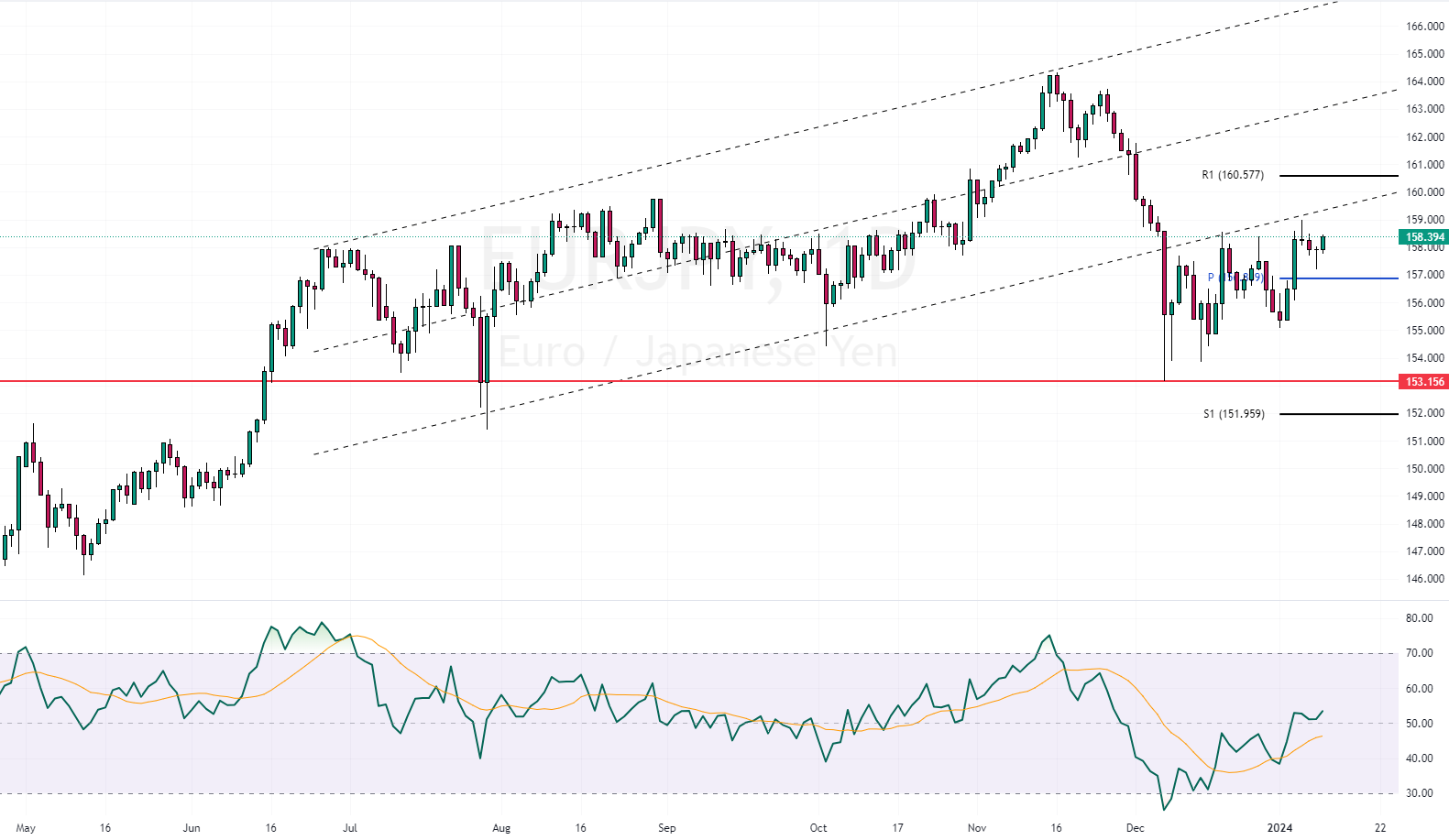

FxNews – The EURJPY price declined to 153.15 after the bears crossed below the bullish channel in the daily chart.

EURJPY Technical Analysis – January-10-2024

This trajectory moved the RSI indicator into the oversold area. Consequently, the EURJPY price bounced from the 153.15 support, and the currency pair is testing the channel’s lower band, which acts as resistance.

