September 27. As of this writing, the EUR/JPY pair is trading at approximately 159.5, testing the 160.0 mark as resistance.

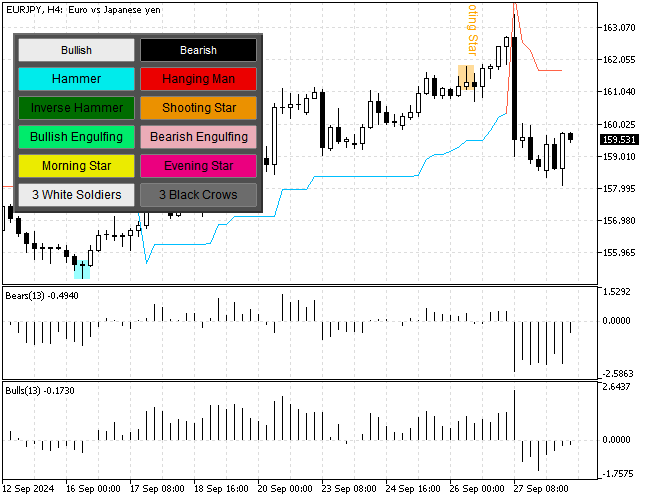

The 4-hour chart below demonstrates the price, support, resistance levels, and the technical indicators used in today’s analysis.

EURJPY Technical Analysis – 30-September-2024

The recent sharp dip in the EUR/JPY value resulted in the Stochastic Oscillator dropping below the 20 level, signaling an oversold market. Additionally, the price is below the 50-period simple moving average and is positioned to break below the 100-period SMA, which serves as resistance.

The EUR/JPY price is also below the supertrend indicators, which is another bearish signal.

Overall, the technical indicators suggest the trend is mildly bearish, and the downtrend could resume to lower support levels.

EURJPY Forecast – 30-September-2024

The September 19 high at 160.0 is the immediate resistance, backed by the 50-period SMA. From a technical perspective, the downtrend will likely resume if the EUR/JPY price holds below 160.0. The next bearish target in this scenario could be the September 16 low at 155.5.

Furthermore, if the selling pressure pulls the price below 155.5, the next support level will be 154.4, representing the August 2024 low. Please note that the bearish market would be invalidated if the EUR/JPY price stabilizes above 163.0.

EUR/JPY Support and Resistance Levels – 30-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 155.5 / 154.4

- Resistance: 160.0 / 163.0