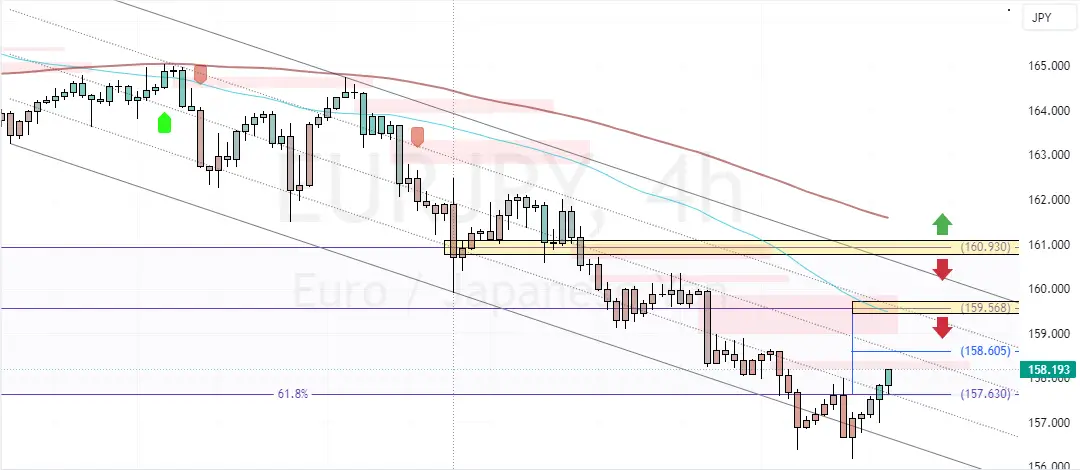

FxNews—The European currency returned above the 61.8% Fibonacci retracement level, bouncing amid oversold signals. As of this writing, EUR/JPY trades at approximately 157.9, erasing some of its recent losses.

EURJPY is Bearish, Below 160.9

Please note that the primary trend should be bearish because the prices are below the 50-period simple moving average. Additionally, the currency pairs trade inside the bearish flag, another sign of a bear market.

As for the technical indicators, the RSI and Stochastic depict 46 and 53 in the description, meaning the bull market strengthens. Furthermore, the Awesome Oscillator histogram is below zero with green bars, indicating a weakened bear market.

Overall, the technical indicators suggest while the primary trend is bearish, EUR/JPY could rise toward upper resistance levels.

Monitor EURJPY Key Levels for Bearish Strategies

Since the outlook for the EUR/JPY is bearish, waiting for the prices to consolidate near 159.56 is recommended. This level provides a decent ask price for planning bearish strategies with much lower risks.

- Good reads: USDCHF Bull Market Prevails: Next Target 0.890?

Traders and investors should monitor this resistance for bearish signals, such as candlestick patterns.