In today’s comprehensive EURJPY forecast, we will first examine Japan’s current economic conditions. Then, we will meticulously delve into the details of the EURJPY pair’s technical analysis.

Yen Stays Close to Intervention-Trigger Point

Bloomberg—As market anticipation builds ahead of the Bank of Japan’s upcoming review of its monetary policy, the Japanese yen hovers near the pivotal 150 mark against the dollar—a threshold stirring intervention concerns.

Despite prevailing market speculation, it’s largely predicted that the central bank will maintain its expansive monetary stance. Yet, there’s growing chatter among traders about a possible adjustment in the yield cap due to the pressure of enduring high inflation rates.

Recent statistics have spotlighted Tokyo’s core inflation rate, which gained momentum and surpassed expectations this October. This trend is a precursor to broader price movements and adds pressure on the Bank of Japan to reconsider its monetary policy settings.

Japan’s financial authorities have not ignored the yen’s decline. Finance Minister Shunichi Suzuki cautioned currency market speculators, acknowledging the government’s heightened vigilance and “sense of urgency” regarding the yen’s fluctuations. Nonetheless, Suzuki stopped short of signaling any immediate intention for the government to step into the currency market.

EURJPY Forecast – Yen Stays Close to Intervention

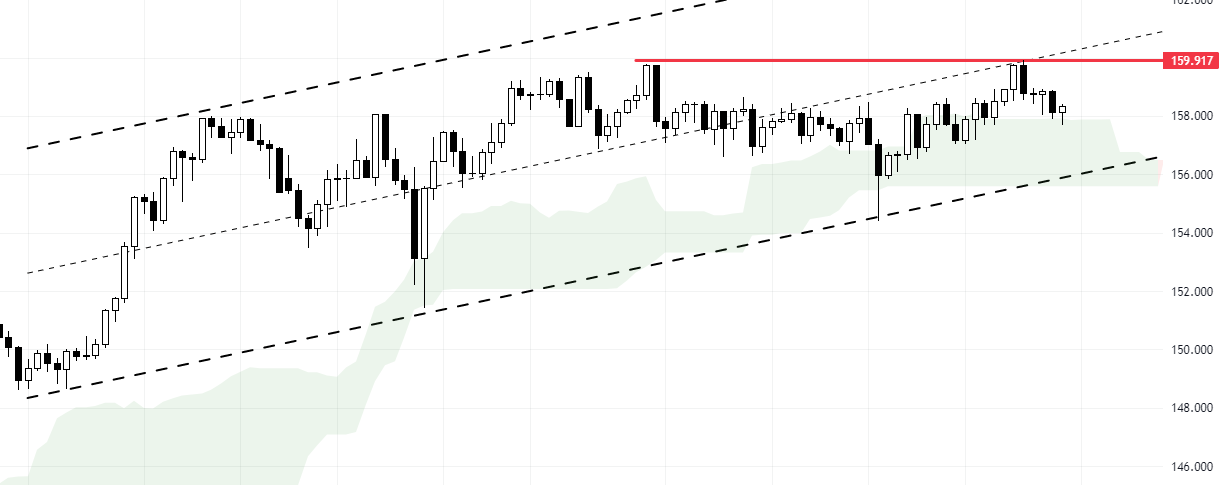

The EURJPY currency pair is currently undergoing a critical phase, testing the boundaries of the Ichimoku cloud. This cloud significantly resists the currency pair’s bullish bias, making it a key factor in our technical analysis.

A closer look at the 4-hour chart gives us more insight into the EURJPY price action. Our comprehensive EURJPY technical analysis on the daily chart indicates a bullish market. Consequently, our primary strategy is identifying opportunities to go long on this currency pair.

The EURJPY pair trades within a narrow, bearish channel and is positioned below the 158.6 pivot point. With the Relative Strength Index (RSI) nearing the crucial 50 level, we standby for the pair to confirm its bullish stance. This confirmation will be signaled by a close above the pivot point, indicating an exit from the bearish Ichimoku cloud.

- Also read EURJPY Market Analysis – Bulls Hit Hurdle.

However, it’s important to note that as long as the pair continues to trade below the pivot point, our short-term target for the pair shifts to the S1 support level. This scenario underscores the dynamic nature of forex trading and emphasizes the need for traders to stay updated with market trends.