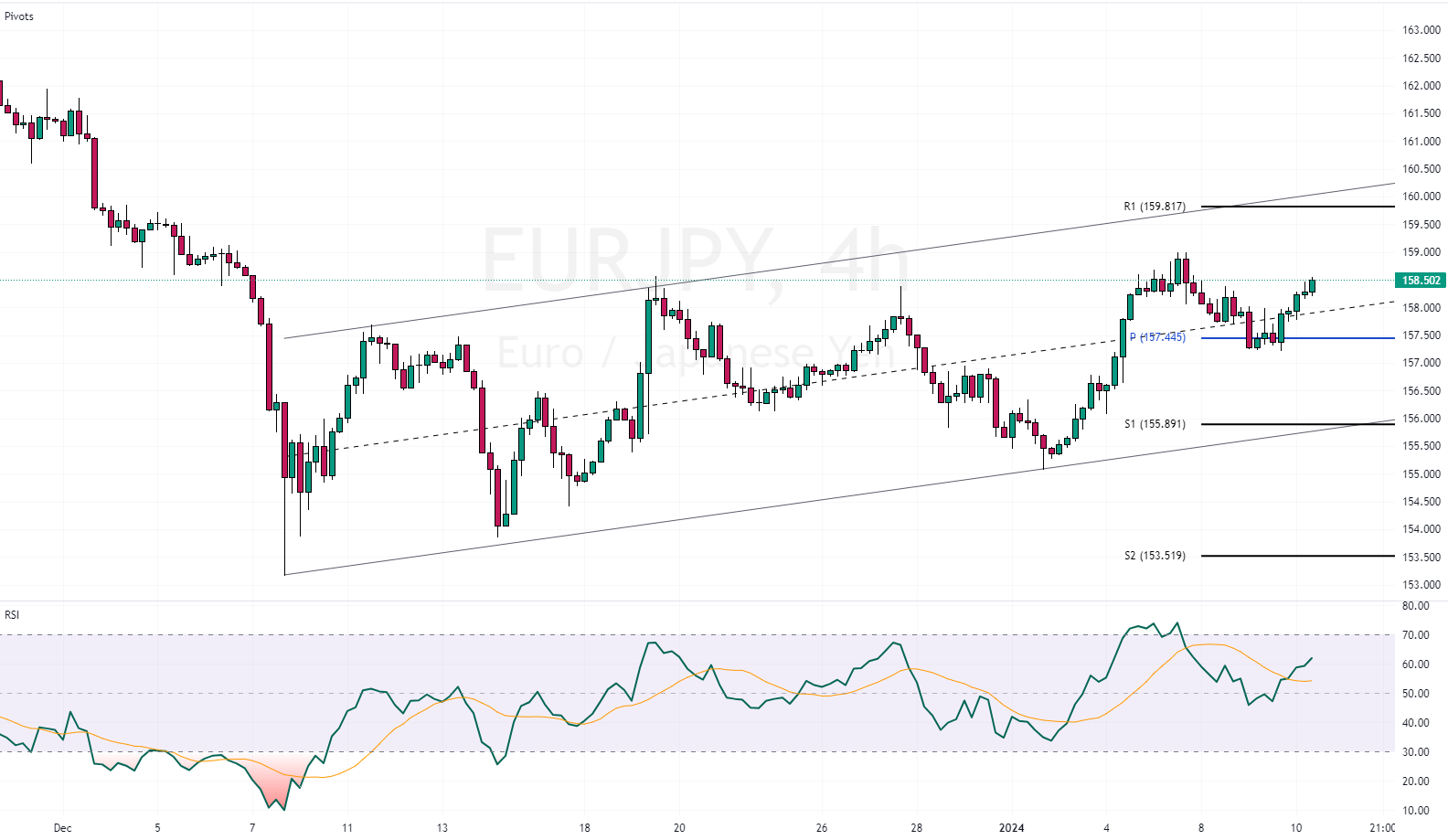

We are zooming into the 4-hour time frame to understand the price action better. The pair seems bullish in this time frame as the price hovers inside the bullish flag. The current EURJPY price is 158.41, above the pivot and the median line of the bullish flag. The RSI indicator floats above 50, another bullish signal for the EURJPY.

Analysts at FxNews expect the price to experience more gains, with R1 (159.81 resistance) as its next target. The 157.44 plays the pivot to the bullish scenario.

The bullish technical analysis for EURJPY should be canceled if the sellers cross below the pivot and stabilize the price under the 157.44 support level. In this case, the daily broken bullish flag stays valid, and the consolidation phase would extend to S1 support, followed by S2, the 153.5 mark.

Euro Area Jobless Rate Hits 6.4% in November.

Bloomberg—In November 2023, the Euro Area’s adjusted unemployment rate reached 6.4%, matching the record low of June and beating expectations of 6.5%. Jobless numbers dropped by 99,000 to 10.97 million.

Youth unemployment also decreased to 14.5% from 14.8%. Spain had the highest unemployment rate, at 11.9%, followed by Italy at 7.5% and France at 7.3%. Germany and the Netherlands had the lowest, at 3.1% and 3.5%, respectively.