FxNews—The European currency trades bullish against the Japanese Yen. But, the uptrend halted when the price peaked at the September 2024 high, the 163.6 mark. As of this writing, the EUR/JPY currency pair trades at approximately 163.1, slightly below the 163.6 critical resistance.

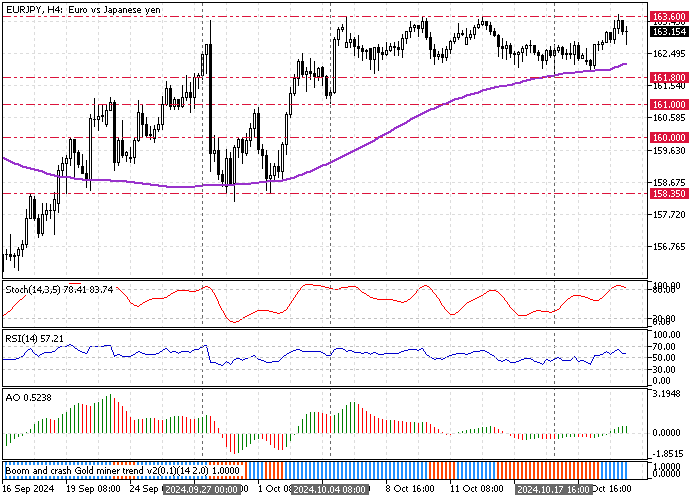

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

EURJPY Technical Analysis – 22-October-2024

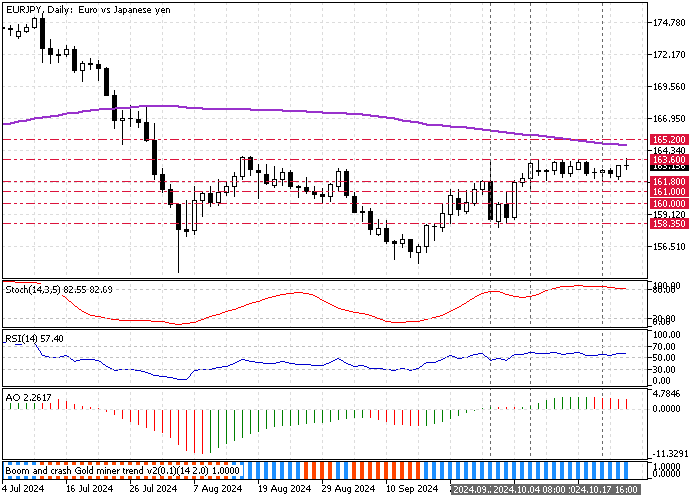

At first glance, the daily price chart shows the Stochastic Oscillator signaling an overbought condition. The Awesome Oscillator histogram is red and declining, meaning the bears add pressure to the market.

Zooming into the EUR/JPY 4-hour chart, we notice the price bounced from the 100-period simple moving average on October 17 from the 161.8 mark, which acts as active immediate support. Furthermore, the Awesome Oscillator and the Boom and Crash Gold Miner Trend indicator signal are bought with green and blue histograms, respectively. On the other hand, the Stochastic Oscillator also signals overbought in the 4-hour chart.

Overall, the technical indicators suggest the primary trend is bullish, but the Euro is overpriced against the Japanese Yen and facing a critical resistance level.

EURJPY Forecast – 22-October-2024

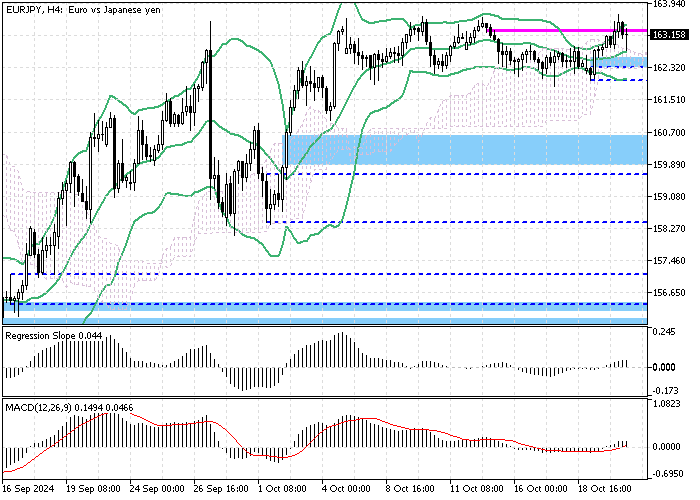

The immediate support rests at the October 17 low, 161.8, backed by the 100-period SMA. If bears (sellers) close and stabilize the price below this mark, a new bearish wave could emerge. If this scenario unfolds, the downtrend can extend to the October 4 low, 161.

Please note the bearish outlook should be invalidated if the EUR/JPY value exceeds the 163.6 mark.

EURJPY Bullish Scenario – 22-October-2024

The primary trend is bullish because the price is above the 100-SMA and the Ichimoku Cloud. The immediate bullish barrier lies at 163.6. If bulls or buyers close a candle above 163.6, the bullish wave from 161.8 could extend to the next resistance area at 165.2 (March 2023 High).

Please note that the bullish scenario should be invalidated if the EUR/JPY price dips below the 100-SMA.

EURJPY Support and Resistance Levels – 22-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 161.8 / 161.8 / 161.0 / 160.0

- Resistance: 163.6 / 165.2